- Fitch recently downgraded the U.S. credit rating citing political turmoil surrounding debt ceiling debates, though it’s not a major concern as the U.S. can always pay its debts since they’re denominated in its own currency.

- The corporate debt situation remains alarming due to rising bankruptcies and complacently low interest rate spreads, forcing us to anticipate more debt renegotiations and potential bankruptcies as debtholders refinance.

- We have continued a shift towards overweighting short-term U.S. bonds due to elevated stock prices, with portfolios currently holding lower level of stocks across all risk levels.

- Despite the resilience of the consumer and low unemployment; rising credit card delinquencies, exiting student loan moratoriums, and increasing bankruptcies along with market complacency, signal potential future risks.

You may have seen the recent headlines that Fitch downgraded the U.S. credit rating. It mainly cited the political shenanigans constantly being played with the debt ceiling debates. In any respect, we do not take much away from this event. The U.S. will always be capable of paying its debts as the debt is denominated in its own currency, as we previously discussed. However, there could obviously be adverse impacts from a default. Market reporters cite concerns that no buyers could be found for more debt issuances. However, the Fed is always there. It’s not just a theoretical concept, as Japan has been executing this strategy for quite some time and is significantly further in this hole than the US. Not to mention, Japan is experiencing incredibly low inflation relative to other developed nations.

Japan’s central bank holds more than 50% of all of its outstanding government bonds. For comparison, the US federal reserve holds roughly 20% of the astounding $32.7 trillion of US debt. Logically, you would think something does have to change, but it’s anyone’s guess as to when or if it ever will. Economists have feared the debt situation for nearly a century. With interest payments alone taking 1/6th of the annual budget, it is alarming. But, it isn’t something we’re overly concerned with as everyone is aware of this; it’s not unexpected. Also, Japan’s debt to GDP hit 264% in 2022, compared to the US’s 129%.

Clients’ portfolios are exposed to US debt, more than in recent periods. So, we remain vigilant in processing various scenarios that could impact portfolios. We are fearful of another debt situation, and that is in the corporate markets. The current spreads (what investors get paid relative to the risk) are insanely low at a time that bankruptcies continue to pile up. The complacency of the markets is astounding and continues to make us uncomfortable. Interest rates have surged over the last 24 months, marking the impending refinances to start ballooning over the next phase. As more debt holders must refinance, we believe we’ll continue seeing debt renegotiations at best and, at worst, even more bankruptcies. For this reason, client portfolios hold almost no other kind of debt/fixed income other than US government bonds or Fed securities.

We have been slowly shifting stocks we now find elevated towards short-term US bonds that are yielding near 5%. For example, not even a year ago in October of 2022, we felt opportunities were abundant and enthused for the long-term prospects of stocks. One stock that was bought for some clients was Meta (formerly Facebook) which was trading around $90 last fall. Today, not even a year later, the stock price is almost $320 per share. This kind of return would be appropriate for a ten-year period, not ten months. We’ve are rotating out of this position finally and choosing to focus on short-term treasuries.

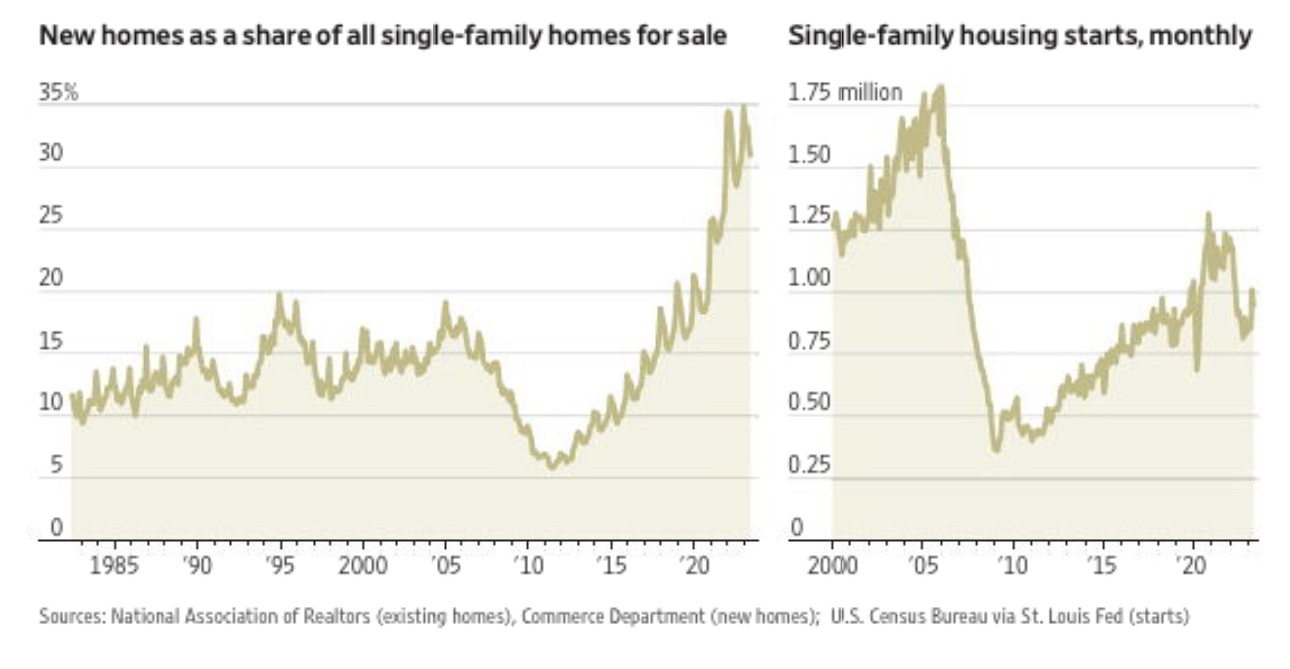

We do still hold stocks for clients based on risk, however, it is at or near the lower level of stocks we have held across the board. We continue to see a strong consumer and well-performing services sector. Home prices remain extremely elevated from 2019, and this is on the heels of multi-decade-high mortgage rates. The median home sales price is $416,100, and the median household income at $69,021 in 2022, a decrease of 2.9% from 2021. So, if we are generous and assume a 20% down payment, based on these statistics, a new home buyer today is paying $811 more in payments at a rate of 7% compared to 3% just a little more than a year ago. Don’t forget, home prices also boomed so moving now is very expensive. That median income consumer now sees 14% of their pre-tax income going solely towards more mortgage interest. This doesn’t even account for the higher spike in property taxes and insurance rates that are still slowly impacting higher payments for all property owners. And this is all concerning due to the pace of interest rate hikes, not the level of rates themselves. It’s impressive to see the consumer remaining so resilient. But, it’s causing most not to sell their homes, most likely adding to the home supply shortage. Looking at the chart below, new homes now account for nearly one-third of all homes for sale, which has benefitted home builders and building suppliers.

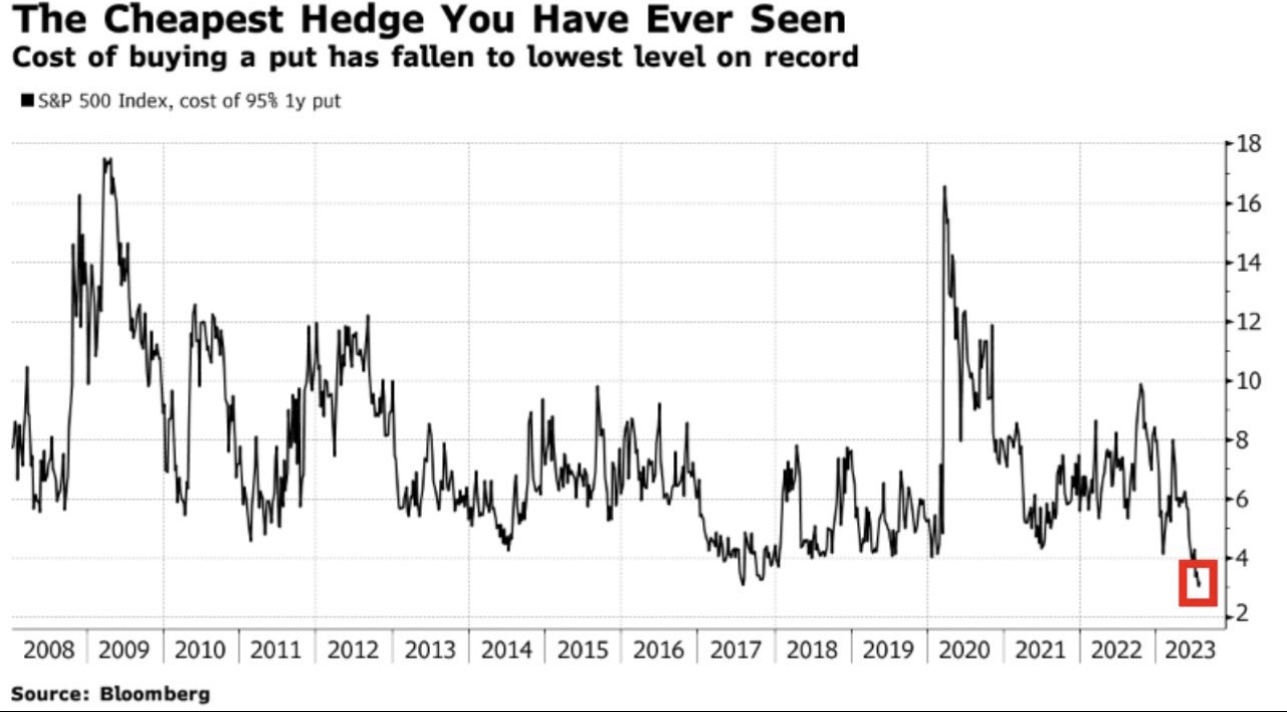

Both the strength of the consumer and the record low unemployment with tight labor markets continue to be pointed at as the reason everything is fine. We agree. But we continue to view much of this as backward-looking, not forward. When people lose jobs, it’s reported in the rearview mirror. Not to mention, when people are losing jobs, times are already bad. Trying to look at the potential future risks from that lens could be misguided. Credit card delinquencies have been starting to rise, the first potential crack to impending consumer issues. Student loans are exiting their moratorium, which will place additional stress on some consumers. Banks also continue to fail, albeit not even making major headlines anymore. We expect to see more failures if rates continue to jump at this pace. Bankruptcies continue to rise as well. Yet, markets are trying to push their way back to all-time highs. We continue to believe the markets remain too complacent. Put options, a security used to protect investors, are at some of their cheapest levels in history. Not concerning when looked at alone, but this is the market simply saying, “we don’t care about the risks.”

One specific example of complacency is a company we’ve held a minor amount of stock in previously, Vornado Realty Trust. It’s a REIT that owns some of the premier properties in cities like D.C. and New York City. It was once the poster child of “secure” returns. In May 2021, the company issued a five-year bond at 2.15% interest. Today, that bond trades at a yield to maturity of just under 8%. This is an unsecured note, which we think the market should demand significantly more than 8%. However, it trades there for now. The business itself is obviously struggling with current retail and commercial office space issues we’ve discussed in the past. But, if that bond were to have to refinance today, it would be nearly four times the interest expense for the company. In 2021, the company paid $191 million in interest. In 2023, it paid $301 million. We believe this number will move significantly higher as debts mature and are refinanced. Rents have actually managed to be nearly flat since 2019, and the company has also somehow kept expenses flat over that period. But the profit margins with this increasing interest expense are evaporating. Their minority-owned businesses, too, are seeing significant issues, causing much of this compression to be accelerated.

We should also point out that this company is actually surviving still in an incredibly difficult environment and doing better than most in it. We held minor amounts of the stock and were excited about it earlier this year, as the stock broke below 2008 levels as it traded in the low teens. Since then, the stock has popped into the mid $20s, and we do not see it as attractive any longer. Higher interest rates are just kicking them when they’re down and may eventually knock them out if continuing higher. Reputable property managers like Brookfield, Starwood, and Blackstone have all been defaulting on commercial real estate loans this year. If interest rates continue to rise, we believe the pain will only be greater down the road.

In no way do we believe we can predict the future. Nor do we know or even believe that a “crash” will come. However, we believe the market is simply a culmination of expectations, and those expectations point to nearly no present risk. On the contrary, we continue to see abundant risks and do not believe investors are properly compensated for these risks in many areas of the market. When the market dove 35% in one and half months in 2020, we found solace in the belief that the market was pricing in chaos. Today, it acts as if nothing could go wrong with more red flags than we’ve seen in over fifteen years. So, we are choosing to proceed with prudence and caution in hopes of more favorable investing conditions ahead. We’re extremely optimistic about the future longer term, and we believe it’s bright. However, the current environment shows significant warning signs that usually reward caution by the end of these periods. So, we’d rather wait for the clouds to clear or at least be recognized by the market before returning to a more aggressive stance. We will keep you posted.

If you have not scheduled your “Half-Time” review and update yet, we now have less than two months left for this quarter. If you’d like to meet this quarter in-person or online, please let us know and we will send you a link with our available calendars so you can reserve a time that best fits your schedule.

As always, please don’t hesitate to call or email if you have any questions or concerns, or if we can be of further service in any way.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility