Happy July 4th!

We want to wish all of you a very Happy July 4th! It’s always a joy to celebrate our Country’s Independence with friends and family. The US financial markets will be closed Tuesday, July 4th and all services will be delayed one day next week due to the National Holiday. Our offices will be closed BOTH Monday and Tuesday next week and we will be back in the office again on Wednesday, July 5th. If you need anything while our offices are closed, you can leave a voicemail on our office phone or email us as we will be checking messages and calls. Have a GREAT July 4th!

Residential Boom, Levered Corporate Bust

Amidst a robust residential housing market characterized by high prices and swift sales, concerns are growing about the corporate and commercial sector, plagued by slow city center recoveries, increasing bankruptcies, and declining economic indicators.

Here are the highlights of this update:

- The Federal Reserve will likely hike rates in the coming July meeting against a backdrop of a tight labor market, elevated prices, and robust consumer strength.

- Housing prices remain elevated, with the low supply and quick turnover, while homebuilder stocks and housing suppliers have surged to all-time highs.

- While the residential side of the market remains strong, the corporate and commercial side is struggling, with slow recovery in city centers and increasing bankruptcies at the highest levels since 2010.

- The inevitable demise of companies like Bed Bath and Beyond and Diebold Nixdorf finally succumbed to financial pressures, along with startups that went public through SPACs, such as Lordstown Motors and Virgin Orbit, who have filed for bankruptcy.

- Despite stability in consumer spending, leading economic indicators are in decline, and the potential for rate hikes, struggling commercial real estate, and problematic balance sheets of certain entities could lead to a volatile economic environment.

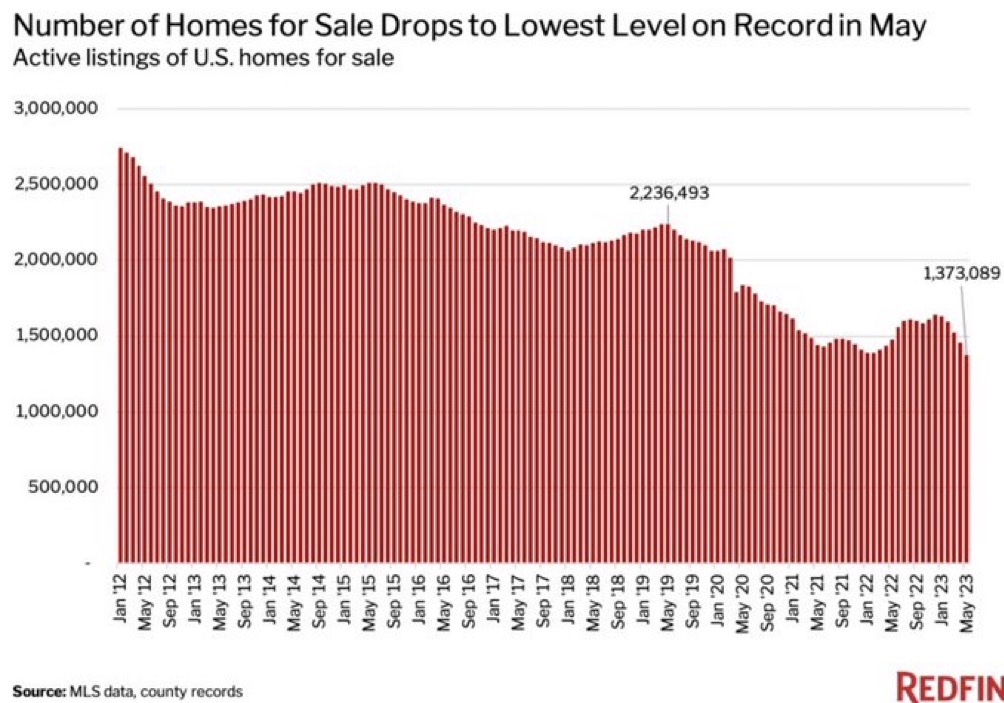

At their previous meeting in June, the Fed held rates steady, opting not to hike and rather pause for more data. However, the market is currently forecasting a 77% chance of a Fed hike in July’s meeting. This at the backdrop of a continued tight labor market and relatively elevated prices. The consumer remains strong and continues to spend, even in discretionary areas like travel. As we spoke about in the past, there is no real let-up in housing prices. While some have rolled over, it is at extraordinarily high levels. It would be healthy for prices to decline, especially given affordability metrics for new homebuyers now seeking a home. Looking at the chart below, supply remains incredibly depressed, allowing for a strong backstop to prices falling too sharply.

Simply put, it seems few people are selling their homes, while the median days on the market still remain well below 2019 levels. So, homes are also selling fast, still, and few people are selling their homes. It could be intuitive to reason that most homes were either bought or refinanced when mortgage rates were half of their current levels. Internationally, there is a little bit more reason for concern in markets where 30-year mortgages are not the norm, such as Australia. One of the “hottest” parts of the housing market is new homes. Homebuilder stocks and housing suppliers have seen their stocks surge to all-time highs. Just last fall, we discussed these as not concerning, as the market gave them extremely low multiples. This is no longer the case, barely nine months after discussing this. The market is now pricing residential markets to perfection, which we don’t necessarily disagree with. However, it is now an area of risk, given the market’s expectations.

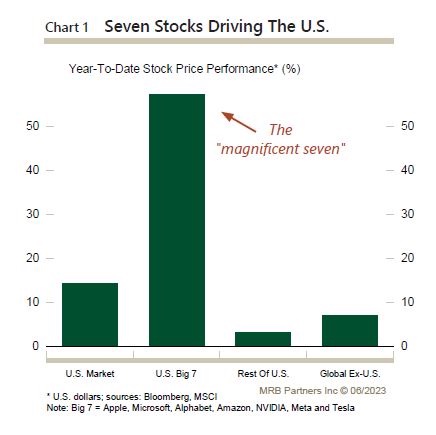

While certain industries are seeing elevated stock prices such as the home builder space, many of the indices so far this year can credit seven companies for their gains: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. Looking at the chart below, you can see these stocks (the “magnificent seven”) are up over 50% on average year-to-date, while the rest of the US stocks are barely above even. So, all is not as it seems this year. This has led the US Markets up almost 15%, quite an astonishing return pulled by just seven stocks. Most client portfolios own Alphabet, Amazon, and Meta, which has helped buoy returns this year. However, it continues to be a difficult investment environment.

Bankruptcies Surge

We felt it important to mention the residential side first, as most individuals are directly affected by this. However, it is not the consumer or the residential side that has caught our attention. While no one likes to see price declines, we still see the housing market with strong fundamentals behind it that do not warrant any concerns currently. Our focus remains on the corporate and commercial side of the equation. City centers are still seeing slow recoveries in traffic, which is impacting already distressed commercial properties, primarily office space. While we’ve discussed some of these concerns before, such as low occupancy rates and interest rates surging higher, affecting building owners, we are also starting to see cracks in corporate financing. Bankruptcies have now hit their highest levels since 2010. They have doubled their pace from just last year.

Some of these defaults are expected. For example, companies like Bed Bath and Beyond and Diamond Sports struggled before the pandemic. The surge in “free” money from the pandemic gave some of these companies lifelines, extending their inevitable demise. ATM maker, Diebold Nixdorf, has been on the bankruptcy doorstep for years and finally succumbed to the pressure this year. With the dramatic rise in interest rates, most of these companies are unable to find new sources of capital.

Others were able to take advantage of excessive multiples during the frenzy of 2021, such as a truck EV start-up, Lordstown Motors, which went public through a SPAC. Virgin Orbit, another company that went public through a SPAC, filed for bankruptcy in May, which was seeking to commercialize space travel. Many of these deals could be characterized by excesses in both grand business plans and insane valuations. Investors finally began to care in 2022 as valuations in these type of investments began to plummet as we previously spoke about, and it has been the only option for many of them to close shop.

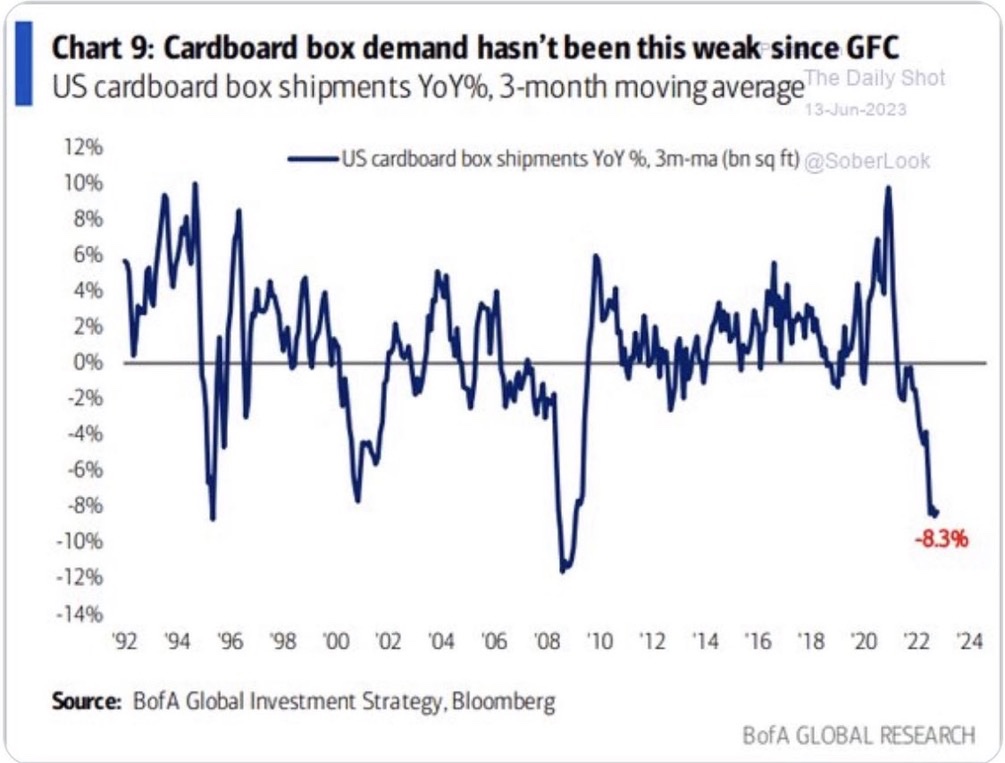

While we continue to see a stable consumer, the leading economic indicators remain in decline. Shipment volumes are dropping. Paperboard production, a leading indicator for the utilization rate of the US, is in decline. Cardboard box demand, seen in the chart below, is declining the most since the global financial crisis. This is quite notable as consumer spending continues to shift online, which would imply higher demand for cardboard. However, this isn’t the case currently. And, as we’ve spoken about previously, the yield curve remains extremely inverted, which is usually a cautionary sign. While the market has decided to ignore these signs temporarily, geopolitical risks are still very present as the Ukraine war drags on. We continue to see a market that is absurdly complacent for all the risks present for investors. While risks are always present to investors, market expectations are important to us, and we believe the market expects little to almost no future risks. The markets continue to be a place we wish to lean away from to try and preserve client portfolios.

If the Fed chooses to continue hiking, we see more financial difficulties on the horizon. It’s not the level of interest rates, but instead, it is the pace at which rates have been hiked. Most businesses with debt will see their interest costs double to triple over the last twelve months. Couple this with the struggling office and commercial real estate space, it could prove to be a volatile next twelve months. Fortunately, UBS was able to close its takeover of Credit Suisse, which should help calm some of the European markets. We can only believe others are hiding in the shadows that will present their problematic balance sheets more clearly in time. And while we watch these economic indicators violently swing from highs to lows, we believe it will continue to pose hurdles for many industrial and material-based businesses, especially those highly indebted firms. So, for now, we continue to exercise prudence and patiently wait for better opportunities ahead. We will keep you posted.

As always, if you have any questions or concerns, please don’t hesitate to email or call us at any time. We hope you and yours have a very safe and happy July 4th holiday this year!

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility