Reviews Available Online or In-Person

As our last correspondence mentioned, we have been back in our offices with normal business hours since Friday, April 24, 2020. We can conduct your personal review either remotely online or in-person, whichever you prefer. Fortunately, no one in our family has contracted the virus, and we all have remained healthy and well. If you are well and want an in-person meeting, just let us know. If you prefer to conduct an online review, we can accommodate you as well. If you have not yet done so this quarter, call or email us today to schedule your review. It’s an important time to not only review your investment portfolio, but your long-term financial plan as well.

May Market Holiday

The US financial markets will be closed on Monday, May 25th for the Memorial Day holiday. Our office will be closed that day as well. Also, since the holiday falls on the 25th of the month, the regular monthly withdrawals processed from E*Trade Advisor Services accounts will be processed on Tuesday, May 26th, one day later.

The Markets – Where We’ve Been, Where We Are Now, and Where are We Headed?

April provided positive results for the US financial markets after a swift decline in March. Although this pandemic and impact to the overall markets is quite an anomaly, recessions are not. With businesses being shutdown globally, we definitely anticipate there to be wild swings in economic data over the coming months. Bankruptcies may rise for some time. We would also anticipate this recession could possibly last another 12 to 18 months as the world starts resetting and getting back to normal. While we would expect quite a few speed bumps along the way economically, what financial markets themselves do in the shorter term is still unknown. Just because the world continues to be in a recession, that alone does not necessarily equate to lower stock prices. Before this pandemic hit, we were expecting a soft, muted recession. However, now with the markets having fallen over 35% top to bottom and the bond markets nearing collapse back in March, the recession may have already been priced in during those declines. Additionally, both governments and central banks have taken unprecedented steps in both scale and speed to try to fill the holes caused by shuttering economies.

We would expect to see more market volatility ahead given the current uncertainty. We continue to find attractive valuations for our individual stock portfolios and intend to hold some of these for the foreseeable future. Banks and financials are showing some of the lowest valuations on record, which could imply a recession does continue moving ahead as well as the possibility for negative interest rates in the US. US Gross Domestic Product (GDP) could see a historic drop, which again, is expected, because governments forced an economic coma world-wide. However, we do not think there will be an immediate surge back to normalcy as it will take some time to get every economic engine running again. Unemployment could remain elevated as the CARES Act continues to pay furloughed Americans an unusually high benefit, which is unlike any other time in history. These events make most reported economic data near meaningless from an investment perspective.

Due to the current amount of uncertainty, we remain “hedged” on a portion of our equity/stock holdings for some downside protection. Typically, we prefer to simply hold fixed income/bonds in time of stock market uncertainty, but these times call for extraordinary measures. As mentioned in previous updates, we fully intend to exit all of these “hedges” at potential gains if markets do indeed decline again. We would then use most of these proceeds to invest in stocks at what should be at lower valuations. If, however, markets decide to continue moving higher, we will eventually unwind these particular assets and reinvest in other assets. We do not intend holding these “hedges” beyond the next six to twelve months, but we will wait for further confirmation of various indicators to give us comfort in a more stable environment, no longer justifying this type of portfolio protection.

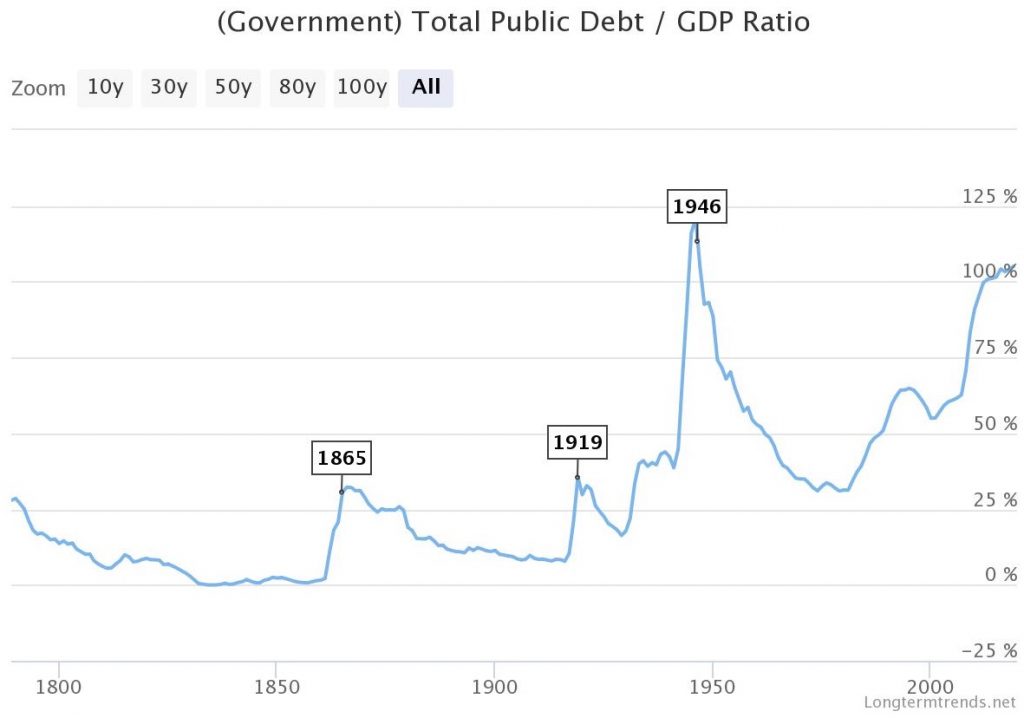

Referencing the chart above, the US debt levels were quite elevated before this global event. After factoring in the new debt issuances, we very well should be higher than 1946 once this data is updated again.

If the world’s governments, central banks, and economies are able maneuver through the pandemic with little-to-no echoes, it will be an impressive feat. We do not see this as a likely outcome. The long-term overall impact of the reaction to the virus remains unknown and whether more participants will be left in a better position versus worse when this is all behind us remains to be seen. We say these things to help keep you informed as well as let you know we are aware of various possibilities. We continue to diligently seek investments that can help protect your wealth for the future. One value investor we have great respect for, Warren Buffett, said it best in his 2018 shareholder letter:

“Those who regularly preach doom because of government budget deficits (as I regularly did myself for many years) might note that our country’s national debt has increased roughly 400-fold during the last of my 77-year periods. That’s 40,000%! Suppose you had foreseen this increase and panicked at the prospect of runaway deficits and a worthless currency. To “protect” yourself, you might have eschewed stocks and opted instead to buy 31⁄4 ounces of gold…”

His premise in the letter is America’s amazing ability to innovate and adapt. We believe in the long-term returns that quality businesses can provide, but we must also be aware of the shorter-term risks to client portfolios. Buffett finally relented on his cautious warnings for federal spending. Although, we could argue that rising interest rates in the future will eventually cause the debt to carry a higher cost and must be paid at some point. And while Buffett has the luxury at looking at a 77-year period, we need to be aware in the shorter-term as well to try to protect portfolios for clients so they can enjoy the years, not just decades, ahead. Ironically, Buffet’s 77 year discussed in his letter started during WWII, and now America will again see unprecedented debt levels similar to that time in history. After WWII, debt to GDP levels eventually fell for almost three decades, before escalating again into the present period. Inflation also did not gain any significant ground until the late 1960s. So, with all this said, it’s not necessarily all gloom and doom from the data regarding government debt.

Businesses face great challenges from this current pandemic which will not be the last challenge ahead, but it does not come close to comparing to the destruction that most of the world experienced from an all-out war. There may be some businesses that do not emerge on the other side of this, but as a whole, most quality businesses will be able to pull through and resume business again.

Looking back at this most recent market decline, we are somewhat frustrated by the impact observed by client portfolios. We had been in the most conservative stance relative to the last five years, anticipating a recession. We invested in fixed income assets that would have normally performed well during a soft recession. This time, however, fixed income/bond assets imploded during the onset of the pandemic leading us to make an extreme move, liquidating all bond exposure for a short time. This did help portfolios avoid a good portion of the decline in bonds that ensued, but we had relied on these secure assets to gain in value while equities declined. Instead, these assets declined in value unlike any other recent time in history, even more extreme than during the financial crisis of 2008-2009. The Fed stepped in with some of the most aggressive asset purchases ever announced, which helped stabilize the bond markets from a potential all out collapse. We began adding back fixed income to portfolios after these announcements while assets were stabilizing.

One market not receiving any stabilizing intervention and witnessed the full scale of chaos: oil. For the first time, oil prices actually went negative, which most in the industry would argue is neither rational nor possible. But it did happen. We believe this illustrates what was happening to markets without any manipulation from an outside source like the Fed. Oil, however, has its own issues outside of this pandemic and its impact on demand, such as the previous price wars and scarce availability for storage. We do not see how these issues will be resolved anytime in the next few months, which make us concerned to invest in the energy sector at this time. Being in Oklahoma, we do get several requests for commentary, and we believe there are too many uncertainties in this space with too many great of opportunities outside of it. This view may change, but it remains our opinion for the moment. We cannot justify an investment that rests solely on the variable of oil prices going higher. At these current prices, no American producer can operate profitably, which we see as too great of a risk until companies can at least hedge their production again. Obviously if prices stay this low for too long, it could evolve into a national security debate. We will let time tell this story, as it is too much of a conjecture at this point. And while we do believe higher oil prices seem likely, it still makes for too risky of an investment at present in our opinion.

We will continue to keep you posted as this fluid environment continues to evolve and encourage you to email or call if you have any questions or concerns.

It is a privilege to serve each and every one of you, and we look forward to working together in the years to come.

God Bless,

Your Team at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility