Last Month of the 2nd Quarter

It’s hard to believe that we only have one month left in the first half of this year. We would highly encourage you to schedule a personal review if you have not yet done so this quarter. It is a turbulent time but that also makes it a great time to review your personal long-term financial plan, portfolio, and portfolio risk level. We can schedule an online or in-person review, whichever you prefer.

CARES Act Affects all Ages

It’s important that you review your overall financial planning this year and make sure you are taking advantages of changes made to Required Minimum Distributions from IRA’s this year-You DON’T have to take the RMD this year and pay the taxes. Also, there are provisions affect loans and withdrawals from 401K plans for 2020 as well. There are other provisions for 2020 due to the COVID-19 virus. Call us with any questions.

The Current Environment

With the nation now slowly beginning to open back up from the global pandemic, some businesses are met with riots and severe property destruction in many major cities across the country. In addition to the global pandemic and national riots, the US launched several aggressive comments on Friday towards China and pulled funding from the WHO, a global statement trying to spotlight areas that some believe to be imbalanced. The nation is clearly in a state of unrest, and it now seems to only be escalating. With so many dramatic headlines, one we continue to watch for is clarification on further stimulus. The US government has already approved over $2 trillion in additional spending with debates occurring around another $3 trillion bill that may be approved, even though the majority of the initial stimulus bill has not even been fully utilized yet. As we previously wrote, the US’s debt to GDP ratio is higher than any other time in history. It is currently estimated around 130%, which handily beats the WWII high of 108%. The official ratio will not be known until next year.

With all this uncertainty, we remain focused on long-term stock valuations. We believe normalcy will eventually be seen, but it will take several years to get there. We believe the COVID-19 virus will take a back seat at some point and almost already has in terms of the headlines. Looking at past pandemics, the virus could easily trail into the end of 2021 in some parts of the world. Another wave could indeed occur later this year, which would be normal based on how our Country has initially reacted. When you shut down an area or try to “flatten the curve,” it typically extends the duration of the pandemic, at least that has been what has occurred historically. We would hope officials take a more realistic approach to the problem if a second round does emerge. Following the recent surge in protests around the country, it will be interesting to see data related to the virus over the coming two weeks. For the developed world, the next twelve to eighteen months will undoubtedly continue to be a volatile ride, at least in terms of headlines and economic data. As to how the market performs, that is anyone’s guess. We continue to be encouraged by some of the valuations we were able to purchase businesses at back in late March. However, if stock valuations continue running up as quickly as they have in the last two months, we will not view certain holdings to appropriately compensate our portfolios for the various risks and we may begin rotating aggressively into different positions. We also continue to maintain our “hedges” for the time being.

Exploding Money Supply

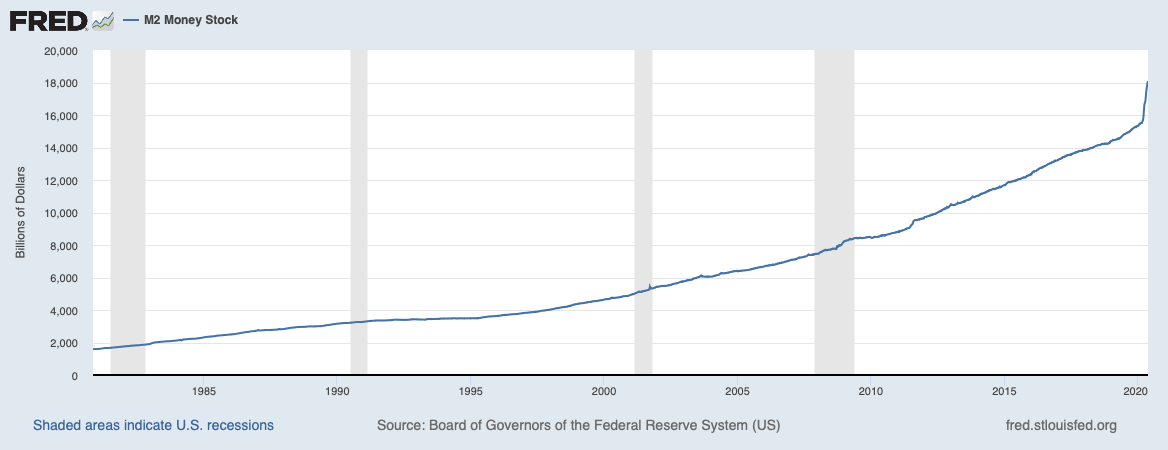

In our opinion economic data remains completely meaningless at this time due to the unique situation of unemployment and GDP we’ve previously discussed. One measure we continue to watch that we do believe has some material impact is the money supply, in particular what is known as “M2.” M2 is a measure of more liquid cash and cash-like securities. And please note, our use of “cash” is not in reference to just the physical paper form. We use this term to refer to liquid securities like banking deposits as well. M2 gives us an idea of the amount of “money” available inside and outside the banking system. Typically, it is an indicator that just slowly rises by a few percentage points per year which leads to marginal inflation over time. In times of panic, such Y2K, 9/11, and 2008, an additional uptick is usually observed to accommodate for the additional demand in cash; times when individuals may be selling assets or creating additional cash due to concerns for the near future. Panics that involve much of the country can place stress on the system which can require additional cash. No other time in history is comparable to this rise in M2 that has been seen in the past two months.

Looking at the chart below, a historical timeline of this version of the money supply can be observed. Since March of this year, M2 has exploded by over $2.5 trillion. Not only is this an unprecedented move in nominal dollar terms, it is also a year over year change currently more than 23%, which far exceeds the highest percent change during the 1980s of roughly 13%. This will continue to rise even higher if further stimulus measures are implemented. Additionally, many of the Fed’s programs will also be taking effect over the next month, which could also lead to a further rise in M2. Ultimately, we believe inflation will start rising at some point from these actions. Stagflation (higher inflation with elevated unemployment) is also a very possible scenario in the short-term, but we believe higher inflation could be seen longer-term, possibly for the decades to come. The US will also reach its highest debt to Gross Domestic Product (the economy) levels in history this year. Inflation is often a primary tool used to alleviate substantial government debt burdens. If you owe someone $100 in ten years, most of us understand that that $100 will be worth less due to inflation at year ten. If you can increase the amount of inflation without major disruptions, that $100 is worth even less making it a better deal for the borrower (the US government). Additionally, most individuals are less aware of this impact due to it occurring over time and not easily noticed one year at a time. However, we believe fiscal measures will also have to be implemented as well, such as less government spending or higher taxes. The former has been shown to be the least utilized solution in recent decades with the latter being the more likely solution near-term.

We must clarify though, the market pricing does not agree with our opinion, at least for now. Currently, market contracts pricing inflation expectations now imply roughly about 1% inflation per year over the next decade. We originally agreed in the short-term with deflation is very possible over the next few months due to the liquidity crisis being witnessed and surge in dollar demand. However, with so much production offline, the supply of goods is becoming an issue for some businesses even more so than demand, which would imply near-term inflation is possible in some areas. Think: substantially more dollars chasing a fewer amount of goods. One major aspect helping prices continue to stay low though is the subdued price of oil. With all the chaos currently, we do not believe the market is able to properly price in future risks, especially as the Fed, and all other central banks for that matter, continue to step in try to prop up prices. Will the world be successful in this massive experiment? It’s possible. Similar steps were taken during the financial crisis in 2008-2009, however this time it is much larger in terms of government and central bank actions. Time will tell, but we believe inflation will have to arise at some point in the future from recent actions. On paper, little to no inflation occurred since the financial crisis. We ask you, can $100 today still buy you the same amount of goods as it could in 2008, with the exception of gasoline prices?

The Investment Landscape

We believe that bonds or fixed income assets will continue to become an increasingly difficult market to navigate. These assets are typically considered the more conservative and “safer” securities. Even if expectations are correct and the US witnesses a modest 1% inflation per year over the next decade, the 10-year US treasury bond only yields 0.67% as of today. This means investors purely buying US treasuries are locking in a near guaranteed real loss on their capital if held to maturity over ten years based on 1% annual inflation.

We continue to be vigilant in seeking new opportunities to try and better protect client assets. As most view the America around them in complete chaos, markets continue marching higher. It may seem perplexing to most, but markets are forward-looking, attempting to price future risks, not the present. While there is continued uncertainty, it seems the markets are expecting economies to resume with the possibility of even further stimulus. If not, the Fed, Bank of Japan, European Central Bank, and the Bank of England have all announced some form of “unlimited” support to the markets. All of this support comes in the form of their respective currencies, which is why we believe inflation must eventually be seen. We do believe undervalued REITs (Real Estate Investment Trusts) should perform well from these actions over the decade ahead, which is why we have made it an allocation in client portfolios for all risk levels. Additionally, we continue to be strong believers in value-oriented stocks, which will continue to be held in portfolios. Within the fixed income space, it will become increasingly difficult. We have shifted holdings to various ABS (Asset Backed Securities) funds, inflation-protected funds, as well as some funds that carry more risk, including both high yield debt and floating rate securities. We continue to hold some municipal debt funds as well, as total returns for these funds should exceed treasury rates, which is unusual. If municipal markets calm further from Fed stimulus, we will be exiting these funds and rotating into more favorable long-term investments at that time.

We expect that similar to all of history the world will continue to experience wars, pandemics, natural disasters, riots, bubbles, crashes, and countless other issues seen and unseen. But, with history as a guide, investing in undervalued businesses has continued to be a wise decision in the long term, especially when it seems like the most difficult thing to do; a decision we believe will continue to be wise for clients moving forward.

We appreciate the privilege to serve all of you and look forward to working with you in the years to come. Don’t hesitate to call or email at any time if we can be of further service.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Looming Risks Overlooked