July 4th Holiday Market and Office Hours

The U.S. financial markets will be closed on Friday, July 3rd in observance of the July 4th holiday. Our office will close at 3:00pm, Thursday, July 2nd and be closed Friday, July 3rd as well. We will be back for business as usual on Monday, July 6th. Reminder: Any distributions from an E*Trade Advisor Services account requested after June 30th will be delayed one business day due to the market closure on July 3rd. Distributions normally set to go out on Friday, July 3rd will go out on Monday, July 6th. We wish you and your family a very safe and happy July 4th holiday!

2020 “Half-Time” is Almost Here

It’s hard to believe but 2020 is almost half over. Given this year’s events, we’re sure many of you are ready to get the first half behind us. This is a great time to set up a review of your personal financial planning and investment portfolio. Call or email us today to schedule your personal “half-time” review today, either online or in-person!

COVID19 Headlines Take Center Stage Again

We felt with all the recent headlines and resurgence of COVID19 cases in certain states, it would be a good time to provide you with some current facts and numbers. Again, we reiterate that we are not medical professionals, but are “numbers” people that try to look at facts and statistics. The available data for COVID19 has become extremely difficult to decipher over the past month. In the beginning of the pandemic, tests were reserved for those who were statistically likely to have the virus. Now, testing is being done in mass with America now deploying over 500,000 tests per day. That is a tremendous amount of data now flooding in daily. Within some areas, cases saw a rise, which was aided by this explosion in testing but also now showing higher positivity rates. The data we continue to look for concerning signs is hospitalization and death rate statistics. Hospitalizations in Texas, Arizona and Florida have been on the rise, which is of concern for those affected. Hospitals are not built for surges such as pandemics, which can put a strain on the healthcare system. Densely populated areas such as Houston and Phoenix are becoming increasingly concerned with their hospital capacity, not solely from COVID19 patients, but from re-opening that is also causing an uptick in normal hospitalizations as well. The increase in COVID patients is creating a burden to some hospitals in addition to existing everyday patients.

We had previously discussed a second wave as highly likely given past pandemic data, however the current cases in the new “hot spot” states seem more like an initial wave than a secondary bump. But this observation is also being made during a time that has seen an explosion in testing as well. Although states that saw the initial surge in the spring of this year, such as Illinois, New York and New Jersey, are not witnessing a second surge. We also had expressed our expectations of cases spreading while watching protests erupt across the country. However, if this were the main reason for cases increasing, it would be expected to be seen in every major city experiencing continued protests. Instead, it is mainly occurring in some southern states. This current pandemic appears much more contagious than recent pandemics of the past, such as SARS1 and MERS. Fortunately, it is also significantly less deadly than those as well. However, the same thing cannot be said for everyone, specifically the elderly.

Looking strictly at mortality data for each state and even other countries, the same unfortunate story can be seen. Nearly a majority of all fatalities have been nursing home residents. It is an important point in understanding the risks. In America, roughly 1.45 million people live in nursing homes, which equates to about 0.4% of the population. However, this small population makes up nearly half of the deaths from COVID19. Roughly 80% of deaths have been over the age of 65 with the median age being 80. A third of fatalities have been in adults over the age of 85. It may be an important point to compare that to the US life expectancy is 76.6 for males and 81.6 for females. The breakdown in affected age demographics is extremely similar to that of the flu, however the mortality rate for those over 65 is much higher than that of the flu. On the flip side, this seems far less severe than the flu for younger individuals, especially children. For example, the 2019-2020 flu season saw 185 pediatric deaths compared to 28 pediatric fatalities for COVID19 so far.

Looking at local data here in Oklahoma, the story is very much the same. Cases are on the rise, but so is our testing. Individuals over the age of 65 make up roughly 17.5% of reported cases yet make up 80.2% of the deaths with not a single pediatric death reported as of this writing. Nursing home and long-term care residents comprised 201 of the reported 375 deaths to date (53.6%). Looking at Sweden, one of the only developed countries that did not shut down, we also see a rise in cases now. However, this seems to be entirely explained by more testing. Deaths remain stable and in decline there, as is currently in the United States. The next two weeks will be a test for America to see whether fatalities dramatically rise in conjunction with the reported bump in cases. Separating the states apart, the data looks less smooth as the Northeast saw a surge in cases and deaths followed by a quick decline. States like California, Texas and Florida have seen essentially flat and stable case counts since the beginning of the pandemic until this last month. If we see a sharp rise in deaths, it will give more cause for concern. If instead daily deaths remain stable, it should bode well for states continuing to move toward full re-openings.

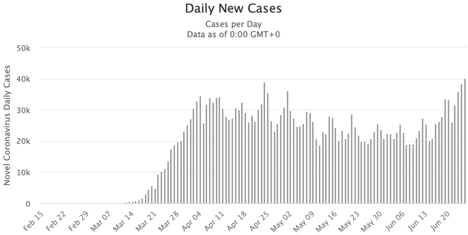

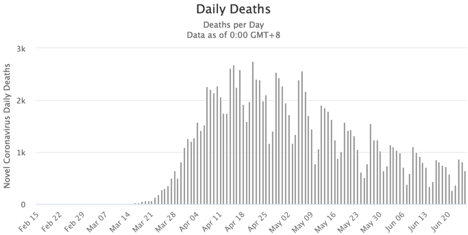

The first chart below provides a visualization of the daily new reported cases in the United States. It does show the US as a whole moving back towards more daily reported cases. We need to reiterate however; this comes with over 500,000 new tests being reported every day. As of April 1st, the US had only performed a total of 1.2 million tests. By the end of April, the US had reported 6.3 million tests. Today, there has been over 29.2 million test results reported. The second chart is what we find most meaningful: daily reported deaths. It has been roughly a two-week lag behind cases, so we will continue to see if this moves higher in any meaningful way.

Source: Worldometers.info

Ultimately, we are not pinning our investment thesis on a vaccine. Unlike pandemics of the past, nearly every health care company is pursuing a solution, with over 100 vaccines or treatments currently being researched with a handful already in trials. When we look back at SARS-1 and MERS, vaccines were also pursued, but the disease disappeared before one ever made it to market. Already in other countries, the lack of cases has been making it more difficult to seek vaccine solutions. Given the higher contagion rate of this pandemic, it may be possible to last longer than other recent pandemics, which would make a vaccine more meaningful. However, given the portion of the population affected, the hard data continues to point to a reason not to have any overwhelming long-term concerns. COVID19 is an undeniable health risk, but we have been focused on the facts or “numbers” and the unprecedented destruction to the economy it has been allowed to cause up to this point in time. We remain hopeful that governments will not force a national or global shutdown again, however it could remain touch and go in densely populated areas for some time. If the virus continues to see surges into next year, it would present greater risks for businesses like cruise lines and other travel related companies as which we have discussed in the past. Although, most of the major businesses have now raised enough liquidity to weather continued negative impacts over the next year or two. We remain optimistic that much of the world will be back to normal levels over the next three to five years, but we remain cautious for the next twelve to eighteen months.

We believe more stimulus is very likely to come which adds to our concerns for future inflation. It is unknown in what form and to what extent the next round of stimulus will be at this time. It should help boost the economy in the short run, however, it will continue to occur at an increasingly expensive future cost. Ironically, many indicators show some move back to normalcy has already resumed even in hotel occupancy numbers. One metric that continues to be severely suppressed is air travel. We believe this is likely to remain for much of the year unless the stimulus includes a travel credit, which is being discussed. However, we believe business travel will continue to be suppressed until 2021. Corporations now have a blanketed excuse to cut costs and increase margins, which is readily being utilized to cut all unnecessary costs. As we have discussed, we expect market volatility to continue for the foreseeable future as headlines shift on a daily basis. We will keep you posted and remember: This too shall pass.

We wish you all a very happy July 4th and hope you have time to spend with family and friends that will provide a time of enjoyment and relaxation. Please stay safe and follow your local guidelines. We appreciate the privilege to be of service and look forward to working with you in the years to come. As always, don’t hesitate to call or email us if you have any questions or concerns.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility