As we gather this coming weekend to spend time with family and friends, let us all remember the reason we celebrate Memorial Day and those that fought and died for our freedom so we can enjoy weekends such as this. Here are some facts about the holiday:

- The day was originally set aside to remember Union soldiers who died during the Civil War, but following World War I, its scope expanded to include those who died in any war or military action. At the end of the Civil War, many U.S. cities held their own memorial observations for their hometown heroes.

- The idea for a specific holiday came in 1868 from Illinois Senator John Alexander Logan, a former Union general and keynote speaker at one early observation. Logan used his position as commander-in-chief of the Grand Army of the Republic, a fraternal organization of Union soldiers, to issue a proclamation for a national “Decoration Day” to be observed on May 30 of that year by decorating the tombs of Union soldiers.

- The name “Memorial Day,” started cropping up from time to time. The new name became more common after World War II, and in 1967 was declared the official name by Federal law.

Source: Farmers’ Almanac

The US financial markets and our office will be closed Monday in observance of Memorial Day. We wish all of you a safe and happy Memorial Day weekend!

Highlights of this Update

- The US debt ceiling debate is dramatized by the media, but the US will always repay its debts as it controls its own currency.

- Concerns about the US defaulting on its debts are unfounded, and even if a default occurs, it would be only lead to a delayed payment that will eventually be resolved.

- The current financial system faces risks from potential rate hikes along with an inverted yield curve, which if rates rise, it could negatively impact bond portfolios and cause economic concerns but only lead to future opportunities.

- The banking system is experiencing a prolonged decline in deposits, which could lead to less lending and potential economic contractions.

- We advise patience and prudence in our portfolio management, emphasizing the need to preserve wealth and wait for clearer economic conditions before increasing risk, which could take some time.

Given the escalating drama provided by the media, we felt it important to remind clients about the mundaneness of the current debt ceiling debate. While a technical default could occur, the US will always repay its debts. Unlike some developed countries, the US owns and controls its own currency. For this reason, it can never be unable to pay its debts as it controls the dollars for which that debt is being repaid. In addition to that fact, it’s embedded into the Constitution. The 14th Amendment, Section 4, states, “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

So, the fears that the US will truly not pay its debts are completely unfounded, in our opinion. If the US defaults due to its inability to come to an agreement, it will simply be a delayed payment. Sure, this could cause temporary issues, however, they are certainly temporary and will be resolved. Just like everyone has already forgotten that the government shut down for a record thirty-five days over Trump’s refusal to negotiate on the funding of the border wall, which he and then Democrat-controlled House locked horns, so too will everyone forget Biden’s showmanship against the now Republican-controlled House, as a deal with eventually be reached.

Where We See Concern

As we said in our update last December, we saw one of the largest risks to the US as not having a near-term recession. When we sat in October 2022, market valuations were suppressed, and opportunities were abundant. However, after the collapse of Silicon Valley Bank in mid-March 2023, we began taking conservative measures to protect portfolios across all risk levels. We continue to sit in an overly conservative stance, overweighting government bonds and fixed income in general. As a reference point, a Moderate client currently holds less than 40% net equity exposure. In normal periods, this would be around 60%, 50% higher than current levels. We plan to get there again someday. However, we do not see this happening soon.

According to the CEM FedWatch Tool, there is slightly over a 30% chance that the Fed will hike rates again in June. While we do not currently believe they will hike, we do see concerns for higher rates. If long-term yields do rise, it will adversely impact bond portfolios. However, this will place even more stress on the current financial system as banking customers would be even more incentivized to move deposits into treasuries as well as those banks would see even larger losses on assets. Therefore, we think the eventual downfall would be even greater, causing our fears to escalate and comfort in overweighing longer bonds.

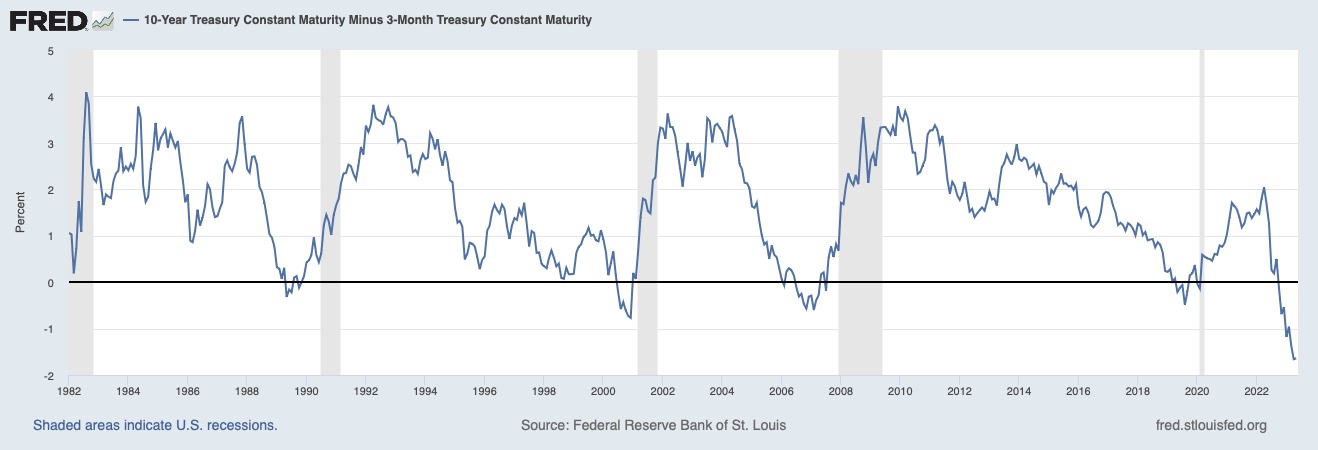

On the other hand, if markets simply march higher with no other changes, we will be forced to remain conservative. One metric we’ve spoken about extensively to help guide our market outlook is the yield curve, which is currently at one of its most inverted levels in history. Said another way, investors can get more short-term yield relative to long-term yield than ever before. This implies the market is showing concerns for rates falling, which typically implies economic concerns moving forward. The chart below illustrates this. The more negative, the more short-term yield an investor can get.

In every instance, a recession soon followed. This does not necessarily bode negatively for equity or stock performances. It is more important to focus on what the market expects, and what is priced in. In this case, as we previously wrote about, we believe the market and stocks, in general, have become complacent. The consumer and economy as a whole remain strong. But, bank failures are not a healthy sign for the plumbing of the financial system. While most of the failures making headlines could be attributable to runs, we still see an underlying theme of deposits transitioning to treasury bonds and money market funds, which the latter has now jumped over 5% for the first time since 2007.

This is unusual. It is not normal to receive such high short-term yields without the need for adding duration, which is the weighted length of time to receive your money back with interest, or credit risk, which is buying less favorable bonds to receive more yield. Now, you can buy some of the most liquid and secure fixed-income instruments and receive the highest amount of yield. Why? Well, as mentioned above, the market doesn’t believe rates will remain here. It implies rates will move lower. Additionally, if the Fed cuts rates, these rates will fall too.

Looking at the yield inversion occurring in the chart above, the normalization period typically occurs when this spread is +3%. Currently, the spread is -1.6%. So, how would we get to 3%? Well, if short-term yields remain where they are, the 10-year US bond would have to surge to over 8%. While this could happen, we believe the damage to the financial foundation would be so severe, both markets and financial systems would break. The other scenario would be instead the Fed dropping rates again, more towards 0.5%, rather than the 5.25% they’re currently at. We see this as the more likely outcome, although it could come as a balance of the two scenarios. Also, we see this coming due to conditions deteriorating, which have yet to occur. For these reasons, we continue to exercise prudence and patience for portfolios, as the Fed dropping rates would imply poor economic conditions. And, if that were to come, we would then look to eventually roll out of bonds into stocks or more risky assets, as the market should begin pricing in more uncertainties which should provide opportunities as well.

The banking system has never had to experience sustained drops in deposits. During the savings and loan crisis, deposit growth eventually flattened from 1990 to 1995 before seeing continued growth yet again. In 2020, the surge in deposits aided by outrageous stimulus measures gave the system a shot of growth never experienced before. However, this is now being met with a decline the system has not experienced, as deposits have fallen $1 trillion since mid-April of last year. We believe this trend will continue, as depositors shift towards higher-yielding investments. This should lead to less lending, which will lead to economic contractions. These concerns are in addition to the severe stresses now being seen in the commercial real estate markets. While the consumer remains strong, we do not believe this alone will be enough to stave off further financial distress in the system.

We do believe much of this could have been avoided if the Fed and government had stopped the excessive stimulus measures sooner, as well as allowed for higher inflation to remain as they more slowly tightened. Instead, the accelerator was slammed on with historic proportions and is now being halted at yet again a historic pace. While we believe the “ripple economy” had its greatest disruption in 2020, we foresee continuous ripples being forced on the economy due to erratic decisions. The Fed has stated it wants unemployment to rise and inflation to fall to 2%. Neither has yet occurred and will, unfortunately, also be backward-looking. When and if the Fed meets its arbitrary goals, the US economy may likely be halfway down the next “ripple” wave, with the picture becoming exceedingly gloomy. At that time, we hope the market will be less complacent, so we can begin pursuing strategies to increase risk for client portfolios and take advantage of possible opportunities.

Practicing Patience

“We encourage continued patience with us as we attempt to be prudent and preserve wealth until a clearer landscape emerges. We believe it would not be prudent for any client’s interest, no matter the risk appetite, to chase market price appreciation at this juncture, especially just for the sake that stock prices have moved higher. The time will indeed come if history can serve as a guide to our observations, to increase our stock allocations once again.”

The above quote was taken from our January 6, 2020, update. After which, the market rallied another 4.5% to peak on February 19th before then falling 34% by March 23rd. We asked for patience from our clients as we believed more opportunities would eventually present themselves in time. It played out quickly, which we never anticipated. The evening of March 23rd, we wrote another update and said:

“We continue to be optimistic for many of the valuations currently paid to buy stocks of good companies today, regardless of what unfolds in the months ahead. As for the “markets,” we have no idea what direction the Dow Jones Industrial Average, S&P 500, or other market indices will take. We can only emphasize the incredible long-term values we remain capable of finding in this environment. […] As for client portfolios, we continue to be concerned with the economic impact of government and central banks decisions especially as they all continue to rapidly escalate their responses. We remain vigilant in assessing these risks and are focused on attempting to position our clients’ portfolios to benefit for the decade ahead as this all comes to an end.”

We do not expect the same “quickness” in being able to change stances this time. The consumer remains healthy and strong; however, too many warning signs are now present not to practice prudence. Delinquencies remain low across the board, but they have crept up in the last few months. The student loan moratorium could eventually end this fall, which will most likely lead to other delinquencies. Business bankruptcies are creeping higher. Most business and manufacturing indicators are moving sharply lower. Commercial real estate defaults continue occurring. Residential housing markets appear to remain healthy and in low supply, but activity is incredibly subdued, most likely due to higher rates.

Just as we asked clients to be patient in January of 2020, we ask again for patience. We will continue to search for attractive valuations and buy stocks. However, it will just be at a dramatically smaller portion for client portfolios relative to risk. And to be clear, this is not due to the debt ceiling debate. This has been slowly unraveling this year, and we plan to wait for a better day to take more risks for clients proactively. That day is undoubtedly not today.

As always, please don’t hesitate to email or call anytime if you have questions or concerns, or if we can be of further service in any way. We appreciate the privilege to be of service to all of you now and in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Looming Risks Overlooked