- Signature Bank’s seizure negatively impacted some client portfolios, but because of this, clients were not impacted by First Republic, and we are avoiding exposure to other regional banks due to government action unpredictability and will be participating in class actions by default for all clients soon.

- We shifted from an optimistic investment approach to extreme caution shortly after Silicon Valley Bank’s collapse, focusing on conservative strategies amidst factors like a severe yield curve inversion.

- Despite some financial decline since 2021, the long-term trend for Americans remains positive, with the housing market benefiting from limited supply and stricter lending standards.

- The “ripple economy” affects various sectors, as businesses that capitalized on increased liquidity now face challenges; we will maintain a cautious approach until greater stability is observed.

Regrettably, some client portfolios were negatively affected by the seizure of Signature Bank, which occurred back in the middle of March. Nonetheless, we currently have no exposure to other regional banks. With yet another massive bank failure announced this weekend with First Republic’s seizure, the second largest bank failure in US history. J.P. Morgan has now been reported to be acquiring the failed bank, aided by the FDIC. We find no opportunities in distressed bank stocks, regardless of their price. Though we firmly believe that Signature Bank’s seizure was unjust despite the FDIC’s recent report, our convictions are of little consequence now.

To put it in perspective, Signature Bank saw roughly 10% deposit outflows prior to the FDIC deciding to seize them, where First Republic had seen over 60% outflows before the Feds stepped in. Regardless of any further opportunities in the space that may arise, we will not partake in them for any client portfolios due to the unpredictability of government actions. For those impacted by holdings in Signature Bank, we will be applying for representation in class action suits as well as any other future potential suits that arise from portfolio holdings, which we will discuss more in a further update. Clients will be given the opportunity to decline representation if they so choose.

While these large-scale bank runs are somewhat isolated to only the ones making headlines, we still see the overall regional banking sector under distress, with $1 trillion of banking deposits leaving for higher-yielding alternative investments since April 2022. We do not see this trend reversing anytime soon, with the Fed set to hike rates again on this Wednesday. We strongly believe these failures could continue as the banks see outflows from depositors seeking higher yields in liquid alternatives. It is not normal to be able to receive such high yields from liquid money market funds, however, the yield curve inversion is so severe it’s leading to the availability of these alternatives.

In our previous update, we talked about a sudden change in our investment approach at the end of March. Back in October 2022, we were quite optimistic, thinking that the market was factoring in significant uncertainties, which we saw as an opportunity to take on more risk. However, the collapse of Silicon Valley Bank in the middle of March has led to a dramatic shift towards extreme caution, a level of caution we haven’t seen since the end of 2019. At present, we maintain this cautious stance. Our primary aim for client portfolios is to be exceedingly conservative and careful with respect to their appropriate risk level. Numerous factors suggest that now is a crucial time for patience and prudence, such as the severe yield curve inversion we’ve mentioned before. If the Fed continues to raise interest rates on Wednesday which we believe they will by 25 basis points again, the inversion will become even steeper. This could lead to more deposits leaving the banking system in favor of money market securities and short-term treasury bonds, which may soon yield more than 5%.

Yet, Economy Strong Currently

We still maintain that America is in a better position than it has been in quite some time. Nevertheless, we previously stated that one of the biggest risks for 2023 would be NOT experiencing a recession, as opposed to the impending recession that many headlines were proclaiming at the time. Although the financial health of consumers has slightly declined since 2021, the long-term trend remains positive; Americans are more educated, earning higher incomes, and forming more households. The housing market continues to thrive due to limited supply. However, rising prices and interest rates have caused a significant slowdown in overall activity, which has further economic consequences, primarily for the banking sector. Just in October, we mentioned the low valuations of various home builders and housing supply companies as indicators of market uncertainty. In January, we spoke about their blow out earnings. Fast forward to today, and nearly all of these stocks have reached all-time highs, now pricing in perfection.

The major problem lies in the rapid pace of interest rate hikes, rather than the actual level of interest rates themselves. This has led to unrealized losses in both security holdings and loan portfolios of banks, which would eventually balance out over time. However, many banks are dealing with net redemptions, forcing them to sell investment at losses to cover withdrawals thereby affecting their capital ratios. While the Fed has opened facilities to help with this process, we believe the main issue is being overlooked: investors are leaving banks for higher-yielding assets. As long as the Fed keeps hiking rates, it could take years for banks to compete for deposits. Most banking systems are designed to withstand short-term shocks, assuming stability and recovery will follow. However, we don’t see these deposits returning anytime soon, which was the case with First Republic. This will force smaller banks that survive to face losses and raise capital at higher rates, squeezing net interest margins and ultimately reducing the system’s overall lending capacity. When banks lend less money, the economy must inevitably contract.

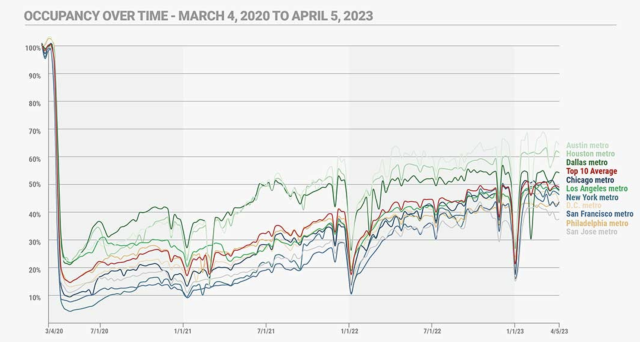

Don’t be surprised, though. This is precisely what the Fed wants. They believe that a recession is the only way to combat inflation and have chosen to pursue it. We previously mentioned their reference to an “imbalance” in the labor market, which meant too many jobs were available. They either wanted unemployment to rise or for companies to stop hiring. And, just like consumers demand their packages arrive in two days, the Fed continues to hike rates, expecting immediate results. We’ve discussed the lengthy timeframes for real estate development activities, with some commercial projects taking years. The surge in interest rates will take time to impact overall activity, which should start playing out soon, if it hasn’t already. By the time it begins to show up in the Fed’s data, it could be too late for them to again reverse course. Almost weekly, more and more commercial mortgages are beginning to default. Occupancies for many major cities remain low, which can be seen in the chart below. Similar conclusions are drawn when looking at cellular data from many metropolitan centers. This will lead to eventually lower cash flow on properties facing even higher interest rates.

We have previously called this the “ripple economy”. The effects are not limited to real estate development; they can be seen across the entire economy. Some businesses decided to take advantage of the influx of liquidity injected into the system, but they now face challenges as this liquidity dries up. Healthcare is another sector that experienced this, with an unusual increase in demand for products that vanished quickly as COVID-19 worries subsided. It’s important to note, though, that not everyone is affected. There will be winners once we navigate through this period. However, we believe we are just at the start of this downward ripple, and we’ve decided to maintain our cautious approach until we see greater stability ahead. We can’t predict how long this stance will last, but we anticipate it might continue into the beginning of next year, all else being equal. And for some reason, we cannot understand, the market and most participants continue to ignore all these warning signs. Jamie Dimon, the CEO of J.P. Morgan, stated this morning that the banking crisis was near its end, which would could not more humbly disagree with. We believe significant economic uncertainty remains, and we will continue to be cautious until we see the markets caring more and pricing in this uncertainty. At this time, we would prefer to err on the side of caution and preservation. We will keep you posted.

As always, please don’t hesitate to call or email if you have any additional questions or if we can be of further service at any time. We truly do appreciate the privilege to be of service to all of you and look forward to working together to accomplish your personal financial goals in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility