Good News! AXOS Advisor Services Custodian Fees Reduced

We are very pleased to announce the reduction of all our client account custodial fees retroactively starting with the third quarter of this year.

We had been negotiating with AXOS for lower fees and were able to get our client account custody fees reduced effective with the third quarter this year. As you know, AXOS Advisor Services charges a small custody fee at the end of each quarter to cover all the services they provide such as quarterly statements, trading capabilities, tax reporting, etc. Their fees are tiered based on asset value in an account. We were able to get them to reduce their first-tier fee on the first $100,000 of account value down to .0012, a reduction of 26% from the previous fee amount. Every level was reduced, decreasing anywhere from 10% to 33%. The reduced amounts were reflected on your third quarter account statements.

Echoes of 1973

- The 1973 oil crisis, ignited by the Yom Kippur War, saw OPEC’s Arab faction impose an oil embargo, fundamentally altering global economic dynamics.

- Oil prices skyrocketed, inducing economic downturns in the West, evidenced by U.S. gasoline rationing, rising inflation, and recession due to abrupt Federal Reserve policies.

- Recent geopolitical events eerily mirror this history, increasing vulnerability to potential oil market disruptions, even with the U.S. as a more formidable oil producer.

- To mitigate these risks, we’re bolstering investments in energy exploration and production firms, predicting an uptick in oil prices and embracing their current undervalued nature.

- We foresee and have, since the middle of this year, possible economic volatility ahead, drawing parallels between past and potential Federal Reserve actions and the repercussions on fixed-income portfolios and banking institutions.

In the precipice of the 1973 oil crisis, the Middle East was a crucible of escalating geopolitical tensions. The drama unfolded on October 6, 1973, with the initiation of the Yom Kippur War, as a coalition of Arab nations, spearheaded by Egypt and Syria, orchestrated a surprise assault on Israel during the sacred Jewish observance of Yom Kippur. The U.S., showcasing allegiance, extended support to Israel, eliciting a retaliatory move from OPEC’s Arab faction—an oil embargo targeting the United States and its Western allies. Announced on October 17, 1973, less than two weeks after the initial attack, this embargo not only disrupted oil supplies but also reshaped the global economic landscape.

The embargo’s aftershocks were instantaneous and sweeping in a time most were already witnessing high inflation. Oil prices soared fourfold, inciting inflationary tremors and economic regressions in numerous Western nations. The U.S. grappled with elongated gasoline lines, rationing, and a recession. To curtail inflation and stead the dollar, the Federal Reserve further hiked interest rates, exacerbating the economic slump. Equity markets buckled under the strain of economic volatility, with significant capital erosion in the stock market. This predicament illuminated the West’s susceptibility to oil supply disturbances, engendering pivotal policy shifts like energy conservation initiatives, alternative energy research, and the establishment of strategic oil reserves as a bulwark against similar future exigencies.

The Yom Kippur War, albeit brief with a span of 19 days, was brutal, inflicting severe casualties on both fronts. Financial markets plunged into chaos, witnessing escalating inflation propelled by surging oil prices and a Federal Reserve on a stringent rate-hiking spree until recession engulfed the U.S. History, though not a perfect replicate, often echoes past rhythms, and the current cadence is unsettling.

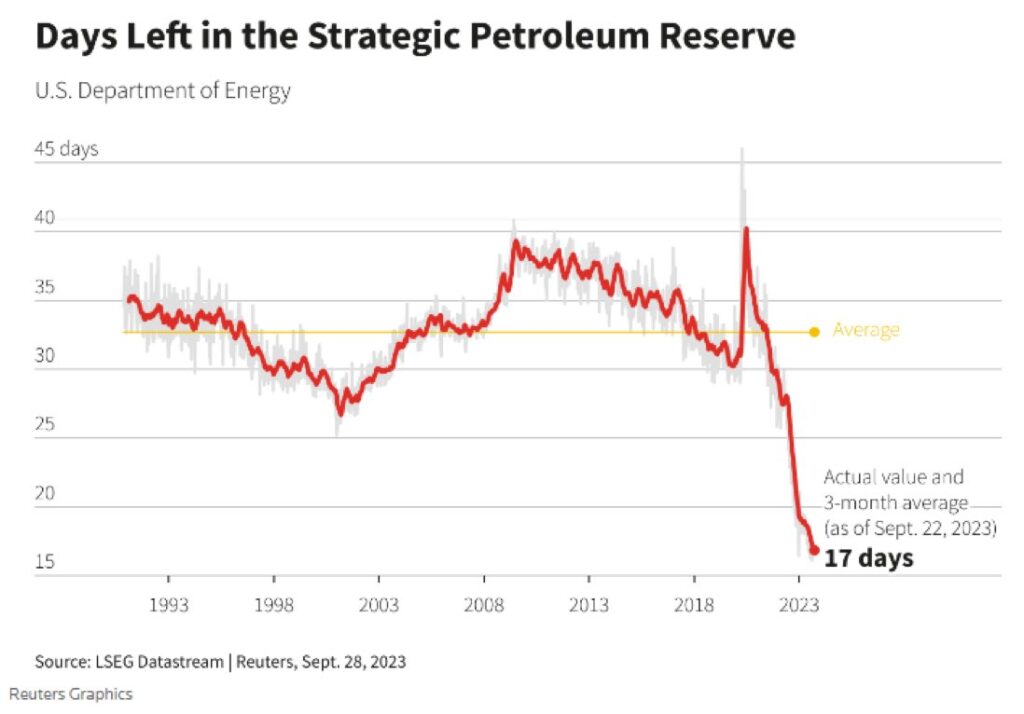

We are currently experiencing the highest inflation rates in nearly four decades. Similarly, the Federal Reserve is aggressively increasing interest rates, just as it did back then. Additionally, we are witnessing geopolitical events that bear a strong resemblance to those of the 1973 oil crisis. Should a new embargo unfurl as it did then, the ripples in the oil market would be undeniable. Despite the U.S. now being a more robust oil producer, the output may fall short of quelling a sharp price ascent. Moreover, the prior decision by the U.S. government to release oil reserves at an unprecedented pace—originally amassed as a buffer against such crises—augments the vulnerability. We sit here on the first trading day after and are rather surprised to see oil only modestly higher (Approximately 4.24%-YahooFinance)

Our portfolio strategy has already been pivoting to a cautious stance since late March of this year, a trend we intend to persist with at this time. It was not in response to this weekend’s news. Similar to how we began a cautious stance in late 2019, we had no idea a pandemic would unfold. However, the pandemic accelerated the concerns before turning optimistic on the markets. Similar to today, we did not anticipate these events, but we strongly believe it will escalate stress on the financial system beyond what was already occurring.

To try and help safeguard our investments from possible disruptions in the oil market, we are increasing our holdings in energy exploration and production companies based in the U.S., Canada, and Europe. We are particularly interested in firms that have a balanced financial structure with limited debt and low valuations that we might hold regardless of the current environment. Their valuations, currently in a trough, are potentially poised for an upswing should an oil pricing tumult ensue within the year. Without this geopolitical event, we believe most of these businesses are already appear cheap and attractive investments. However, we also see them as an effective hedge, utilizing them to protect us from further unknown risks in the energy markets. Had these valuations been lofty, alternative investment avenues would have to be explored. The current low valuations have facilitated a modest exposure in portfolios already, which we’re now escalating with additional positions to begin overweighting the sector.

In an ironic twist, pre-1973, energy corporations were only a small component of the American markets, like recent years. By 1980, they mushroomed into substantial market constituents, albeit under political siege. While the horizon remains nebulous, a similar trajectory could unfold should energy prices face exorbitant upward pressure. This rationale drives our resolve to bolster our energy sector holdings, alongside augmenting our treasury bond exposure, principally within shorter term two-year durations and money market funds.

If oil markets surge higher and the Federal Reserve decides to aggressively continue to raise interest rates as they did in the mid-1970s to combat rising inflation that could result from higher energy prices, we believe it would be a repetition of past mistakes. Such actions could eventually force a shift to reduce rates if the U.S. economy slides into recession. In such a scenario, our fixed-income portfolios might bear some short-term turbulence, albeit shorter-duration bonds could provide a smoother ride if rates continue on a trend higher. We continue to focus holdings on treasuries, as we believe this scenario would lead to a severe spike in credit spreads and massive struggles for any firm relying heavily on debt to operate. We already anticipated some choppy economic waters ahead, and this new geopolitical event cements that view.

Banks and Bonds

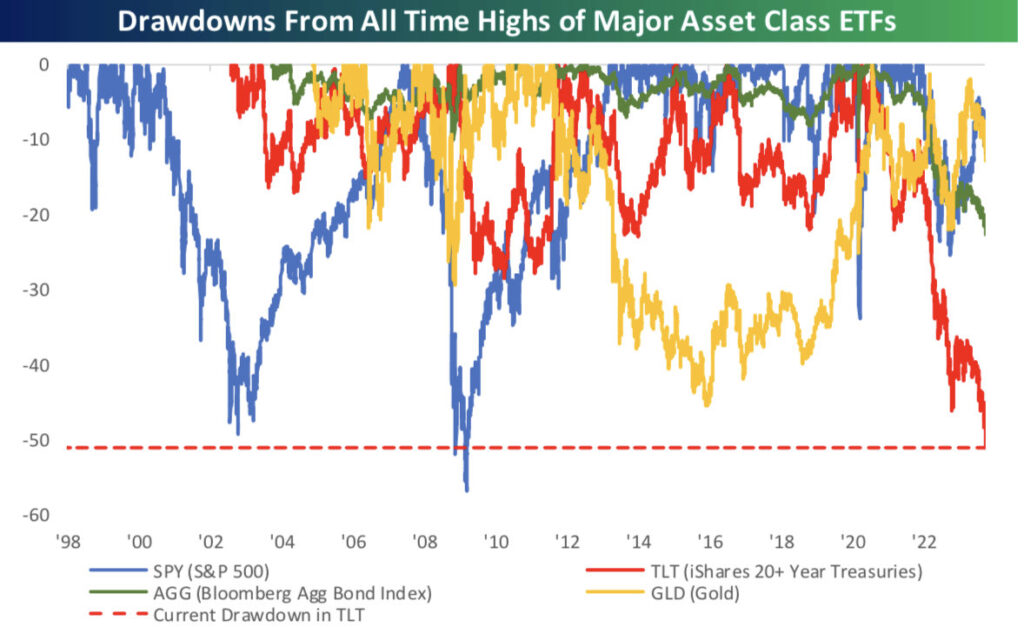

We also accept the possibility that none of this unfolds, but we find solace in still seeing extremely low multiples in the businesses we’re buying. For bonds, we’re purchasing investments that are yielding over 5% at present, which is a yield not realized in the treasury markets since 2007 and one we’re happy to collect until more certainty is revealed. Prior to this weekend, banks were continuing to struggle in a difficult environment, holding the highest unrealized losses on their books ever due to the worst bond market seen in history. Looking at the chart below, it compares the TLT (an ETF holding long-term US treasuries) has witnessed a greater decline than stocks during the dot-com bubble. If this continues, it could rival the 2008 financial crisis for equities!

Source: Bespoke Investments

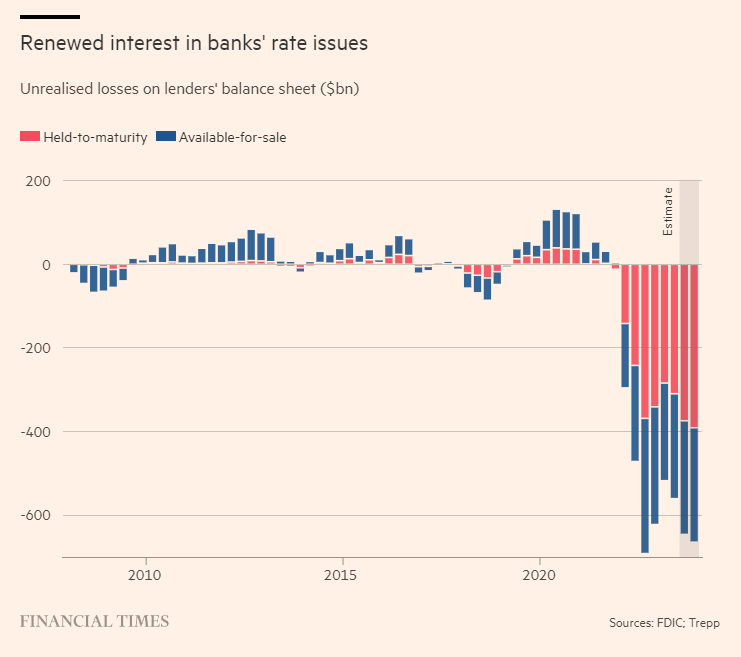

Banks in particular are bearing the brunt of this decline, as seen in the chart below. It tracks the unrealized gains and losses as reported by the FDIC. However, it is much worse than this chart even depicts, as banks are not required to report this for loans they originated and continue to hold, such as mortgages or commercial loans. While it is true most of these losses will evaporate as their portfolios reach maturity, the question begs, “Can the bank stay solvent until then?”

We see the strong possibility of continued bank failures on the horizon, especially if the 1973 embargo game plan arises as the next step. Deposits have been in decline, and loan growth is soon to follow, pulling more dollars out of the system as the Fed continues to attempt to wind down its balance sheet which also yanks dollars out of the system. Mortgage markets remain frozen with high unaffordability and inability for consumers to move due to locked-in low rates and surging home prices. Consumer loan delinquency rates continue to increase. As the US government seeks to finance its ever-expanding deficit, we’re unsure where all these US dollars will come from if the status quo remains, but we’ll save that discussion for another day. For now, we remain extremely cautious and intend to hold that stance for the foreseeable future. We rebalanced all client portfolios today to affirm this conservative stance and increase energy holdings. We will keep you posted.

As we enter the final quarter of 2023, we encourage all of you to schedule your year-end review if you have not yet done so. Also, if you ever have any questions, concerns, or if we can be of further service in any way, please don’t hesitate to email or call at any time. We look forward to serving you in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility