“For unto you is born this day in the city of David a Savior, who is Christ the Lord.” Luke 2:11 (ESV)

Merry Christmas!

We wish you all a very blessed and merry Christmas! As has been our tradition for the past several years, we have once again made a donation on our client’s behalf for $1,000 to Prison Fellowship’s Angel Tree Program this year. For more information you can go to: www.prisonfellowship.org

Holiday Season Reminders:

Since Christmas is on a Sunday this year, Monday, December 26th markets will be closed as well as our office. We will also be closing our office on Friday, December 23rd as well this year. REMEMBER: Since the 25th is on a Sunday this year, and the 26th is a holiday, monthly distributions from AXOS Advisor Services accounts will not go out until TUESDAY, DECEMBER 27th.

Since New Year’s Day also falls on a Sunday, the markets and most businesses will be closed on Monday, January 2nd. This will also delay any distributions by one business days as well. We will be back in our offices Tuesday morning, January 3rd for business as usual. We are looking forward to 2023 as we start another year, which will also be the 40th anniversary year for F.I.G. Financial Advisory Services, Inc.!

What’s the Fed Trying to Do?

Many of you have probably seen the news headlines in relation to the Fed hiking rates and the impending recession. We thought it would be helpful to walk through what the Fed is doing and why they believe they should. Additionally, we will offer our opinion on what 2023 could hold.

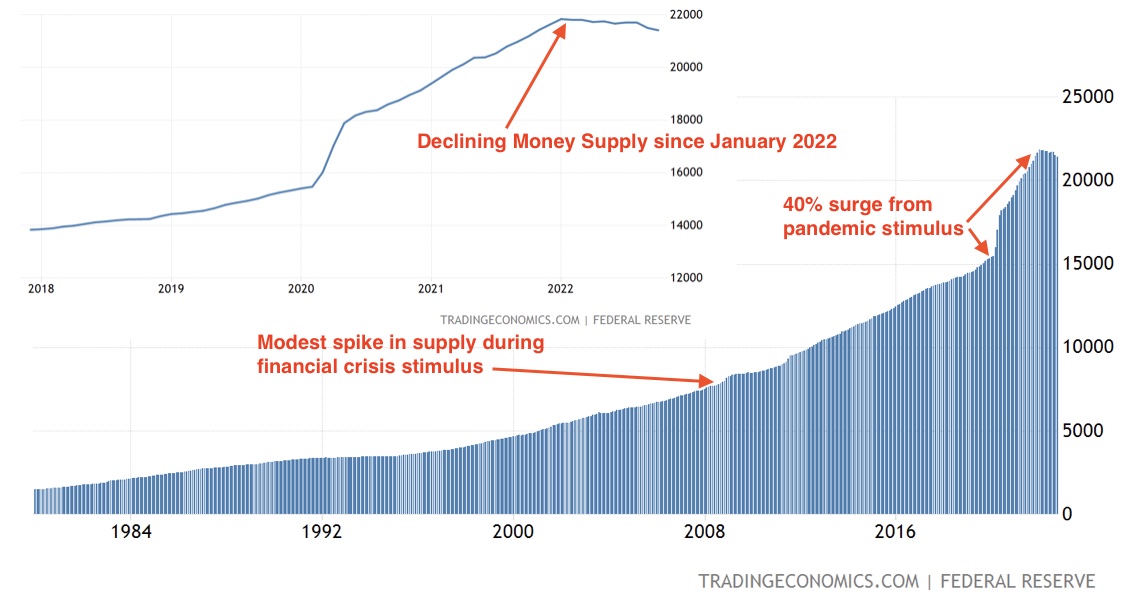

Most have forgotten that the Fed started dropping rates in the late summer of 2019, well before the pandemic. However, it was in April 2020 that the Fed took rates to 0%. Many governments worldwide were mandating business closures and shutdowns. It brought much of the world economy to a grinding halt and created a severe liquidity crisis. In response, the Fed unleashed the largest easing program in history. Additionally, governments began shoving money into the accounts of their citizens. In the US, we witnessed the advent of PPP loans, multiple stimulus checks, unchecked unemployment benefits, child tax credits, and much more. During this process, we watched the money supply jump over 40%, the largest spike since World War II.

Witnessing this unfold, we became incredibly concerned about inflation when most touted severe deflation was upon us. Fast forward to 2022, and we saw a large spike in inflation, prompting central banks worldwide to slam on the brakes and begin tightening.

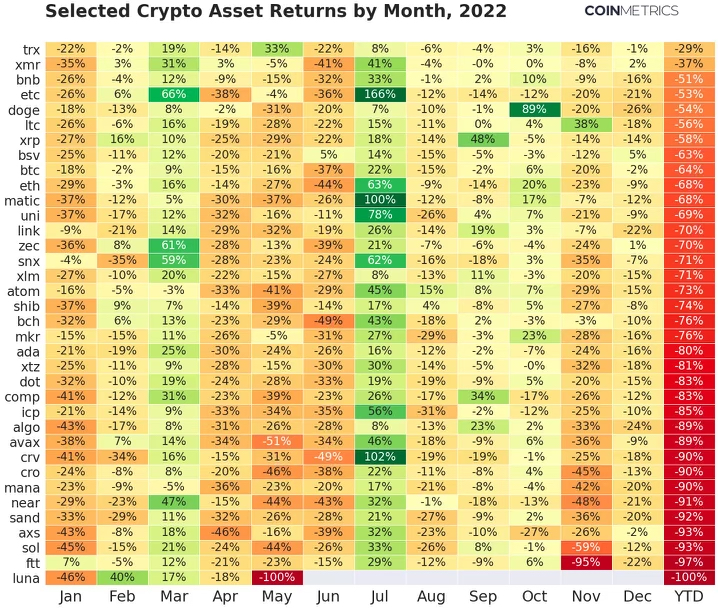

We’d be remiss at this point if we didn’t mention cryptocurrencies. We have advised against this type of investment for the long term, and 2022 has not been kind to the crypto world. We never believed crypto currencies would be a good hedge against inflation as many had thought. With FTX and the problems it is facing capturing headlines almost daily, crypto currencies have fallen substantially in 2022 as the chart below illustrates:

For the first time since 1930, the US saw its money supply contract, albeit after one of the largest surges it has also seen. This can be seen in the top left chart above. While we once believed the Fed was easing for too long, we now, unfortunately, believe they’re tightening far too fast. The Fed stopped its easing programs and hiked rates from 0% to 4.5% in less than a year. But how does the Fed hiking rates impact the economy?

Let’s imagine a business looking to receive financing to buy a building. When the business buys the property, the seller receives cash, most likely then deposited at their bank. The seller’s bank can then use those deposits to lend money to someone else looking for financing as well, creating a cycle or velocity of money in the system. When the Fed hikes rates, it makes money more expensive to finance every type of loan. The business originally looking to buy the building may postpone their decision or may find it to be entirely too expensive now. The seller will not receive cash, which will also not allow their bank to receive more on deposit and have more to lend. It creates a break in the cycle to slow the economy down.

On the consumer side, it will make mortgages and auto loans more expensive, causing consumers to have to reduce their available budget. If shopping within their means on the advice of their financial advisor, it may not be beneficial to take a loan any longer but instead, pay cash as the average auto loan rate is now north of 6%. This further reduces the availability of assets as a bank does not get to make a loan, another bank may lose deposits, and the consumer may have to sell investments or other assets to buy the vehicle. For leveraged investors, it can cause leverage and margin loans to be too costly and force investors to reduce balances by selling investments. This can be exacerbated if stock prices decline as they have lately. While you may assume it does not impact those that do not use debt, it can still indirectly impact asset prices. At F.I.G., we do not take on any direct leverage when investing for clients, but we can indirectly be impacted by the leverage of others.

When you have a 40% surge in the money supply in such a short period, you do not have an equivalent surge in goods. So, you have substantially more money chasing the same amount of goods, hence inflation. Not only that, the Fed was also making money extremely cheap by keeping rates suppressed, allowing for the escalation of the flip side of our illustration above. The Fed tries to control the economy during market cycles gradually. When things heat up, the Fed slowly takes its foot off the gas and tries to slow the economy down. They also put their foot on the gas when the economy is weak. This is an attempt to avoid excesses and depressions, yet history shows the Fed has repeatedly been unsuccessful in this, yet here we are.

The Year Ahead

We watched the Fed, other central banks, and governments worldwide provide an amount of stimulus never seen in history during the effects of the pandemic. It was followed by hesitation rooted in fear of both the virus and taking the foot off the gas too soon. However, realizing they stimulated for too long, the Fed and other central banks globally are tightening at the fastest pace in percentage terms on record, not even a year later. What’s that mean for 2023? Well, it seems that a real recession could occur. However, the financial market is already saying this, both the bond and equity markets. If the market seemed oblivious, we’d be practicing more caution and be incredibly concerned. But even the Fed has this outlook, with the vast majority of those on the Federal Reserve Board of Governors expecting to drop rates by 2024. So, why they continue raising rates at this pace is beyond us.

As we previously discussed, a recession will likely emerge in the coming year, but it does not necessarily equate to stocks performing poorly. We may see a ripple of defaults possible from dramatically higher rates and a tougher labor market. Most of our stocks held in client portfolis have little to no leverage relative to peers and should not be affected by higher rates. However, it could have a drag on the economy. It’s possible to wake up to lackluster economic news but see the markets marching higher by the end of 2023, as a struggling economy seems to be priced in and expected by the markets. If the Fed continues hiking rates and interest rates remain elevated, we believe the economy could normalize and get accustomed to higher rates. However, some businesses will struggle, such as those that are over-levered or reliant on cheap financing.

Geopolitical risks are always outliers, but we have become less concerned with the China and Taiwan rhetoric as we see a possible merger by politics alone rather than military action sometime in the future. It would look similar to the action taken in Hong Kong. But, if Russia continues to prolong the war with Ukraine, it could pose grave difficulties for Europe next year. For the time being, we continue to hedge the Euro and European securities. We are also short the financial sector for continued protection for client portfolios. Additionally, we are overweight intermediate and long-term US government bonds. If geopolitical risks flare up or the economic outlook becomes more dire than expected, these hedges and investments should perform well. We do not intend to hold the hedges for any extended period; however, it remains an investment for the time being.

This past year was one of the most difficult investment landscapes in which to navigate. Still, that difficulty was primarily driven by the bond markets, which saw interest rates jump at a highly unusual pace. As for the Fed, we would be surprised to see them hike rates too much further. Currently, the Fed forecasts a peak of 5.5% at a current rate of 4.5%. Once the economy catches up to these hikes and the Fed recognizes the slowdown, the Fed should at the least refrain from hiking rates any further. We would not be surprised to see them initiate bond purchase programs again, but time will tell. If the economy experienced a severe decline, they would most like be forced to drop rates again, continuing what we’ve dubbed the Ripple Economy. But remember, if we witness a recession next year, the market are currently expecting this.

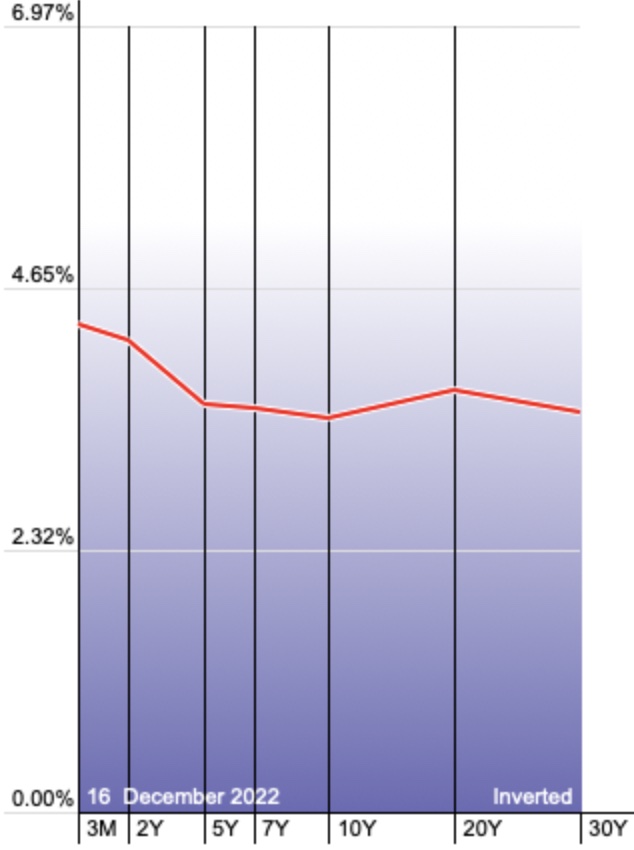

One tool used to gauge the market’s temperature is the yield curve, shown in the chart above. The red line connects different durations of US government bond yields. In a normal market, you would expect this to look like the left side of a rainbow, arching up to the right. This implies that investors receive less yield for shorter-term bonds and more for longer-term bonds. However, the yield curve is inverted, meaning investors in longer-term bonds are instead receiving less yield. The logic behind this is that the market indicates that the higher short-term yields received today will not last, usually signaling concern for the economy. In addition, the equity markets have suffered a large pullback in what seems to be front running these concerns. We conclude that the market is already aware of the struggles the economy could face in 2023.

Because of these expectations, the risk lies in not seeing a recession next year which would raise concerns about a longer period of interest rate hikes. Or, the US could potentially experience a more severe recession than expected, leading to currently mispriced stocks. However, we are less concerned with the latter, as the fundamentals of the housing market remain strong despite the headlines, employment continues to be robust, and the economy does not seem set up for severe weakness. The coming twelve months will be interesting, but we remain focused on discovering the best value investments for client portfolios for the decade ahead and are looking forward to any challenges it may bring.

We appreciate the privilege to be of service to you and your family and are looking forward to working with you in the years to come. We hope you all get to spend some extra time this Holiday Season to enjoy family and friends. As we move into 2023 we do so with renewed optimism and excitement to see what the New Year may bring as we celebrate our 40th year as an independent investment advisory firm.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility