Highlights of this Update:

- Morgan Stanley acquisition of E*Trade Advisor Services completed.

- This year’s political, social and economic instability and uncertainty is not endemic to the US, nor this period of History.

- A quick walk through History (i.e. US History) demonstrates the similar psychological fear and stress that we are experiencing today, potentially explained by “presentism.”

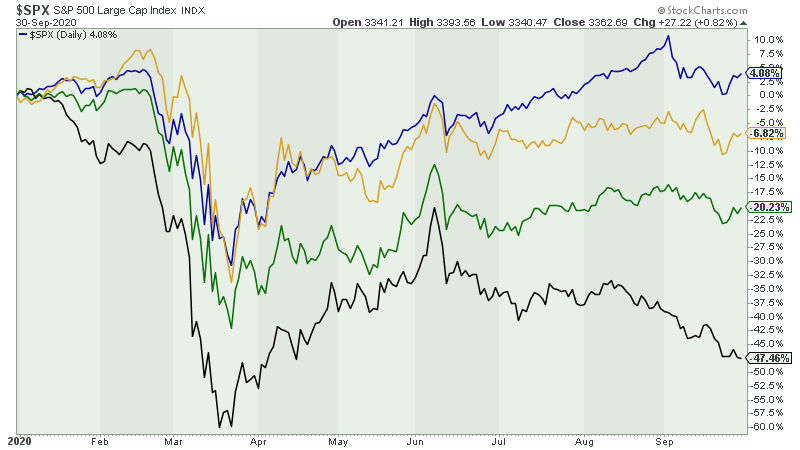

- Sector performance divergence has been extreme this year, with energy (XLE) lagging the most, down 47% year-to-date.

- F.I.G. Financial remains steadfast in our approach for clients of Disciplined Investing and Principled Financial Planning, keeping an eye on the long-term.

Morgan Stanley’s Acquisition Of E*Trade Advisor Services

On October 2, 2020 the acquisition of E*Trade and E*Trade Advisor Services was completed. At this time, we do not expect any changes to our day-to-day operations and are continuing to work with E*Trade Advisor Services on a “business as usual” basis. Should there be any changes that might affect the service and low-cost operational services, we can look to other alternatives that might better serve your needs. We will keep you posted, but at this time, we don’t anticipate any major changes.

Are we Victims of “Presentism”?

As we enter the 4th of quarter of 2020, we are constantly reminded of the typical election year accelerating hype and chaotic headlines; nonetheless, 2020 has had its fair share of both warranted and unwarranted causes for concern. Understandably, with our 24-hour news cycle and the onslaught of social media, it’s no wonder that fear and anxiety are at the forefront of most Americans’ consciousness. But as we begin to wade through the issues, renowned academic professor and social critic, Camille Paglia reminds us that far too often we become “prisoners of the moment”, sensationalizing the current events over and against any previous event in the distant past. For instance, the term “unprecedented times” has become cliché in as little as 9 months, capturing the imagination of our American society and dominating most news headlines. Yet, we fail to acknowledge that many previous generations have experienced pandemics, economic downturns and civil unrest, not to mention even all out global wars.

Not even a century ago- during Franklin Roosevelt’s presidency, the country was emerging out of what would become the worst financial depression of the 1900s. He passed one of the most aggressive programs that would lead to the largest taxing of America’s future generations through Social Security. America would force some citizens into camps for fear of domestic spying. After the President’s surprise passing, the US later dropped atomic bombs on not one but two civilian cities in Japan. Having some overlap to present day, Nixon’s election year was marked by the assassination of Martin Luther King Jr. and subsequent riots across the nation, the assassination of President John F. Kennedy, and widespread opposition to the Vietnam War across university campuses. Nixon ran on a campaign that promised to restore law and order to the nation’s cities and provide new leadership in the Vietnam War. In the early ‘70s, many scientists were even fearful of an impending ice age.

You could easily thumb through any point in written history and repeatedly find examples of these wild times, even more so than just in the last hundred years. Paglia notes that she encourages her students to avoid the pitfalls of only focusing on current day events, citing the social phenomenon- “Presentism”. “Presentism” is a “major affliction- an over-absorption in the present or near past, which produces a distortion of perspective and a sky-is-falling Little Chicken hysteria.” At the risk of oversimplifying, a step-back into history offers a sobering perspective that we may not be veering off the inevitable economic cliff that seems to loom behind every media report. History shows us that although the current political, social and economic tensions feel like it’s at its fever pitch- ready to burst at any moment, there have been numerous events throughout even just U.S. History that mirror the same fear and uncertainty that we are experiencing today. In the eloquent words of Mark Twain, “History doesn’t repeat itself, but it often rhymes.” And, we believe we again find ourselves in the rhythm of History’s poetic meter, and it would serve us all well if we take a step back to unplug from the media-induced frenzy that dominates so much of our daily activities.

We do want to mention that this is not meant to delegitimize or undermine real problems that need to be addressed. We understand that much of the political and economic landscape of the present day is complex, requiring very nuanced bi-partisan approaches. However, this is simply meant to help reduce the anxiety that comes from reading headlines or catching the latest remark on social media. We encourage all of our clients to stay committed to disciplined investing and principled financial planning as we approach the Presidential Election season. Regardless of the outcome, we remain focused on protecting our clients the best we possibly can and are constantly analyzing various potential impacts form a variety of potential changes that may lie ahead. Through any environment, we fervently believe in value investing, constantly seeking investments we believe to be undervalued and should be to the benefit of our clients in the years ahead. We believe in remaining invested for long-term returns.

2020 Market Indices Disconnect

As an illustration, even after all the chaos that unfolded during FDR’s presidency, the markets made all-time highs by what would have been the end of his three terms. If you had a crystal ball to see the insanity faced worldwide, would you have dared to invest? Turning to present day, if you would have been able to see the entire outcome of 2020, would you invest? The S&P 500 has been able to inch out all-time highs this year, despite a global pandemic that saw governments close their doors worldwide. While the same cannot be said for every sector, you can see the Energy sector (-47.46%), Financial sector (-20.23%) and Real Estate (-6.82%) in the chart below have been among the worst performing groups compared to the S&P 500 up 4.08%.

As previously discussed, we do remain concerned with the concentration of the indices, but we are encouraged by the investments we continue finding for client portfolios. For example, just 10 companies in the S&P 500 index, or 2% of the total number, account for 28% of the index weighting. The markets have seen major divergences between certain stocks, which is somewhat unusual for a “normal” recession. But, as we’ve said before, this is not a normal recession. And moving forward, we believe there is much opportunity that lies ahead in many areas for various reasons. As always, we urge our clients to remain focused on their long-term plans rather than the day-to-day headlines. We can assure you the headlines will only get louder towards the election and ask you to look at the decade ahead, rather than focusing on the short-term. That’s what our focus is for you and preparing how situations or events affect our clients’ personal outcomes. So, let’s stick with your plan and start enjoying life with its unending chaos. As certain with death and taxes, insanity can be seen anywhere you look in history and that has never been a good reason to not invest. Remember the words of the wisest man to ever live-King Solomon: “What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun”. Ecclesiastes 1:9 ESV

We hope you and yours are having a great start to the fall season and we wish you all the best for the rest of the year! As always, please don’t hesitate to call or email if we can ever be of further service, or if you have any questions or concerns.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Markets Confused over Mixed Signals