Reminder-Withdrawal Requests

Just a reminder regarding withdrawal requests from your AXOS Advisor Services account. Please give us a 10-business day advance notice if you are needing an extra one-time withdrawal from any of your investment accounts. With holidays, weekends, and regular monthly systematic withdrawals, timing of available cash to distribute can vary. We can be sure your funds are sent to your bank in a timely manner with advance notice.

Our Outlook

Back in the fall of 2020, we discussed the term “presentism” to help give an objective perspective on what at the time subjectively felt like the “worst” period in history while helping show Americans have actually never been better off than the present time. In late 2020, we saw the beginnings of a tech bubble forming, which quickly peaked and began to burst in mid-2021, with the pendulum eventually swinging so far in the opposite direction we began to highly favor some of these stocks and even began overweighting them. We continued to iterate that we believe we’re in a massive moment of opportunity particularly for growth-oriented investments.

But now… we sit in the midst of a historic heat wave in the Midwest, a Fed that’s aggressively hiking rates to tame multi-decade high inflation, an energy crisis, a cooling housing market, whipsawing GDP numbers that could show the US is currently in a “recession“, and the list goes on. Surely, we’ve never seen anything like this before, right? Not quite. Please, read on with us to look at just how much history seems to rhyme. We’ll be looking back more than thirty years to compare an eerily similar point in time.

The Rhythm of History

The year is 1980, and the midwest would face its deadliest heat wave in history. While it may not be the deadliest, many midwestern cities are now breaking their 1980 temperature records with the heat wave of 2022. In 1980, The US was experiencing 14% inflation and a Fed that had been aggressively hiking rates since 1977 from 4.5% to 17.5% by spring of 1980. The US experienced two-quarters of negative GDP prints in mid-1980 and declared a recession, causing the Fed to drop rates to 9% by the summer. However, Gross Domestic Product (GDP) surged the following two quarters, and the Fed quickly changed course and spiked rates to 19% by Christmas. Today, we see inflation at 9.1% with a Fed funds rate at 1.75% and economists tremble at the discussion of them potentially jumping 100 basis points, or a full 1%. The Fed hiked 1,000 basis points in six months in 1980. With the current ripple economy, we believe it could be possible to watch the Fed whipsaw rates just like they did back then.

Then, we saw the oil crisis and hostage situation in Iran, leading to a further surge in oil prices that led to rationing and endless lines at gas stations. During our research, we even found a video of Biden, a senator at the time, giving an interview on the hostage situation as well as concern over Soviet forces. It could be easily compared to the geopolitical risks of today with Russia invading Ukraine. It’s aided the surge in gas prices, which have been crippling for Europe and causing them to stockpile supply. While we haven’t yet seen any excessive concerns for the US besides higher prices at the pump, we expressed our concern for the European utility operators back in December of 2021, and it has only gotten worse with France even nationalizing their largest operator. If power prices remain elevated, it only seems logical that nationalization will continue in the European nations.

Birthrates saw their first positive change in 1979, which gave way to the Baby Boomers’ children, the Millennials. In 2019, the US again saw a positive change in birth rates, which was for the first time since 1988, marking the next potential “boom” generation: the children of the Millennials. The “peak” of the wave from this group is between the ages of 25 and 34. If you know someone in that age range that had children sometime from 2019 until now, you’re witnessing this next ripple build.

The Unhappy Family

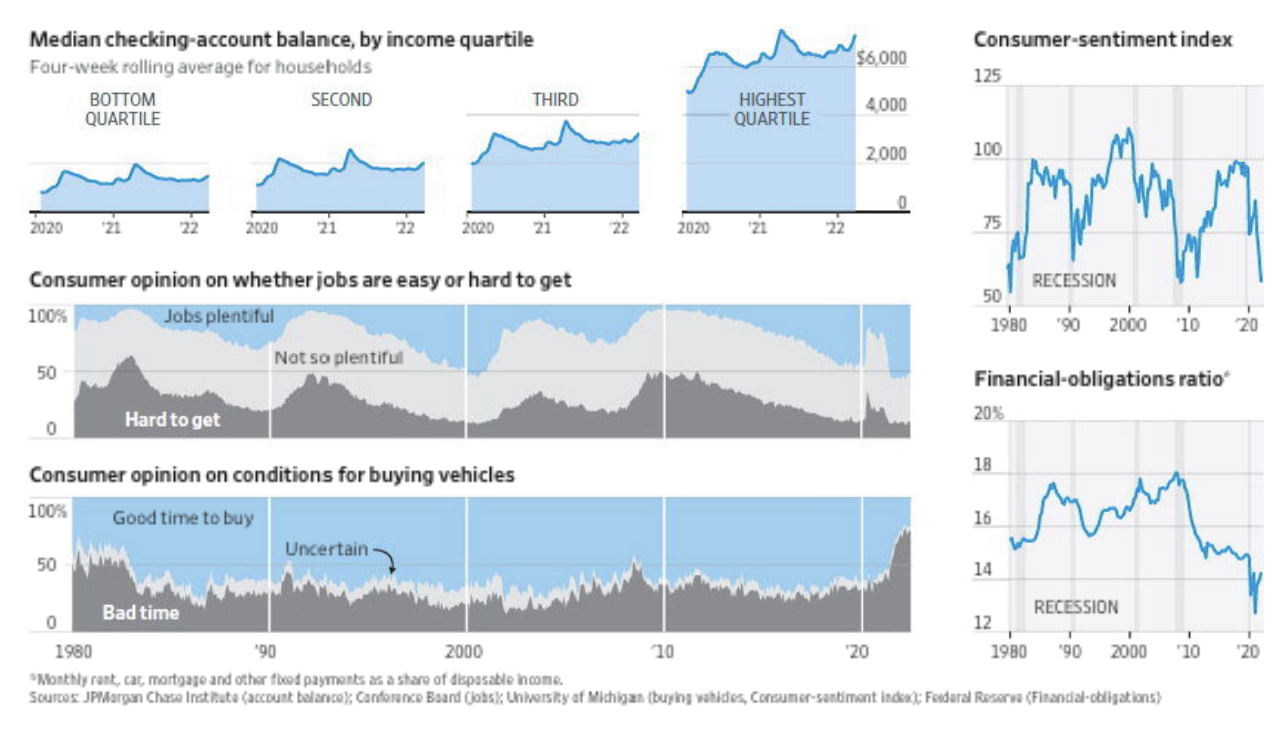

With all these similarities, what was different between 1980 and now? Well, a great deal. But the biggest difference today is jobs. The unemployment rate was near 6% back then and rose to well over 10% by late 1982. That’s compared to 3.6% today with two job openings for every one unemployed individual. Then, over half surveyed described jobs as hard to get. Today, over half describe jobs as plentiful. Looking at the charts below, you can see a few metrics over time. Cash balances across almost all household levels are still quite high. The consumer’s financial obligation ratio is also at one of its lowest levels in several decades. But, most interesting of all, consumer sentiment is near all-time lows.

From the Wall Street Journal

Is that not ironic? Unlike the 1980s, the consumer today is in quite a strong financial position, however, they have one of the most negative financial outlooks similar to the 1980s without much merit. While Americans have never been financially better, they’re as negative as they were in the midst of the 2008 financial crisis. Is this not remarkable to anyone but us? Leo Tolstoy famously said, “All happy families are alike; each unhappy family is unhappy in its own way.” It could not be better said. Consumer sentiment also hit these low levels in 1980. While the unhappy family seems to be more prevalent right now, we remain focused on the data pointing to incredible opportunities ahead and a relatively strong economic backdrop.

We do anecdotally observe this theme when having discussions with many who feel their personal situation has never been better. However, they typically conclude that it cannot be the same for others and that certainly, the proverbial shoe is about to drop. We’re positive there is a psychological lesson in this, however, we are only financial professionals. Although we have seen price movements over the last two years that can only be explained by the psychological arm of financial theories: behavioral finance. We watched the “to the moon” philosophy and “FOMO” send prices to irrational bubble levels, which quickly sobered when some of these stocks fell 90% in only a matter of months. But now, investors want nothing to do with most of these investments, many of which we are now finding great opportunities .

History the Teacher

For a historical reference, you may be wondering: How did markets perform in 1980? While it’s no indication how stocks will perform in the decade ahead, it still is interesting to reflect on a market with so many similarities as well as differences that show the current environment could be even more favorable than back in the 1980’s. Investing $100 in the S&P 500 in 1980 would have yielded $464.51 by the end of 1989 or $308.67 after adjusting for inflation. This is a remarkable return of roughly 12% after adjusting for inflation. It was one of the strongest decades for stocks, being bested by only the 1950s and 1990s. We should also point out that the 1980s included the historic “Black Monday,” October 19, 1987, when the S&P 500 fell 20.4% in a single day as well as two “confirmed recessions” during that decade.

Again, we only use this as a historical illustration to echo our belief that optimism prevails in the long run. We have no way of knowing how markets will perform in the days, months, and years ahead. However, we continue to be rooted in value-based investing, buying stocks we believe to be undervalued for client portfolios. We continue to believe this to be the best protector of wealth for clients far into the future and believe history serves as a great teacher of this, continuing to show this to be a sound long-term investment approach regardless of the current environment. So, while headlines may soon read “recession confirmed” and the Fed potentially hiking rates again, we’ll continue focusing on finding valuable businesses for clients to own, confident in being fixated on the long-term. While we could see continued ripples in the years ahead, we remain rooted in the future being very bright.

We leave you with what the wisest man that ever lived said: “What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun.” King Solomon, Ecclesiastes 1:9 ESV

As always, please don’t hesitate to call or email if we can ever be of further service or if you have any questions or concerns. We are looking forward to the privilege of serving you in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility