“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold.”

-Warren Buffet, 2016 Shareholder Letter

As value investors, we oftentimes look to proven investors, such as Warren Buffet, for guidance by researching historical actions, especially in navigating periods of uncertainty. Time and time again it is during these periods of dark economic clouds that typically produce the opportunities that provide the best long-term returns. However, the short-term always remains impossible to predict on a day-to-day basis and it seems when so many investors panic is when these opportunities are created due to short-term decisions to sell investments well below their long-term intrinsic values. If something is undervalued, it could easily become more undervalued by falling further in price. But for those investors that take advantage by looking to the next decade and beyond instead, it could prove to be extremely fruitful.

A multiple is typically used to define what you, as an investor, pay for each dollar of some metric, such as earnings. So, if a multiple were to be ten (10) relative to earnings, that means you are paying $10 dollars for every $1 that company currently earns. If a ten multiple were to be considered a fair valuation, however, and you find that you could buy it for a five (5) multiple, that would be extremely attractive. Even if the company traded down to a four (4), three (3) or even (2) multiple, if you believe the long-term outlook for the business you purchased would eventually be trading a ten (10) multiple again it still would be a promising investment. Using this same example, if earnings instead turn negative, it becomes extremely difficult to grasp multiples which brings further uncertainty for the future. Multiples can become hazy when choosing to focus on a short period of time. However, with a long enough time horizon, it should prove to be consistently valuable for investment selection.

The multiples we are paying on most client investments today are comparable to those seen in the chaos of 2008 and 2020 when multiples were severely depressed. While some are not as extreme, others are even more depressed than those periods. This already implies the market is concerned, which is accounting for potential difficulties ahead. So, for the short-term, the question becomes: “Will events get significantly better or worse than the market already expects?” But, for us as value investors, we look at these as incredibly attractive levels to invest for the decade ahead, regardless of near-term fluctuations or concerns.

European Uncertainties

However, we do have tools available to try and lessen any potential near-term impacts. It is not desirable, but we consider protection when extreme uncertainties arise. The last time was shortly after the markets massively rebounded during the pandemic. We have been outspoken about our massive concern for Europe since last December, which we believe could dramatically drag the Euro lower if no relief comes soon to the energy crisis they are dealing with at this time. We do have some direct Euro exposure with holdings such as Stellantis, which we previously spoke about the immense value we see long-term in that stock. To help soften any major decline in the currency, we have begun investing in an ETF (Exchange Traded Fund) that profits from a declining Euro. This should help offset loss in the investment solely from the currency impact.

Secondly, we are trying to protect portfolios from any major negative macro event. When we look at the individual stocks held in client portfolios, we are very optimistic regarding current valuations and believe them to be worth significantly more in the future. However, what if European banks begin failing due to both the energy crisis, accelerating interest rates, and falling currency? Higher rates are typically good for the banking sector, but that statement is said in moderation. Currently, we’re witnessing one of the most accelerated paces for rate increases and that in turn can cause dramatic short-term gyrations and instability that financial systems could find difficult to navigate. We have been closely monitoring this potential. Recently, Credit Suisse, which is a Swiss bank that has been beleaguered with many issues in the past, made headlines about raising capital and restructuring its business. However, when coupled with the current swift jump in rates, it could lead to further difficulties let alone for all European banks if they are unable to raise capital efficiently. Many events circling this potential could lead to a “panic” event that could cause others to act irrationally.

When we look at the Fed’s actions of aggressive rate hikes, we have discussed the potential halt in future projects. This, too, would lead to a short-term slowdown, like the “ripple” economy analogy we previously used about the current environment. Given these ripples, we believe any economic trend data to be meaningless for the time being. With mortgage re-financing near non-existent and a temporary lull in home purchases, most like spurred by the spike in mortgage rates, it could pose near-term risks to the financial sector. However, we must point out most financial firms seem priced extremely cheap and seem to be expecting this outcome. But, with the concern of a “ripple” in mind, the potential concern for European banks, and geopolitical risks seeming to increase daily, we have chosen to include an ETF that moves inversely with a basket of financial stocks. We do not intend to hold this for a long period, but we would like to see rates stabilize and have more clarity abroad. As of today, Tuesday, we began adding this investment and will continue to increase it over the coming days and weeks as volume allows. Credit Suisse reports earnings at the end of the month, which will hopefully provide more clarity into their current situation as well. But, if rate increases continue to move against them, concerns could remain for the months ahead.

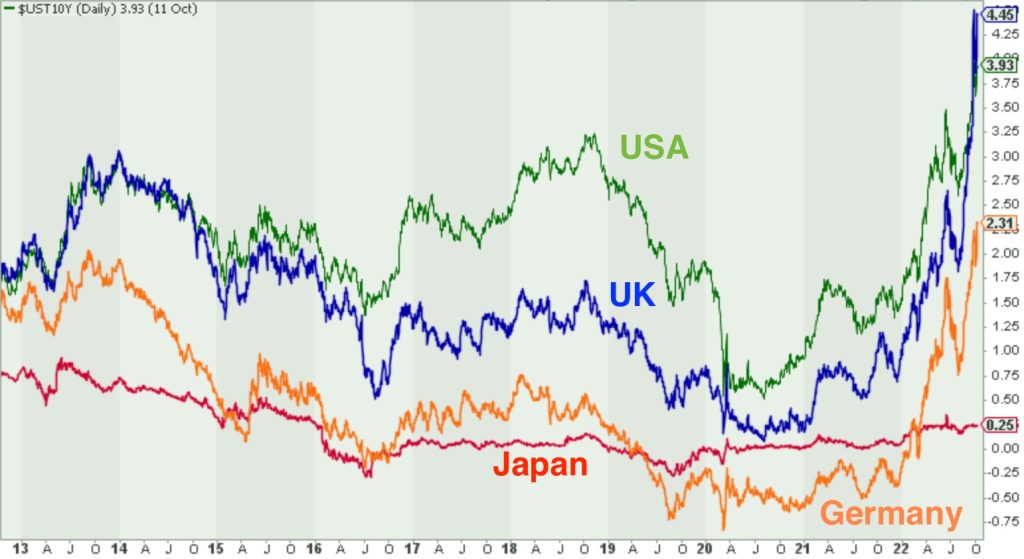

The Fed hiking rates on a strong US economy has forced the ECB (European Central Bank) to hike rates there as well, not due to a strong economy but instead to try and strengthen their currency. We believe this could have an adverse impact on their economy and have decided also to hedge European securities as well. While many of their businesses seem incredibly cheap, we believe this area could see further weakness in the near term. We do not see a solution to their energy crisis happening anytime soon, which could further exacerbate these issues. We believe the hedge is a “doomsday” protection that will allow any further geopolitical events not to impact client portfolios as significantly. While this week could mark the market “bottom,” this is something we will not know for some time, which in that event, these hedges will most likely have hurt performance. But, even with a market bottom, we believe the European energy issue will continue for years, so we have more comfort in hedging those markets compared to US equities. Below is a chart showing various global rates for 10-year government bonds since 2013 illustrating the sharp increase so far this year:

We are long-term value investors. We believe this current environment to be an incredible investment opportunity for the decade ahead. But we are balancing this with the awareness of potential macro-related events that could have near-term impacts. Our more conservative clients will have more protection. However, this is also a trade-off that if the economic skies clear quickly, part of the upside return will have been given up. We view this as an appropriate trade-off to risk and assumed time horizons. Our more aggressive and typically younger clientele, we have encouraged them to allocate to these suppressed multiples and disregard the next eighteen months as most will not look to this capital for decades. These more aggressive investors are receiving much less protection, but it will still be placed in these portfolios to help offset any outsized near-term event if it were to come.

We are not selling any stocks to achieve this. We are placing these investments within the allocation funds by selling certain fixed-income (bond) assets, predominantly those that could be at risk in a further economic downturn. Truthfully, we feel we are more so protecting from psychological concerns of panic selling than any one event. But as we look at the situation in Europe, we do not see a near-term resolution, which could pose unnecessary risks. We believe most valuations currently account for this, however, we are choosing to practice caution based on clients’ risk levels. We continue to be extremely optimistic at the valuations we continue to be able to buy certain stocks at in the current environment. As always, we will continue to keep clients updated with any changes.

We encourage all of you to schedule a personal update/outlook meeting if you have not done so for this quarter. It’s a great time to review your personal long-term financial plan, investment portfolio, and risk, and for us to provide you with an update and our outlook moving forward. Also, the current environment may be an opportune time to invest additional cash for long-term investors, much like we saw in March of 2020.

As always, please call or email if you have any questions or concerns. We are here to serve!

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility