Memorial Day Holiday

The US financial markets will be closed Monday, May 30th for the Memorial Day Holiday. Our offices will be closed as well. As a reminder, any withdrawals requested from your AXOS Advisor Services account will be delayed one day as well due to the Holiday.

Value in Growth

Last Friday marked the official rebalancing of portfolios. And with that, most portfolios now hold an overweight position towards technology. This is a stance that we have been unable to hold before given the premium valuations previously given to the space. Many clients now hold wonderful businesses at what we believe to be fair prices. Companies like DocuSign, Spotify, Zoom, Vizio, Zillow Group, PayPal, Alphabet (formerly Google), Meta Platforms (formerly Facebook), and many more. Growth-oriented clients are now able to hold Uber, Etsy, Pinterest, Upwork, Sonos, among many others. We could not be more thrilled about the long-term outlook of client portfolios. These businesses are not on “fire sale,” but should they ever be? If prices fall further, we will continue increasing our weighting. We believe current valuations now tilt in the favor of investors for attractive long-term returns.

In Berkshire Hathaway’s 1989 shareholder letter, Warren Buffet, the famed value investor, outlined many principles that were personal lessons he experienced over his, at that time, last twenty-five years of investing. One of the most conflicting statements and potentially difficult for value investors to learn is that “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” And more importantly, “Time is the friend of a wonderful business, the enemy of a mediocre.” Essentially, Warren is saying it is better to pay a slight premium for an excellent business than invest in a poor business at a severe discount. Assuming the business is excellent, time is on its side. But of course, it still matters what you pay for that business and what expectations are, as those expectations are almost always priced in already. The premium paid cannot be too great as well, as we saw that occur in many tech businesses just last year.

We are happily paying ten to twenty times current free cash flow for attractive businesses with healthy balance sheets that are continuing to see strong growth. These companies’ current cash hoards will only grow, allowing these multiples paid to shrink over the coming years. It was only eighteen months ago that investors were paying unreasonably high multiples for these companies. A company we previously discussed to illustrate the absurdity of valuations, Rivian, has seen its stock fall from a high of $180 per share to now under $30 in less than seven months: a decline of 88%. If the stock falls towards the low teens, it will be trading at a negative enterprise value. This means the market is valuing the business at less than all its cash on its books. What a wild turn of events! From a valuation north of $160 billion to potentially trading below its cash value, the markets are behaving quite flippantly. Rivian may eventually make our shopping list if the decline continues, but we do not have any current plans of purchasing the stock at this time.

Instead, we’re focusing purchases on massively cash flow rich companies with many of them holding no net debt. As we said, it matters what price you buy these businesses at, which was a principle vastly ignored by investors in 2021. A company like Zoom for example, which was once valued at almost $170 billion when it was doing just over $100 million in free cash flow can now be bought for less than $20 billion net of cash. Zoom now pumps nearly $1.5 billion in free cash flow per year with almost $5.5 billion in cash. However, will Zoom ever be worth $170 billion again? It does not seem likely anytime soon. So, investors that paid those lofty multiples then will find it difficult to ever recoup their losses. We would have never been able to justify a purchase of a company like Zoom back then, however now we are happily acquiring the stock for clients at these suppressed multiples. Another example of a business we now love, PayPal, does $6 billion in free cash flow per year trading around $90 billion in value. Its stock has fallen over 75% from its highs when it was valued at $360 billion. The company processes over $1.2 trillion in transactions per year, and we see them as a strong competitor far into the future with this processing power.

We continue to justify premiums for businesses that have some form of defensible moat or ability to achieve scale or network effects. One example is Spotify, the music streaming service. While most may find it easy to turn off and on their video streaming services like Netflix or HBO, music is a bit different. Additionally, all the licensing agreements are no easy feat to compile. At least today, consumers do not want to have to subscribe to multiple music services like they currently do for video content to get access to their favorite music. Instead, Spotify consolidates the industry, which is extremely difficult for anyone to compete with besides a mega tech like Apple.

Upwork is a great example of a network effect. Upwork hosts contractors in nearly all industries worldwide on its platform that can easily be hired for remote work. As Upwork continues to grow and gain traction, it will be increasingly difficult to compete with them. Those looking for web programmers, graphic designers, architects, landscape designers, and many more will increasingly look to Upwork. Others wanting to be employed will continue to turn to the site too as that is where the demand will be. With traction continuing to gain for Upwork, it will become increasingly difficult for them to face meaningful competition as long as the company continues to execute well. Upwork has a great product and should see continued growth as remote work holds a place in the future and the company’s network continues to grow. Uber, Meta, and Alphabet would be other great examples of defensible networks.

Markets and the Economy

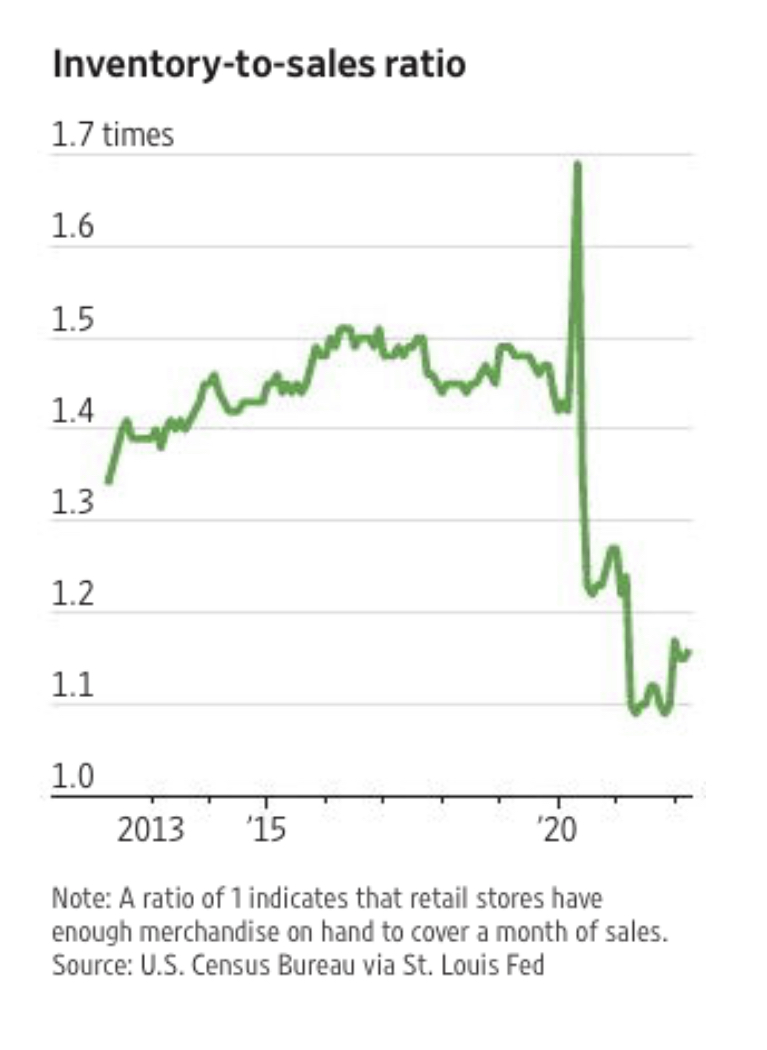

Back in March, we had been getting quite excited for the valuations being offered to investors in tech. However, April saw a bit of a “relief rally” causing some of the valuations to expand. But this month, the space has seen new annual lows, allowing us to continue buying at even more attractive valuations. We have no idea where the “bottom” is, but we believe we’re paying fair prices for wonderful companies. We strongly believe the economy continues to be in a recovery. Most economic data continue to be difficult to compare as numbers have violently gyrated from unnatural events like the pandemic. Both inventories and labor markets remain constrained, that is, businesses are unable to build inventories to previous levels or fill all their open employee positions. Both characteristics describe a strong economy, not one in recession. Looking at the chart below, it’s clear to see inventory remains suppressed. That is not a sign of an “oversupplied” market with slowing demand.

We believe if a recession is seen on paper, it is simply one of semantics. If businesses are unable to secure the products they need, it simply creates a backlog that will show up as a drop today and a boost tomorrow. Ask anyone in construction about lead times and material sourcing, and you will find dramatic timelines relative to the past. This has clear short-term economic consequences and will potentially take years to be able to ease as supply chains across the board attempt to catch up.

We believe if a recession is seen on paper, it is simply one of semantics. If businesses are unable to secure the products they need, it simply creates a backlog that will show up as a drop today and a boost tomorrow. Ask anyone in construction about lead times and material sourcing, and you will find dramatic timelines relative to the past. This has clear short-term economic consequences and will potentially take years to be able to ease as supply chains across the board attempt to catch up.

As for energy markets which everyone is enthralled with right now, we personally envision prices staying elevated for some time. However, we should point out that prices are simply where they were back in 2011, not even adjusting for inflation. We became spoiled with unusually low prices from 2015 to 2020. It was after 2010 that the energy companies started accelerating production which eventually led to price declines. Currently, most energy companies remain cautious, but we believe if elevated prices remain, producers will eventually follow suit with higher production. In terms of our portfolio exposure to the energy space, we have liquidated all pure oil and gas investments as of Friday except for one position, Civitas Resources (CIVI).

It’s not just the tech space we’ve been finding great values in, however, it is the first time we’ve been able to overweight such a growth-oriented sector justified by the current valuations. We continue searching for the best investments for client portfolios, which has been rapidly changing due to the increased price volatility. As always, we will continue trying to keep you updated as new, relevant information presents itself. We are hopeful that these investments will be able to be maintained for the years ahead, however, if valuations snap back too sharply, we may be forced to readdress sooner than later. We will keep you posted.

If you have not had a chance to schedule your personal review yet this year, please be sure to do so as we are now heading into the last half of the second quarter. We can set up an in-person or online review, whichever you prefer.

We appreciate the privilege to be of service and look forward to working together in the years to come. As always, please don’t hesitate to email or call if we can be of further service in any way.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility