We were recently fortunate enough to get to enjoy an annual conference held by our custodian, Axos Advisor Services. This is the first year it has been held since 2019, before the pandemic. It’s an important event to help show us the future roadmap for what improved services and value they can continue to add for our clients. We’ve been able to have representation there ever since 2011, except for 2020 and 2021, which were canceled due to COVID. In attendance are other asset managers and financial advisors from all over the country that use their services.

The event’s timing was beneficial given the volatility in the markets giving us the ability to engage with other professionals during a difficult investment environment. One significant difference among all of us is the various investment management styles. While we do apply economic data and various analyses for our portfolios, we have never been shy about our affinity for value investing, which can contain varying methods. However, at the end of the day, it’s investing in something you believe is undervalued for one reason or another.

It remains a mystery why so many investors completely ignore valuations when investing in the public markets. It seems hard to find any other industry in which this is true. If you were to go out to buy a home in Oklahoma and see one listed for $10,000 per foot, you would probably not schedule a showing. On the contrary, if someone wanted to buy your residence for $20 per foot, you would hopefully not be inclined to sell. If so, please call us so we can advise otherwise! In all seriousness, it should be easy to assume your home is clearly worth more than that. It has a higher valuation. But, when it comes to buying and selling stock, in many cases, absolutely no attention is given to valuation.

We witnessed bubble-like valuations in 2021, where investors were happy to buy some stocks at a similar $10,000 per foot price. A year later, we’re experiencing near dystopian low valuations in many businesses where the market won’t even buy at $20 per foot. The gyration over the last two years has been remarkable, even more so on a psychological basis. Just two years ago, investors were paying over 250 times each dollar of expected EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) DocuSign (DOCU) was earning. The stock has fallen from $310 a share to now almost $50. Investors are barely paying 20 times for each dollar now. The company has no debt, has grown revenues by 350% over that period, is ten times more profitable, and yet, the stock has fallen over 80%. We own DocuSign for most clients now.

The value statement cannot be blanketed to the market as a whole. There are definitely overvalued stocks still today; however, we remain focused on businesses that have continued to do well and hold little to no debt. As rates rise, these businesses do not experience higher debt expenses, and those with large cash hoards can even earn more interest as they decide how to allocate their cash. They can also focus on expanding their business when others are fearful. One great example of this is Stellantis (STLA). They make automobiles and are aggressively investing in their company’s transition to EVs. Their brand portfolio is expansive, which includes names like Jeep, Dodge, Maserati, and Fiat, among many others. The company has already raised funds for its expansion plans, so there is no concern for dilution or increased capital needs soon. Because of that, the company currently holds over $20 billion euros in net cash. The stock also yields over 8% in dividends. Manufacturing vehicles is extremely expensive and rightfully deserves a lower multiple historically relative to a business such as DocuSign. For a peer reference, a company most are familiar with, GM, is trading around a 6 multiple. However, GM also has $90 Billion in debt, rather than a massive cash surplus like STLA.

So what should you pay today for Stellantis, a business in a significantly better financial position, making positive long-term decisions, and rewarding investors to wait with excessive dividends? You’d probably expect at least higher than GM, right? No. The stock trades at a one multiple… One! Said another way, Stellantis’s EBITDA will be more than its entire business’s worth over the next year. To go back to a real estate example, let’s say you had a rental home that you were earning $10,000 a year from and expected that to continue into the future. Would you sell it for $10,000? Hopefully not. The market currently is pricing Stellantis like this, and we are happily buying the stock for all clients. We view our favor of this stock similarly to H&R Block (HRB) back in 2020, which performed well for clients, up more than 85% just this year alone.

Stellantis is based in Europe, and we are concerned about Europe and the euro currency. However, let’s ignore STLA’s cash hoard and assume another 25% decline in the euro, we still see the business trading for a valuation multiple under 3. So, exercising these egregious assumptions to Stellantis’s detriment, is it worth half a GM? One-third a Ford? One-sixth a Ferrari? One-tenth a Toyota? Or one-twelfth a Tesla?! We see selling Stellantis stock at these levels no different than someone selling their home at $20 per foot. Not only that, but the psychological concern is also that if the stock price goes down further, the investors’ desire to sell increases, as if it’s better to sell your home for $10 per foot in fear of seeing it fall to $5 per foot. None of those sales would be rational.

Europe and the Fed

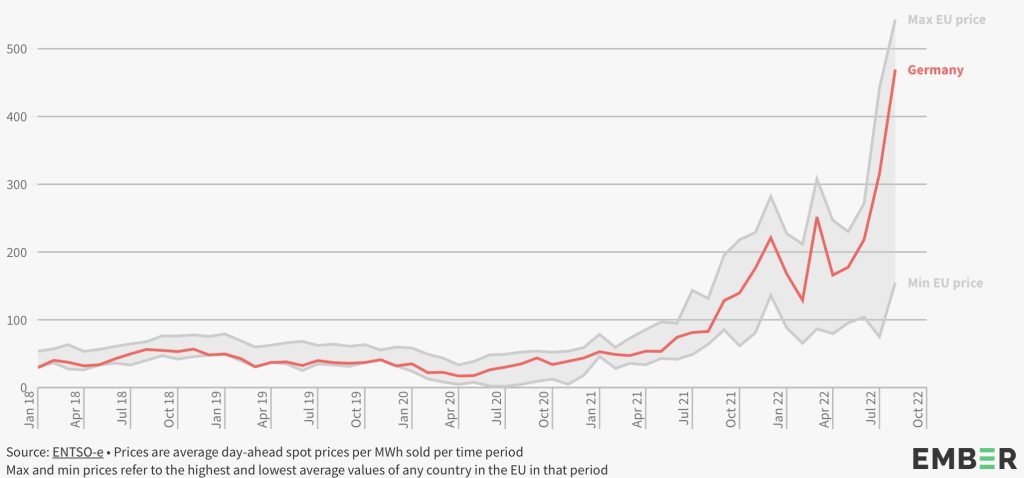

Our largest concern continues to be the European energy crisis. We began discussing this in December of last year, prior to Russia’s invasion of Ukraine. As you can imagine, the issue has become multitudes worse. France had recently taken control of one of its largest utility operators. Germany previously bailed out one of its largest operators and now just recently nationalized 99% of the company. Germany also seized control of three Russian refiners. Germany was one of the most dependent on Russian gas. Transitioning away from it, German utility providers were forced to buy at astronomical levels on the spot market. Europe remains incredibly short of gas, while other parts of the world like Asia do as well. Exacerbating the issue is the strength of the US dollar as much of the energy contracts remain to be settled in dollars, driving up costs even more than implied by price alone. The US economy remains stable and relatively strong, while the US central bank continues to aggressively hike rates in an attempt to hose the economy down to correct the “imbalance” of the labor markets, claiming Americans have too many jobs to do. The following is a graph showing current power prices in Europe.

After the recent rout in energy stocks during the late summer, we’ve added a few into portfolios again. One example is Vermillion (VET), which is a Canadian producer with half of its sales to European countries. This fact has made it increasingly attractive on a future demand basis due to the current geopolitical environment, while it also trades at a decent discount to other alternatives. Energy as a whole isn’t concerning to us, especially in the US. In geopolitical terms, we’d be capable of handling our own demand if necessary. From a consumer perspective, just like we were spoiled with unnaturally low interest rates, we received the same benefit from cheap energy prices. Oil remains below its 2010 high, which was over a decade ago, and we’re not even factoring in inflation. West Texas Intermediate Oil (WTI) prices were near $110/barrel then, while they currently rest at around $80 now. The same can be said for natural gas, which was at these levels in 2000, over two decades ago. Our use has increased, but really only from the electric power side.

Back in late 2020, we became increasingly concerned about inflation. Much of the market indicated we would see deflation, which we could not understand. Fast forward to 2022, and inflation is here. We no longer view this as a pressing issue as it’s being witnessed and understood. Fundamentally, we believe there is an imbalance in supply and demand across the board, including in the labor markets. There’s more demand for workers, which has been the case for the last decade. However, the pandemic has magnified these issues, which we believe to be driven by the excessive stimulus provided by all developed countries. We believe that’s the only rational explanation that every nation is concurrently seeing high inflation. We previously argued that the central banks were overshooting and being too aggressive for too long on stimulating. Now, we’re seeing the reverse occur.

The Fed recently hiked rates another 75 basis points, which was largely expected but still led to a wild ride in markets last Wednesday. Jerome Powell issued statements with an overly aggressive tone that he’s essentially committed to tanking the economy if it brings inflation down. One of the most significant issues that he seems to ignore is that many large-scale projects take years of planning, preparing, and permitting, to even break ground. Many of these projects are directly affected by the Fed Funds rate through higher lending costs. So, it would seem these short-term hikes are not going to be able to have any near-term impact outside of future projects taking years to truly see any real effects. If the Fed continues doing this every month expecting immediate results, it seems highly unlikely in our opinion to occur. And for that reason, we see the Fed trapped in continuing to hike rates for the remainder of the year, which will only increase the dollar’s value globally unless inflation dramatically cools.

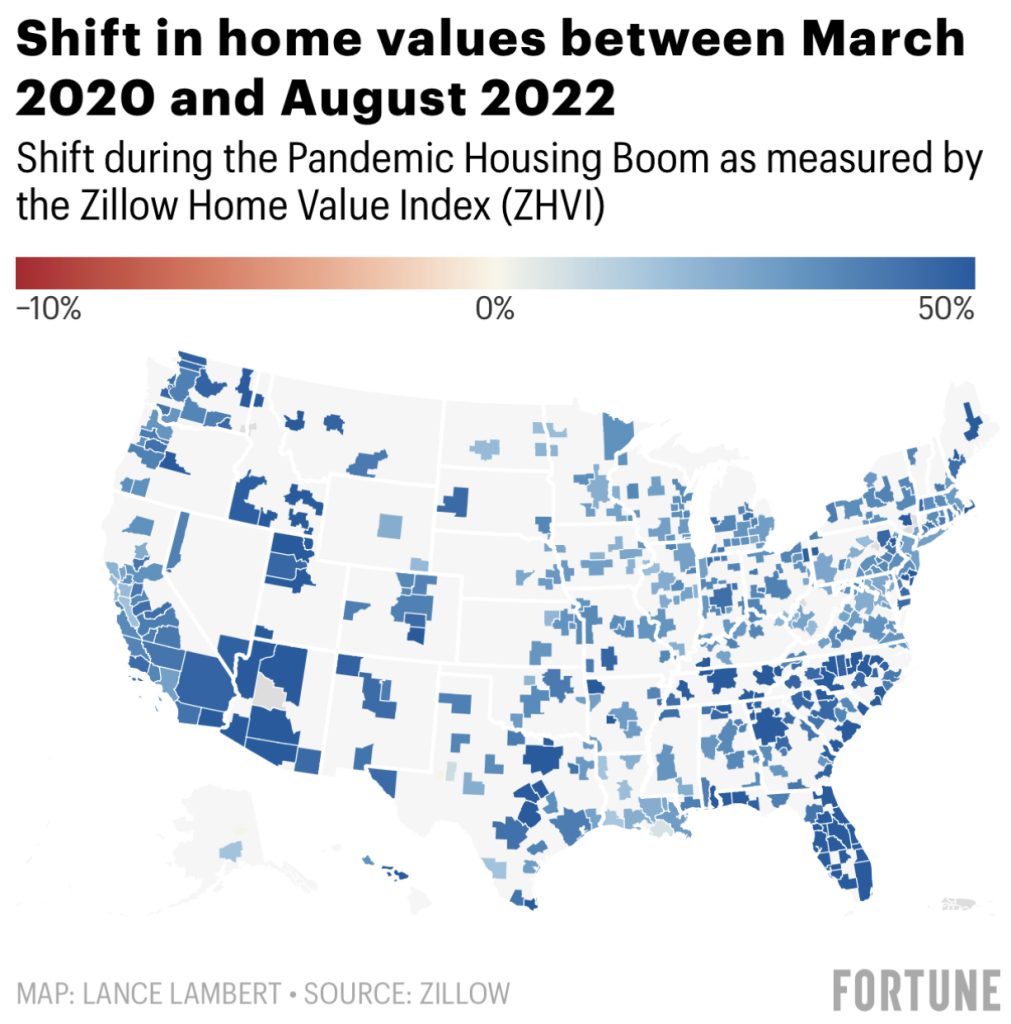

We do believe inflation will at least stabilize. Looking at most commodity prices, we see an overall decline. For example, lumber is down over 70% from its 2021 highs, oil is down over 30%, wheat is down over 25%, and copper is down roughly 30%. However, natural gas remains elevated along with home prices. Since the pandemic, home prices have exploded to unsustainable levels. We would not expect this to continue at its current pace as its simply not sustainable. It would not be unusual to see a decline especially given the recent rise. Looking at the graphic below, you can see that every major area in the nation remains excessively positive from just March 2020.

Within the last few months, some areas have seen modest price declines, but prices remain dramatically above their 2020 levels.

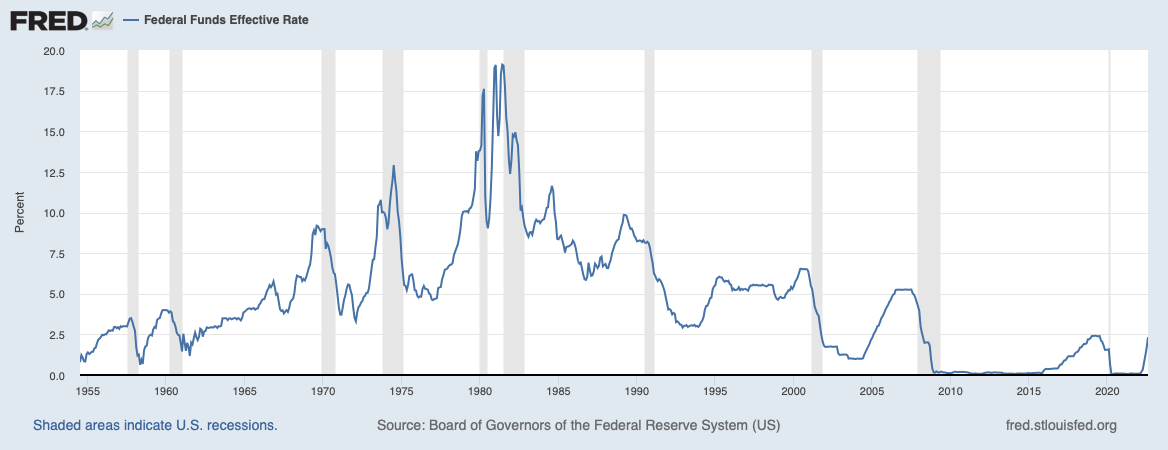

When we look back in history, the dollar has taken similar strong runs. In our opinion, the decade with the most similarities continues to be the 1980s. From 1980 to 1985, the dollar nearly doubled in relative power globally. Although from 1985 to 1990, it had returned to its 1980 level. During that decade, the Fed Funds rate went through a roller coaster of hikes and drops, peaking at 19% in 1981. Compare this to the current rate of 3.25%. The Fed signaled an intention to get the rate to 4.4% by year-end. With two meetings remaining for the year, it would be 4.75% if they continue hiking 75 basis points at a time, which does not seem unlikely. As we talked about in the past, we see many demographic parallels to the 1980s as well, which had two robust decades of stock performance with significantly higher rates, especially when factoring in inflation. So, why is the market so enamored with the Fed’s decisions? Do investors not remember when the Fed chair at the time in 2007 said the effects of the subprime market would be limited? The chart below shows the history of the Fed Funds Rate going all the way back to 1955. Many of you will remember the decade of the 1990’s and the economic growth the US economy experienced. We might point out the Fed Funds Rate hovered around 5% during that time frame. The gray shaded areas on the chart are recessions.

We do not disagree that there is an impact of a higher Fed funds rate. It should slow future projects or make them more expensive. However, we believe the Fed has a track record of continuing to either be behind the curve as in 2020 or too far ahead like we believe they are now. Instead of focusing on basis point movements, we continue to focus on well-capitalized, undervalued businesses. Yes, if the economy does indeed experience significant deterioration next year, it will likely impact stocks. However, we continue to be focused on the next five to ten years and cannot be more excited about the businesses we are being given the opportunity to buy like DocuSign discussed above, but also companies like Zillow Group and now even Adobe.

Travel-related stocks have also become an area of interest for portfolios. Companies like Expedia, Trip Advisor, Southwest Airlines, and now Lyft. Southwest is one of the few airlines with no net debt and even a surplus of $4 billion in net cash. As more commercial events like the one we just attended recently come back online, we should continue to see a more significant pick-up in travel demand. While it’s anecdotal, have you traveled lately? The recent conference we attended was held in Denver. If you’ve ever been to the Denver International Airport, security lines are usually long but fairly fast and efficient. The lines this week for us wrapped around through the baggage claims area, unlike anything we’ve seen having flown through that airport many times. Not to mention, we flew back on a Thursday. Thinking abroad, China is still enforcing extremely strict COVID measures. While the US has witnessed air travel mostly back to pre-pandemic levels, China’s air travel remains severely suppressed. Imagine jet fuel demand once China travel comes back online.

With all the recent market volatility and concerns, we believe the main thing that matters, in the long run, is valuation. We remain astounded by how so many investors focus so little on valuation. Markets are depressed and seem to be expecting a gloom and doom scenario. Viewing our investments through a valuation lens, it is extremely difficult not to be bullish about the decade ahead. What happens in the next six to twelve months? No one really knows what markets will do in the short term, but everyone seems to have an “opinion”. We’ll continue searching for the best valuations for client portfolios in the meantime.

This is a good time remember just a short time ago, 2020, and how the markets fell swift and sharp, but rewards came in 2021 to those that looked for undervalued investment opportunities while others were selling. Keeping a focus on long term planning and reviewing your long-term goals and objectives is important, especially at times such as these. We all know that financial markets will fluctuate, but if your long-term plan is still solid, you can rest well and look forward to the future!

If we can ever be of further service or if you have any questions or concerns, please don’t hesitate to call or email at any time.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Extreme and Swift Market Movement/Rotation