Martin Luther King, Jr. Holiday

The US financial markets will be closed tomorrow, Monday, January 18th for the Martin Luther King, Jr. holiday. Our offices will be closed as well and our office will be open on Tuesday, January 19th for business as usual. Also, any distributions from E*Trade Advisor Services will be delayed one business day since it’s also a banking holiday.

2020 Tax Reporting

All Forms 1099-R for retirement accounts (IRA’s, etc.) will be mailed by and available online on January 31, 2021. Additionally, all required minimum distribution (RMD) account owner notifications will be mailed and available online by January 31, 2021.

All non-retirement account tax forms will be mailed and available online by February 15, 2021. Non-retirement tax forms being mailed include Forms 1099-B, 1099-DIV, 1099-INT, 1099-MISC, and 1099-OID (as applicable), their associated detailed reports, a fee statement (if applicable), and a reference sheet titled “1099 Reporting Information for 2020.”

Bitcoin: A Line of Code

Most likely due to its meteoric rise in price and continued exposure in the media, we have been fielding an uptick of questions concerning Bitcoin. We thought it may be beneficial to broadly explain our stance, if not only for the record. These opinions are ours, and we understand significantly more intelligent people, especially in Technology fields, have opposing views to ours. We do agree with most of these professionals’ comments; however, we just believe in and prefer other opportunities at this time.

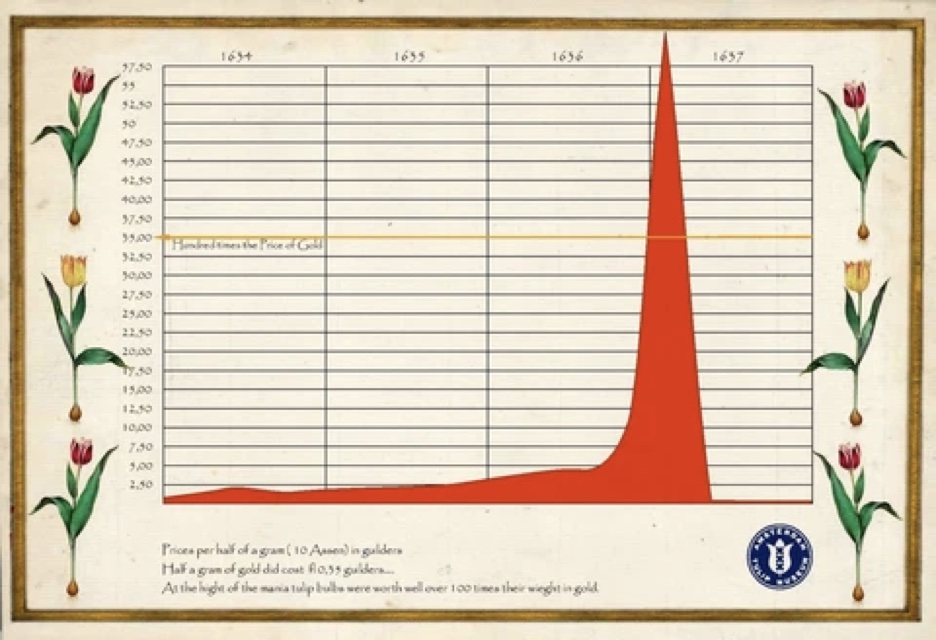

Tulip Mania: “Price-Only” Bubbles

When looking back in history at “bubbles,” it is difficult to not think of the “Tulip Mania” that occurred during the Dutch Golden Age in the 17th century. Price-only bubbles are fascinating to observe, as they have no real means of valuation. For example, when 3D printing stocks saw a meteoric jump in price during 2011 and 2012, it was significantly easier, for us, to show the absurdity of valuations by illustrating what these businesses would have to achieve in order to justify the trading price. These achievements were arguably impossible; however, it would only be possible decades from that time with flawless execution. Investors were simply amassing the value of this future potential and bringing it forward to today. In our opinion, this places substantial risk on investors now with little reward moving forward. From December 2013 to January 2016, one of the leading 3D printers of the time, 3D Systems (DDD), saw its stock price fall from nearly $100 to $8 per share, over 90% loss in value. Now, let’s contrast a stock that we can value by several metrics to something like the Mona Lisa where objective valuations become extremely difficult. What is the right price for this painting? What is its “fair value?” It’s clearly worth more than the components that comprise the painting, however how much more? The Mona Lisa has no inherent cash flow, unless maybe you could rent it to museums. In general, it’s simply a price-only asset and as such only “worth” what the next buyer will pay.

One problem with “price-only” assets is that nearly any price can theoretically be justified. Scarcity typically plays a large role in these bubbles, as the argument of something being rare is easy to justify a higher price . While tulips could technically bare more tulips, in most cases, these price-only bubbles happen when something relatively useless gains substantial value solely from price speculation. There’s a commercial that beautifully displays the progression of the hysteria during the Tulip Mania that ultimately leads to collapse and despair. One scene in the commercial comes after watching the hype build for tulips, in the midst of a chaotic auction for yet even more tulip bulbs, a participant steps forward and says, “Excuse me. Excuse me. Why’s a tulip worth so much?” Gazing at the now silent room around him with what seems to be a rational head, he says, “It’s a tulip.” After which, the crowd walks away with the auctioneer pleading for people to come back.

Image Source: Amsterdam Tulip Museum

The market, which is simply made up of people, decided tulips weren’t worth the absurdly high price any longer. Tulip prices were so high with no observable reason other than the next person was willing to pay more. Yes, we may be over- simplifying this historical event, but you can imagine the justifications that were probably said in that day. Individuals buying tulip bulbs to plant tulip farms watched their future crop yields skyrocket daily with ever increasing prices. These price bubbles can compound in these instances, where higher prices induce even higher potential profits for those pursing the assets, such as planting more tulips, exacerbating the manic demand. It must have been fascinating to watch the psychology of the time, which we cannot get a true grasp of with only charts and data we get to study today.

Roughly twenty years ago, most of us remember the insanity of Beanie Babies. That was an epic price bubble with some of the most irrational justifications for hoarding stuffed animals. It seems humorous to talk about now, but individuals were literally cashing in their children’s college funds to ride the wave. Zac Bissonnette wrote, “The Great Beanie Baby Bubble,” which tried to observe the psychological phenomenon. He illustrates the price surges that occurred with each “retired” doll, until one year, prices didn’t surge. Hence, the market (people) paid absurd premiums for these stuffed animals until it decided not to. So, in retrospect, would any price-only bubble “assets” be pursued by individuals if the prices were not skyrocketing? It’s for the sole sake of speculation for higher prices that fuels much of the desire for these “assets.”

Politics and Government Spending Fueling Asset Prices, Generally

We have written repeatedly in the past that we believe there will be long-term consequences from endlessly compounding debt levels not only by the US but the majority of developed governments world-wide. We had felt this way prior to the pandemic, which has ballooned spending to unprecedented levels and skyrocketed the US’s debt to GDP to levels never seen. There hasn’t been a US president that has shrank America’s debt load since Calvin Coolidge. We have argued that inflation is typically the easiest path forward to help governments reduce leverage. Disregarding this, the US flooded the financial system in the last nine months with trillions of dollars from both federal spending and central bank actions, adding to the already excessive debt levels. Just looking at the most recent stimulus checks, over $160 billion was shot directly into the banking system, with a promise from Democrats of an immediate approval for almost $350 billion more by increasing individual checks from $600 to $2,000.

All of this doesn’t include the incoming $284 billion additional PPP loans that can be forgiven and even further rounds of stimulus Biden had campaigned with now a high probability of occurring as previously warned with a blue wave, not to mention all the additional spending from infrastructure and spending bills that most likely could come in the spring. These promises are on top of already high levels of planned deficits. We believe all of this additional spending will accelerate our inflation thesis and cause long-term interest rates to rise as well. We have positioned portfolios for these beliefs and are prepared to take advantage of opportunities we believe will come from this, which does not include Bitcoin like so many professionals are now advocating.

Enter: Bitcoin

Potentially accelerated by these fiscal and monetary policies as well as the precedent set for endless printing of dollars to happen in any crisis, we believe a price-only bubble may be unfolding before us today observed in Bitcoin. But first, what exactly is Bitcoin? First described in a white paper released in January of 2008 by a mysterious Satoshi Nakamoto, Bitcoin is a “cryptocurrency” that is built on the concept of what is now called “blockchain” technology. In attempts to keep it simple, blockchain is essentially a method of validating something with the use of a decentralized network by way of a public ledger. Cryptocurrencies are digital measures of “value,” not much different to fiat currencies like the US dollar or Euro, except they are not controlled by a central power or government. To us at F.I.G., currencies are only a way to easily communicate worth and barter goods. However, Bitcoin has started to be touted as the “store of value” or replacement for gold, by being more accessible and digitally storable. This has come out of the thesis that governments are endlessly printing their own currencies and devaluing their treasuries, which erodes savers holding cash in terms of fiat currencies, like the US dollar.

But as most our clients have heard before, we are not big advocates of holding cash except to pay for near-term liquidity needs. We fully agree with the thesis of inflation and erosion of currencies over time; however, Bitcoin is trying to serve as a longer-term store of value but we much prefer owning shares of profitable businesses or other real assets and not a line of computer code with only the hope of what the next buyer will pay. In the developed world, we take for granted the amazing financial systems that have been built over decades to protect consumers. Bitcoin holders are opting to throw away all these safety nets in order to hold a “digital” currency… a line of code. For developing nations, a cryptocurrency seems immensely valuable, where no safe banking sector exists or where there may be political tyranny or unrest. Sadly, Bitcoin, in our opinion, does not fit these needs, as it does not have any price predictability. Facebook tried to help organize such a currency, Libra, but it was halted by regulation. Something like Libra would have enabled developing nations to more easily store liquidity and transact business, which would have made these markets more valuable to businesses and help to progress economic activity in emerging markets.

We are unsure where Bitcoin’s purpose lies within a developed country, specifically for the individual. Looking specifically to Bitcoin’s price, what is even a fair value for it? Is it no different than every bubble before that seems solely based on the point that others are paying more and speculating it to go higher for whatever justification can be given? If a stock of a company we hold were to drop in price, all else equal, the earnings power of that company just became more attractive. We could now pay less than the day before for ownership in a business we love. We’d be enthused and want to buy more. If Bitcoin drops in price, all else equal, does it become more valuable to buyers? Do more people want to buy it, again hoping only for further price increases or attempting to “store more value?” Ironically, from a mechanical perspective, a drop in price actually takes away incentives from those trying to authenticate transactions, which could lead to substantial risks as well.

To that point, and looking at the mechanics, what validates a Bitcoin? It’s done by individuals that are called “miners,” which authenticate transactions by essentially solving cryptographic “puzzles” and rewarded in Bitcoin by the network if found to be correct. These correct transactions are added to the ledger and are unable to be changed, at least not easily, today. These miners have invested massive amounts of capital in computer systems that simply do nothing other than “mine” Bitcoin. There are buildings full of servers consuming massive sums of power that do nothing other than validate Bitcoin. You can easily understand the miners’ incentive to keep the hype of Bitcoin alive. As the price increases, so does their profit. However, more computing power is also incentivized to come online, potentially increasing the competition. Too large of a decline in price could put these miners at losses and cause the overall network to shrink.

Bill Miller, ironically an old value investor, has been riding the Bitcoin wagon arguing it becomes “safer” the higher the price goes and points to the limited supply coming online each year. He says corporations should be placing their cash in Bitcoin instead. We agree with the low supply issue as one of the main drivers of this current price escalation. However, short supply does not necessarily equate to higher prices if demand plummets or the supply is for a meaningless good. Regardless, the soaring price seems to only be coming from the belief that prices will continue rising, so there are currently limited sellers. As of the last few months, many platforms have continued opening up access and making it easier to buy and hold Bitcoin, further exacerbating this supply “problem” with PayPal and Square acquiring the majority of all newly mined Bitcoin supply.

As far as we can tell, Bitcoin’s price is solely determined by what someone else is willing to pay, with no other true valuation possible, similar to our example with the Mona Lisa. Some argue with an extrapolation of the market capitalization of other commodities such as gold, which we find to be a creative experiment to justify what we see as insanity. We must clarify that we do not understand how to value a pure commodity like gold either and prefer owning stocks of companies, not chunks of metal. For gold, you could argue a value in terms of cost to mine, but this same argument is also being used for “mining” Bitcoin. It has become humorous to hear the outlandish justifications utilized that all point to higher and higher prices of these “rare” lines of code. Even financial firms such as JP Morgan have released astronomical price targets, several multiples higher than Bitcoin currently trades, typically referencing gold supply and market capitalizations. Looking at all this research, we can only reasonably say Bitcoin’s price seems solely what other people are currently willing to pay for these lines of code, backed solely on the complete trust of its decentralized network.

In the end, we believe the market (also known as people) will decide not to pay these ridiculous prices for lines of code one day, which could be driven by the trust in the network itself being lost potentially by the network being compromised. Asking a simple question, how do you distinguish between a “real” Bitcoin and fake? It is validated by its network. So, imagine if the network can’t be trusted someday, who would buy Bitcoin? You have no way to determine what is an authentic Bitcoin, therefore a rush of selling seems logical at that point if any buyers were even able to be found. A world power could gain control of the network in the future by controlling more than half of the network’s power, thereby rendering Bitcoin no more useful than any other fiat currency, converting the once decentralized network to a central power. However, it would most likely lose all its value in that instance as no other “miners” would be relevant, and it could theoretical be inflated like any fiat currency.

When does this day come? It seems highly possible to arrive if we see the sustainable advent of quantum computing, which is coming closer into reach. We believe technological developments over the next few decades are not even comprehensible today. So, we definitely wouldn’t want to trust a technology created over a decade ago to “protect” our wealth by means of technology alone. That said, we have no way to know if the day ever even comes. Bitcoin may endlessly increase in price and be utilized far into the future. But in our opinion, we do not see much upside to letting go of consumer protections just to blindly hope some buyers pay more at some point in the future for a line of code we “own.” For today, we choose not to risk client assets and futures in such a blind belief system when we, in developed countries, have much better opportunities to actually invest and not simply price speculate. We are investors, not gamblers. We will maintain this position, no matter the price of Bitcoin. Whether it falls to $0 or skyrockets over $1,000,000, we believe Bitcoin is solely price speculation. If you are concerned with the value of the dollar just as we are and have been, there are plenty of attractive options without having to turn to Bitcoin.

We do believe cryptocurrencies in a different sense will take hold in the future to replace paper cash, but we do not believe in them holding any “intrinsic value.” China has already created and has begun circulating its own cryptocurrency. The US has discussed creating a digital dollar, which seems to be a solution in search of a problem. To us, currencies of any kind simply allow two parties to more easily barter and exchange with each other. We do not see currencies as investments, in any form. For our client accounts with F.I.G., the accounts are priced in dollars and do have some US dollar exposure to an extent, but the accounts are invested in investments and businesses we believe to be undervalued based on valuation principles. And these investments are simply shown or expressed in US dollars as that is currently the currency of choice to display values in, as we see no difference to someone explaining temperature in Fahrenheit or Celsius.

As iterated before, we see currencies simply as an expression or measure of conveying an agreed upon reference of value, not as any true value in itself. Therefore, in order to justify purchasing it, Bitcoin must be described as an investment. And if views as an investment, we believe we must be able to value it, which we cannot. We overwhelmingly prefer owning shares of businesses instead. So, as in the video discussed at the beginning of this article, imagine yourself as the person of reason telling the chaotic crowd, “Excuse me. Why’s this line of code worth so much? … It’s a line of code.” You must ask yourself, what is Bitcoin and what is its “worth?” The only logical answer we see is what the next person pays for it with no true measurement of valuation, and that is not something we’d want to rest anyone’s wealth in, not our own or our clients’. If you’d like to discuss this further, please don’t hesitate to call us at any time.

As we move into the New Year, we will continue to monitor the markets and make any adjustments we feel warranted client portfolios. We appreciate the privilege to be of service and look forward to working with you in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc

Uncertainty and Volatility