July 4th Holiday Hours

On Monday, July 4th, the US financial markets will be closed, and our office will close as well. We will be back Tuesday morning, the 5th, for business as usual. As a reminder, due to Monday’s holiday, there will be no withdrawals processed from AXOS Advisor accounts and they will be delayed by one day. We wish all of you a safe and Happy July 4th!

The Ripple Economy

Prior to the pandemic, America was experiencing the beginning of a housing boom, which we had previously written about. However, given the chaos of 2020, we saw an initial plummet in housing activity followed by one of the largest price spikes on record. While the number is skewed by California, the median home price for the nation jumped from $327,100 at the end of 2019 to $423,600 by the end of 2021. That is a remarkable 30% jump in only two years. Lost in this eye-popping number is that roughly 65% of US households owned homes during that jump, which is typically levered by a mortgage and comprises the largest amount of the average American’s net worth. While those owning homes gained wealth, they are not necessarily any better off without selling and downsizing. However, they are wealthier on paper, and the new home buyer or individual yet to buy a home will find it increasingly difficult to do so leaving those individuals less wealthy for the time being. If the median home price dropped 10% this year, home prices would still be almost 17% above their starting levels of 2020. If that were to occur, we wouldn’t see this as a true housing slowdown or price decline.

The market is typically good at taking care of demands. Housing permits have surged in the last two years, showing more supply coming online to appease these higher prices. However, the market still could use even more homes. However, it does open up the possibility of eventually overshooting in the opposite direction, especially when factoring in how fast prices have moved higher. Sprinkle in the Fed hiking rates at the fastest pace since 1994, we are bound to see quite the gyrations in data and most likely an effect on individuals’ decisions and inevitably some impact on the economy. The pendulum continues to swing, and it seems the speed at which it swings will be quite fast for several years as economies can hopefully normalize. We refer to these gyrations as ripples and do not see much concern from them other than volatility. This is not unique to the housing market.

The Fed is determined to correct the current “imbalance in wage negotiating.” Said another way, the worker is experiencing their time in the spotlight, but the Fed sees this job market as “unsustainably hot” with job openings outnumbering job seekers two to one. Somehow, this is spun into a belief that we’re in the midst of a real recession? How lucky are we that our economy is apparently in a bad situation and workers simply have too many jobs from which to choose? The only issue we see is some businesses struggling to manage the ripples and also slowdowns in industries that were over-extended or in outright dreamlands, such as “crypto” related firms.

Ripple Management Matters

In our day-to-day observance of the living standards and current economic condition of the average American and we see no indication of a dire recession in sight. Depending on how the specific economist defines it, a recession is simply a decline in some economic metric. Most define it as two consecutive quarters of negative Gross Domestic Product (GDP) growth. With gyrations or ripples, you inevitably have a sharp rise, a fall, and a potential echo before eventually stabilizing. At the end of the ripple, the change isn’t as dramatic as initially implied while riding the waves up then down then up again. The management of one of our portfolio companies, Vizio, was incredibly aware of the artificial spike in their device sales from the pandemic. Vizio witnessed an absolute boom in TV sales, followed by an unnatural decline and artificially low sales in 2021, and now visibly stabilizing numbers as of this past quarter of 2022. In a vacuum, one may look at the decline as a concern. However, taken in context with the prior surge, growth rates have been relatively stable over a multi-year period.

Peloton’s management was not so fortunate, and they believed the surge in pandemic sales was a new normal. They aggressively expanded and now find themselves having to halt and now liquidate their warehouse construction project as well as being severely hit with inventory struggles. These speed bumps caused the stock to crater, allowing it to now become an attractive opportunity for clients as we continue to be focused on their streaming business. Regardless, the point is to illustrate is that not every company is properly navigating these economic ripples.

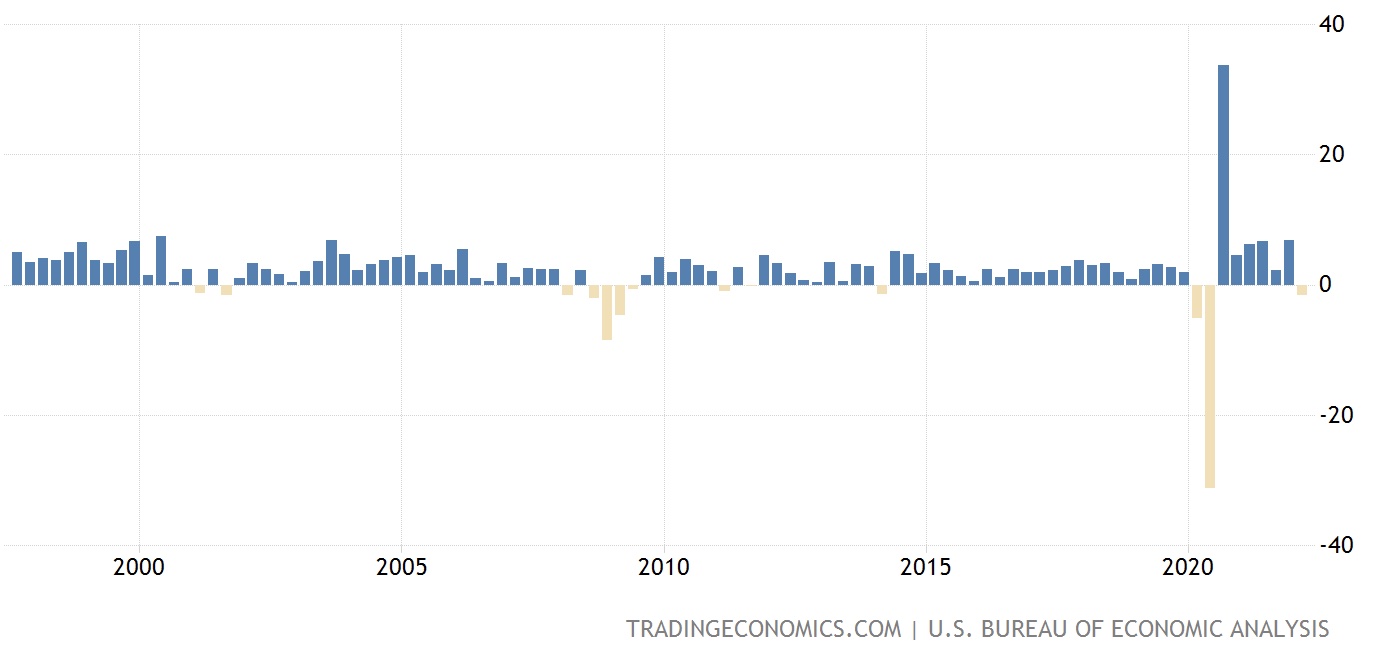

To help illustrate the dramatic spike in quarterly GDP, we have included a 25-year GDP growth chart below. Looking at the pandemic, the gyration becomes clear when GDP “dropped” 31.2% then quickly rebounded 33.8%, unlike anything seen before. And, you must also realize these are annualized, quarterly numbers… Not confusing at all, right? Simply put, these are not numbers or data we use to guide our investment portfolios. They’re extremely backward-looking and could eventually be used to claim we’ve been in a recession since January 2022. Economists use this data, and it can be relevant in normal environments. As can easily be seen, these gyrations are not normal. If another quarterly decline is present, the headlines will be blaring about a confirmed recession. It would be a recession of semantics in our opinion, and it would not be one of major concern. Nonetheless, the headlines will still read, “recession,” so we think it important to clarify what is causing this definition to occur.

You can see the confusion of the ripples by looking at recent commentary by another investor we respect, Howard Marks, in his July 29, 2021 memo. Below, he’s discussing the ripple boom higher that preceded the economic drop with the inability of the Fed to react in order to stifle fears of inflation, which at the time, were not a concern of the markets:

“The economic outlook turned positive last summer in response to the Fed/Treasury actions and then was further bolstered by the success of vaccines. Thus, we’re seeing strong economic growth – real GDP rose at an annualized rate of 6.4% in the first quarter – and expectations remain high for the rest of 2021 and perhaps 2022. Yet, the Fed continues to hold interest rates near zero and buy $120 billion of bonds per month. Why stimulate an economy that’s doing so well, and run the risk of inflation?”

We completely agreed with him at that time and still do today. His fears of inflation echoed ours and proved to be correct with hindsight now in our favor. But now that the Fed has reversed course, stopped buying bonds, and has begun aggressively hiking rates, the question becomes: Once the Fed starts seeing these arbitrary negative number prints, will they whipsaw rates back down and start bond-buying programs again, most likely causing further ripples through the fixed income markets and the economy as a whole?

As these ripples unfold, they will impact our own investment decision process, usually forcing us to respond faster than desired. One example is our recent decision to liquidate the majority of our oil & gas energy exposure last month. Within a mere few weeks of that decision, an index tracking E&P firms fell nearly 30%, forcing us again to review the space for opportunities that may have adjusted in price enough to justify an investment again. With little change in fundamentals, we’re witnessing price swings typically seen for multi-year periods occur in multi-weeks instead. For these reasons, as the pendulum swings, we must also adjust. It could be argued the market does not know what to expect at the moment causing further gyrations with these ripples, but with valuations fluctuating at such quick speeds, we must continue to be nimble for client portfolios.

These ripples can be seen in almost every segment of the economy with each of them showing an eventual decline on paper following a historic boom, allowing economists to ring their bells. We believe these ripples will take years to unravel, which will continue to cause gyrations in various markets. By the end of the process, we will hopefully find stability at least from the impacts of the pandemic. However, we must note that there are also larger thematic ripples when looking at longer-term trends such as demographics, which unfold over decades. For example, we are now seeing a wave in demographics from the baby boomers’ children, the millennials, coming into adulthood, forming households, and even having children of their own. In 2019, the annual growth in the birth rate was positive for the first time since the 1980s which was the birth of the millennial generation. The longer theme ripples have collided with the ripples caused by the pandemic, which most greatly impacted the housing markets in our opinion.

Rational Optimists

Some tend to call us eternal optimists or “perma-bulls” always looking at the potential upside. But it was not until April that we got excited about the current opportunities. We like to focus on what value we’re paying for investments and can usually find exciting opportunities regardless of the present environment. Although, we believe there are certain periods of greater opportunities, which we believe we find ourselves in one of those moments. In recent history, these moments of divergence in valuations have not come often: 2008, 2011, 2020, and now 2022. The current opportunity really being one of the first for tech-related businesses since 2003. Though uncomfortable at times, it becomes even more exciting for us as value investors during periods of increased volatility in the overall markets, as it allows for more opportunities to arise than otherwise might not have presented themselves.

Since our founding in 1983, history has rewarded the optimist over the long-term while the pessimist may have seen short periods of personal vindication because markets do eventually fall from time to time. In the present moment, these pessimists will feel vindicated if headlines confirm the “recession” the US has been in within the next few weeks. However, we believe that story will be quickly forgotten as markets could likely march higher. The markets are forward-looking, and in our opinion, have already priced in a “recession”. Consistently, given enough time, the optimist has prevailed. It was not even six months ago that markets saw all-time highs, and we firmly believe the day of all-time highs will come again and most likely sooner than many currently believe. We will continue seeking attractive investments for client portfolios based on risk, and we have increasingly looked to the tech sector for such opportunities in this current environment. We’re extremely optimistic for the second half of this year, especially given the current valuations we’re continuing to find. And if it is any consolation, the investor we quoted earlier has also been finding bargains and “starting to behave aggressively” in his investing. We are reminded of the first rule for successful investing: “Buy Low, Sell High”.

As always, we are here to serve you and if we can ever be of further service, or if you have any questions or concerns, please don’t hesitate to contact us at any time. We hope you have a great July 4th weekend with friends and family

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Looming Risks Overlooked