Special Announcement:

We are extremely happy and excited to announce the newest member of the Jurrens family. Sam and his wife Betsy welcomed Elizabeth Faye Jurrens into this world on Saturday, September 9th at 9:24am. She weighed 8lbs. 5oz. and is 19.5 inches long. Mom and baby are doing great (and so is the proud daddy!) It is their first girl, and they have two sons, Jack who is 7, and Jett, age 4 and both are very excited to have a little sister. Welcome Elizabeth!

Update:

- We currently have several concerns, many of which we cover in private client meetings, revolving around the financial markets, which have convinced us to maintain a conservative investment stance by heavily allocating funds to short-term U.S. government bonds.

- There are alarming signs in some REIT businesses, capex-heavy firms, and small banking institutions, such as being able to barely cover interest expenses and experiencing deposit flight, yet the markets appear to be overlooking these issues at present.

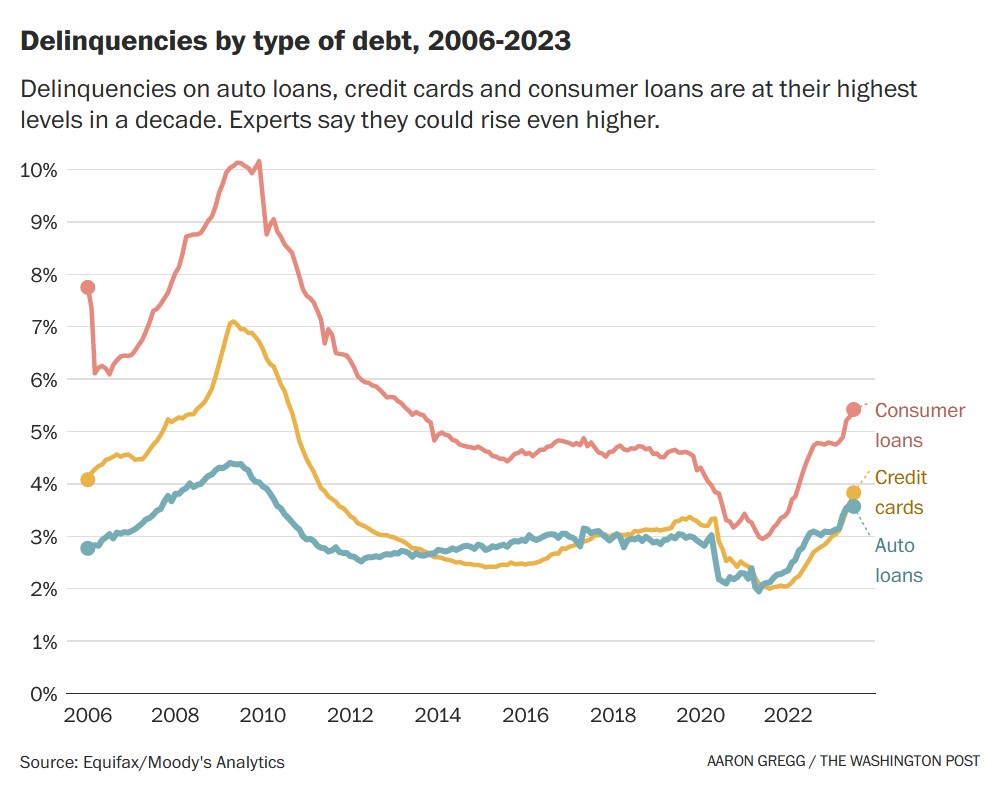

- Consumer loans and credit card debt in the U.S. are seeing rising delinquency rates; while not yet at crisis levels, the trend could become alarming, especially with elevated mortgage-to-income ratios for new homebuyers.

- The commercial and institutional sectors face major headwinds, including a dramatic increase in interest expenses and challenges in the commercial office space area, exacerbated by the rise in remote work options.

- Central banks and governments worldwide have acted recklessly, flooding markets with liquidity without considering long-term ramifications but rather wanting “immediate results,” and are now seeing further cracks in the system as they try to clean up the mess.

The Dilemma of a Portfolio of Bonds

Last Friday, as is customary, we rebalanced our portfolios, continuing to maintain a conservative posture. Any equity-related positions that were either trimmed or divested were substituted with the proceeds being allocated to short-term US bonds. Our allocation to fixed income, heavily skewed towards US treasuries, is reflective of our apprehensions about impending market volatilities. Notwithstanding the current buoyant US economic indicators, it’s akin to driving while looking solely through the rearview mirror. A glaring red flag is the several REIT-associated enterprises teetering on the brink, barely covering interest obligations with their EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) while also grappling with skyrocketing interest rates. Strangely, some of these firms have enjoyed appreciating stock values. Likewise, companies with heavy capital expenditures face squeezed margins which are set to constrict further as their maturing debts beckon refinancing. The banking landscape is not immune either, with smaller entities being pinched by both fleeing deposits and the pressure of offering higher yields to retain clients. Established banks are adopting stringent lending standards, yet loan growth appears steady despite shrinking deposit bases. Loan growth will eventually have to see accompanying declines, further decreasing liquidity in the system.

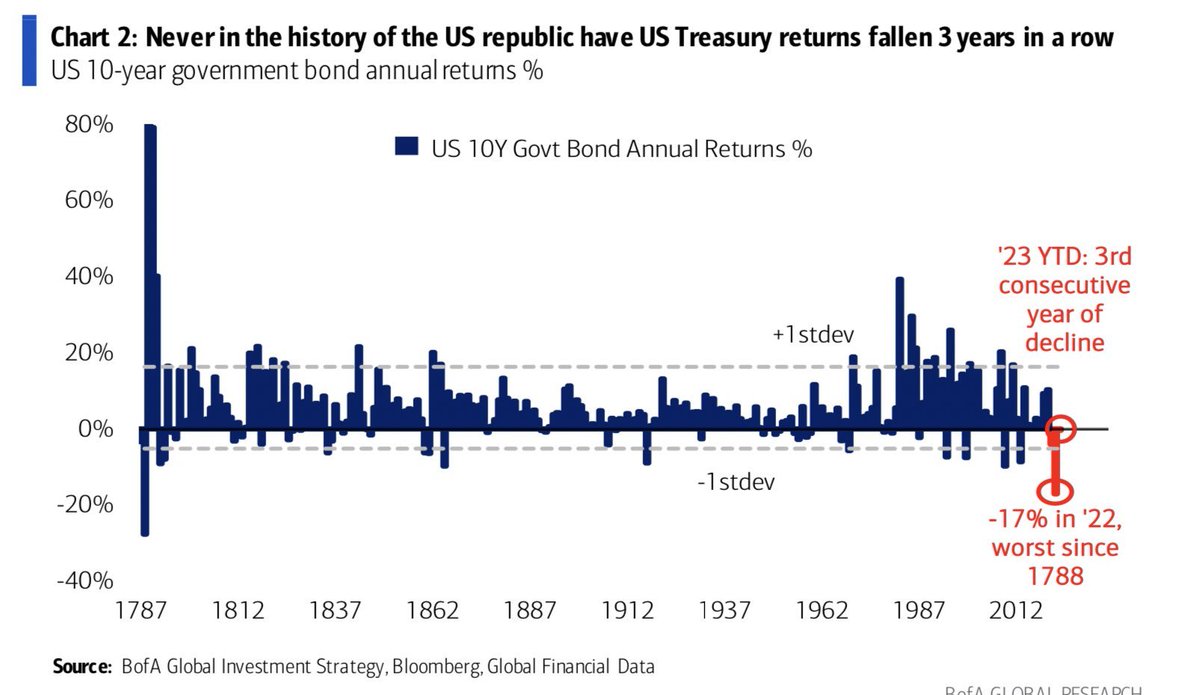

It’s crucial to clarify that our cautious perspective crystallized only six months ago. In October 2022, during a market trough, we identified monumental opportunities even amidst the prevailing economic gloom. We often jest about our perennial optimism, only sounding an alarm once in the past decade, which was in 2019. We perceive today’s environment as fraught with high risk and scant reward, given the plethora of uncertainties the market overlooks. This blind spot makes it challenging to advocate for aggressive risk-taking within client portfolios. The mercurial trajectory of interest rates, for instance, has negatively impacted bond performance for conservative portfolios. We would contemplate this as a transient phase. Notably, history has shown that US treasuries have never endured three consecutive years of decline, and 2023 might just be a first. While it does not hold any weight in our decision, we use this statistic to show the rarity of the current situation.

Market Equilibrium Disruption

The market’s usual role as a predictive barometer seems amiss. Typically, it would be bracing for upcoming storms, but such prudence seems absent. The bond market’s implied yield curve, perhaps, is the sole exception. Yet, the credit aspect of fixed-income markets remains eerily silent. For instance, the acclaimed Vornado Realty, despite its formidable focus on retail and commercial office space, has shockingly modest yields above treasuries, which we previously discussed. Surprisingly, a company that may encounter future challenges, including defaults, witnesses near 8% yield to maturities on its debt. Simultaneously, US bankruptcies are mounting without any visible shift in credit spreads.

Michael Burry’s legendary bearish bet against the housing market in 2005 serves as a pertinent reminder. While the popular film “The Big Short” offers a snapshot, it’s worth noting that Burry’s audacious strategy nearly bankrupted his fund due to its premature timing. He was vindicated eventually, but not without immense risk. There were evident fault lines in the mortgage market by 2005, yet the broader market only took note by 2008. Our point is, something presently is amiss, and we do not intend to “time” it. Rather, we’re watching the signs closely, which do not paint a rosy picture.

While we don’t anticipate a calamity mirroring 2008, we’re spotting unsettling parallels. Back then, the debacle was fueled by residential market speculation and exuberance. Today, while housing prices remain stable, driven by homeowners clinging to their properties, the underlying dynamics are different. As we’ve previously elaborated, new home sales constitute a disproportionately high portion of total sales. Overseas, clouds of uncertainty loom. Unlike the US where 30-year mortgage lock-ins are common, in nations like Canada and Australia, the prevalent real estate bubble is exacerbated by the widespread use of adjustable-rate mortgages. And just like we witnessed in 2005 when residential mortgages were not properly pricing reality, we see the same conundrum happening in the commercial mortgage-backed market.

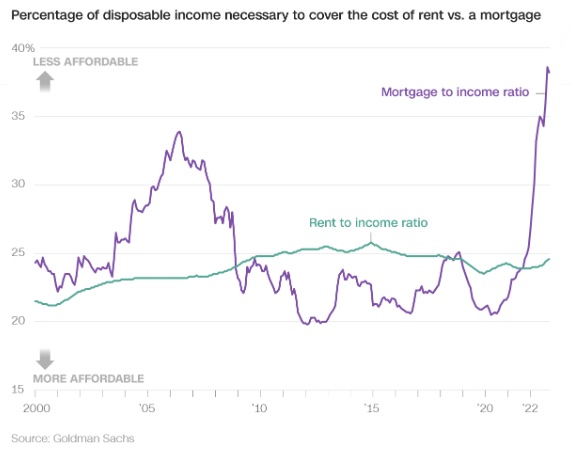

Outside of the commercial space, domestically, there is reason for concern for first-time home buyers, who also make up one of the largest demographics in the United States. Home prices surged along with interest rates, which that group had no participation in the initial price appreciation. However, now, those buyers are facing soaring costs, limited supply, and one of the highest mortgage-to-income ratios seen in US history, which is depicted in the chart below. This is a product of both larger median homes contributing to higher median prices, but we do not see elevated pricing issue correcting in the near-term if rates stay elevated, which will place some stress on that demographic specifically.

On the backdrop of consumer debt, we are also witnessing delinquency rates beginning to rise. While the rate of delinquencies isn’t alarmingly high, the trend is not positive. All the “savings” shoved into consumer accounts during the pandemic have now been depleted, and student loan repayments are set to start on October 1. Consumer loans, credit card loans, and auto loans are now seeing their highest delinquencies since 2012. This is something that seems to be ignored. We have avoided almost all securitized loans in portfolios for this reason. The vast majority of fixed-income exposure comes from treasury bonds.

Commercial Real Estate: A Nexus of Concern

Our focus remains tethered to commercial and institutional sectors. Businesses across various industries, from furniture suppliers to restaurants, are feeling the ripple effects of the ebbing commercial real estate tide. The rapid surge in interest rates, impending tax hikes on property values, and the unforeseen insurance cost surge are all brewing on the horizon, causing further crunches on landlords already struggling. Not all of this is a by-product of the pandemic; however, that event did allow many of these issues to be more prevalent.

Temporary Band-Aids, Persistent Challenges

Visualize a colossal dam on the verge of bursting. In desperation, a huge hole is blasted in its center to relieve pressure. This outpouring mirrors the massive liquidity that global governments and central banks unleashed without fully contemplating the cascading effects. And now, in a bid to remedy their impulsive actions, they’re inadvertently causing fissures elsewhere. A recent illustrative episode is the collapse of the Silicon Valley Bank due to liquidity challenges. While many are nonchalant about this, believing a simple liquidity infusion will suffice, we foresee more banking disruptions, albeit without destabilizing the market entirely. International repercussions are evident, too, with China’s real estate sector unraveling.

As 2023 marches on, with the Nasdaq and a handful of tech behemoths dominating headlines, it’s imperative to discern that the broader S&P 500’s performance remains tepid. This myopic focus on a few stellar performers can distort the true health of the overall market. Our commitment is to navigate these complexities astutely, ever conscious of protecting portfolios while remaining agile and responsive to evolving market dynamics. We hope to announce some new strategies/systems we are focusing on in the coming months to better supplement accounts that could allow for some protection along with participating in top market performers. The strategy will also help guide our allocation models in portfolios specifically rotating between various fixed-income and commodity ETFs. As we progress towards its implementation, we will begin communicating both in private meetings as well as these updates on the opportunities we see lying ahead in utilizing it. We will keep you posted.

Please don’t hesitate to call or email if you have any questions or if we can be of further service in any way. We appreciate the privilege to work with all of you regarding your investment and financial planning needs and look forward to working with you in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility