Annual Offer of Disclosure Statement & Privacy Policy as of March 26, 2023

As required by Rule 204(3)(c) of the Investment Advisers Act of 1940, F.I.G. Financial Advisory Services, Inc. must provide each client annually with a disclosure document that outlines all of the material changes that occurred within our firm in the past year or provide a complete a copy of our Disclosure Statement and Client (ADV Part 2 and Form CRS) which provide regulators and clients with a description of F.I.G. Financial Advisory Services, Inc.’s programs, fees, conflicts of interests, and other business activities.

Within the past year there have been the following changes that may be considered material:

- We have updated our Assets Under Management as of December 31, 2022. Please refer to Item 4-Advisory Business from more details.

If you would like a complete copy of the current Form ADV Part 2A and Form CRS for F.I.G. Financial Advisory Services, Inc. call us at 405-844-9826 or email rickjurrens@figfinancial.com and we will furnish the most recent filing to you in either digital or hard copy form.

Additional information about our firm is also available on the internet at

www.adviserinfo.sec.gov. You can view the firm’s information on this website by searching for our firm. You may search for information by using F.I.G. Financial Advisory Services, Inc.’s name or by using our firm’s CRD number, 105506.

F.I.G. Financial Advisory Services, Inc. Privacy Policy

We at F.I.G. Financial Advisory Services, Inc. consider the protection of your sensitive personal

information to be an important priority. Our privacy policy and practices are designed to support this objective. We want our customers to understand what information we collect and how we use it. We collect nonpublic personal information about our clients such as you from the following sources:

- Information we receive from you on applications and other forms and in personal

- Information about your transactions with us, our affiliates, or others which we may obtain in writing, during telephone or Internet transactions or from data gathering software; and

- Responses from your employer benefit plan sponsor, or association regarding any group products we may provide.

We do not disclose any nonpublic personal information about our customers or our former

customers to anyone, except as permitted by law or directed by you. We restrict access to nonpublic personal information about you to those employees, agents, and third parties who need to know that information to provide products, services, or specific

transactions to you. We may be required by law or regulation to disclose information to third

parties–for example, in response to a subpoena, to prevent fraud, and to comply with rules of, or inquiries from, industry regulators.

We maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information. We DO NOT sell lists of our customers nor do we

disclose customer information to marketing companies. Since we work with a variety of third parties in providing financial services and products to our clients, we encourage our clients to review the privacy policy of each third-party firm with which a particular client may do business. If you have any questions regarding this policy, please contact us at 405-844-9826 or visit us online at www.FIGFinancial.com.

Banking Trend Concerns

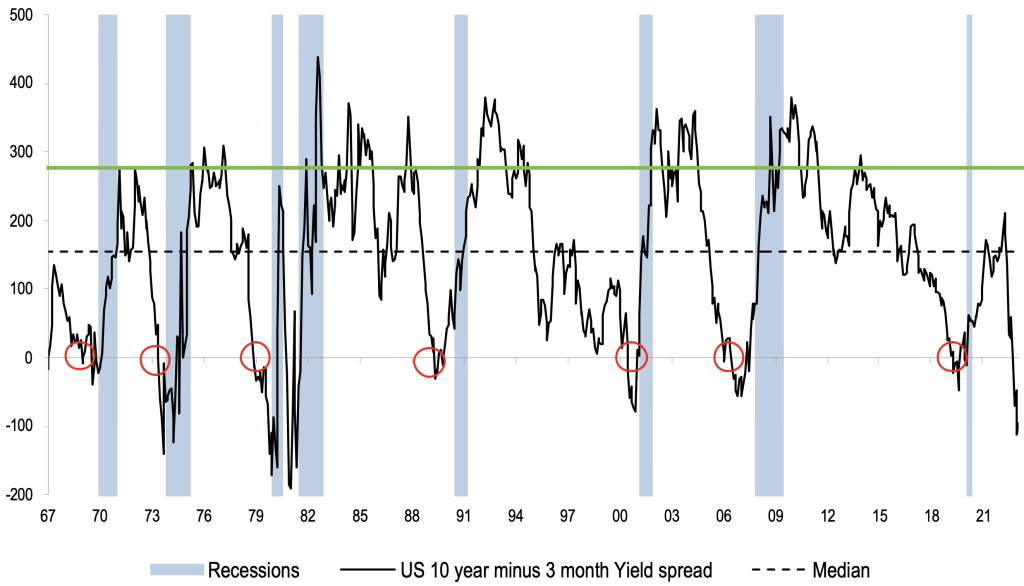

We’ve previously written at length about the yield curve and how it can aid in deciphering economic conditions. In late 2019, we issued some cautionary statements, which took us to throttle back equity exposure. At the same time, valuations were somewhat elevated, so this was a natural progression for us as value investors. Through 2021, the yield curve indicator we specifically watch had begun stabilizing. However, it has since taken a steep dive, showing spreads in the inversion not seen since the 1970s and 1980s. Looking at the chart below, you can see this indicator as far back as 1967. Each time it inverted, a recession typically followed within the next few months or year.

What does this mean? If an investor buys a 3-month US treasury, they can receive more annual yield than a 10-year US treasury. This implies that the market believes rates will fall, and the investor buying the 3-month bond will not be able to receive more yield in the future. Typically, this also implies growth concerns or the potential for a recession. If rates fall, investors in the 10-year US treasury will substantially benefit from price appreciation, as bond price rise as interest rates fall.

This indicator alone does not cause us to make any dramatic shifts in portfolios. It simply serves as one of many tools we use to guide portfolio decisions. With the recent bank failures that we previously wrote about, we’ve become increasingly concerned. Ironically, our greatest concern revolves around how little the market is concerned. In times of panic, we find solace as value investors, given that those are the greatest periods of opportunity. In March 2020, we wrote that we were increasing equity exposure, as the opportunity seemed to outweigh the risks. Another tool we use to gauge this is the VIX, the S&P 500 volatility index. It is sometimes referred to as the “fear” indicator. Simply put, the higher it is, the higher in premiums the market pays. So, if someone wanted to buy protection for a portfolio, it would be incredibly expensive the higher this indicator is. Looking at the chart below, you can see this indicator dating back to 2003. Clearly October 2008, the height of panic during the financial crisis sticks out, along with March 2020 when businesses were being mandated to shut down by governments.

Given the US just witnessed two of the large bank failures in history, you would expect this to be moderately elevated, right? Wrong. The market is merely saying “meh, I’m not worried.” In October 2022, we discussed our concerns for a Swiss bank, Credit Suisse. It was a massive institution that had experienced years of troubles that were finally coming to a head. Later in the year, they were able to successfully complete a Hail Mary capital raise, which would quickly turn out to not be enough. On March 19, 2023, it was announced that UBS will be acquiring Credit Suisse. Make no mistake; this was a bailout by the Swiss government, fearing systemic collapse. UBS will acquire the bank with no shareholder approval for $3.2 Billion, less than half the bank’s stock worth the day before it was announced. Additionally, after the first $5B of losses, the Swiss will be backstopping the next $9 billion of potential losses and even sharing in losses thereafter.

The Swiss government seems to have put out that fire, however at what cost? Additionally, what other fires are underway? Friday morning, Deutsche Bank, Germany’s largest banking institution, saw its shares slide 14%. It was on news that the bank’s credit default swaps, contracts that protect investors from the bank defaulting, rose sharply in price. It should be made clear-we do not see anything wrong with that specific bank. But in all reality, nothing was wrong with Silicon Valley Bank (SIVB) either. While SIVB had some issues for sure, but none warranting a bank failure. They faced a bank run that very few banks would ever be able to survive.

Runs, Unrealized Losses, and Yields

In addition to the recent runs, some banks have also made poorly timed investments leading to large unrealized losses. In the long run, these would normally work themselves out. However, if faced with liquidation today, the loss would be realized. Charles Schwab (SCHW) has been one of these institutions that has been pointed out lately, as they currently have a $22B unrealized loss in investments relative to a tangible book value of $6B. That’s extreme. They could undoubtedly raise capital today to plug this hole if forced to; however, the market may not be willing if financial stress begins to escalate further. It should be said, we do not currently have any real concerns for Charles Schwab in particular. Regardless, we do not custody any client assets with them. Instead, clients’ assets are custodied at Axos Advisor Services. Axos Financial (AX) has a marginal $6.9 million unrealized loss relative to its $1.63 billion tangible book value. The banking system as a whole has been estimated to have $1.7 trillion in these unrealized losses. If banks holding these large losses also face steep deposit declines, it could spell trouble.

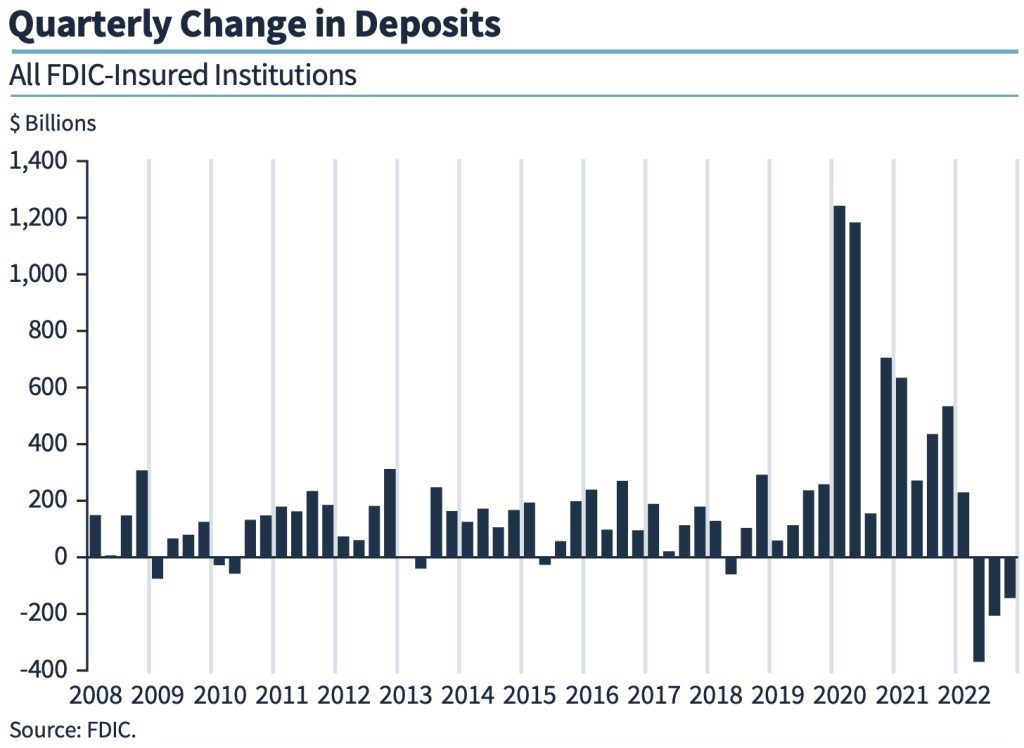

The banking system as a whole has seen issues prior to this year. In the FDIC Quarterly report for December 2022, the banking system saw loans surge almost $1 trillion while deposits fell for three quarters, almost solely driven by non-FDIC insured depositors. This takes liquidity out of the system, which may appear positive with no other context, as loan growth rose. However, now seeing two large bank failures and potentially more on the way, it could be troubling. Deposits peaked in early 2022 after surging more than 35% from the pandemic, and banks may be struggling with the deceleration, similar to the way other businesses struggled with the boom and bust of demand. Looking at the chart below, you can see total banking deposits have repeatedly been declining in the last twelve months. Recently, large depositors that pulled funds were said to be connected to venture capital firms that all started redeeming their deposits in mass. While many issues could be pointed to, this predominantly caused the collapse of SIVB, which we previously wrote about. The evening of writing that article, the Feds also announced they had seized Signature Bank of New York, which also catered to large depositors.

The following week, First Republic (FRC) came into focus when the eleven largest US banks placed $30B on deposit to help try and save the bank from a similar run it was facing. Some have pointed to the digital age allowing for such quick withdrawals of deposits. However, we see a continued trend of large depositors leaving the banking system for better alternatives. The steep hikes by the Fed have led to the current interest rate environment, which is causing most banks to be unable to compete with yields so quickly. Large depositors are transitioning towards money market funds as well as treasury bonds. Money market funds saw almost $500B in inflows over the last year, with half of that happening just this year. That could account for the majority of the banking deposit decline seen. We do not see this as a “temporary” issue and a transition that will continue throughout the rest of year, which could bring more banking issues. That’s separate from the headline-grabbing bank runs, but it could be a more gradual process as deposits transition elsewhere, causing liquidity issues. We see this potentially causing stress on the IntraFi system, but we’ll save that topic of discussion for another day.

This should not be taken as a doom and gloom message, especially given our previous post about how America is booming. It is ironic to see such banking stresses in the current good economic times, which we feel was caused by the flood of stimulus from the pandemic and now the system having to adjust to normalization. The American economy remains strong, and the residential housing market seems to be as well. Consequently, this poses issues for the Fed to continue hiking rates and potentially doing further damage to the banking system and the inability for banks to compete, thereby further losing deposits.

Portfolio Plan Implemented

For portfolios, we had rebalanced to a more conservative stance the Monday after Silicon Valley Bank had failed, and Signature Bank of New York was seized. However, we decided to rebalance again and took all risk levels to the lowest equity exposure we are comfortable with as of Friday. This is highly unusual for us to rebalance portfolios more than once a month. The last time we did this was in March 2020. However, at that time, we were increasing equity exposure and getting more aggressive for all risk levels. Today, we sit at the opposite end of the spectrum, as we now see too great of risk in a market that has become complacent. Markets are all about expectations, and we are uncomfortable with the current market expectations. At the height of the pandemic, we were comforted as the markets expected the end of the world. Today, we watch banking failures on trends that we believe will very likely continue this year, and the markets seem to have no concern. Because of this, we’ve chosen to overweight US treasury bonds. We have continued to hold positions that will profit if the financial sector, the Euro, and European equities decline, and we intend to hold these at least for the time being. We do continue to hold some stock exposure based on portfolio risk as we believe they trade at attractive valuations.

For composition comparison, an aggressive client could hold 100% equity exposure in environments we see as extremely conducive to stock investments. Those holdings have now fallen below 70%, the bottom range we want to hold for such a client. It may still seem high at 70%, but these clients typically add to their investments and do not need these assets for decades. A moderate client, or balanced portfolio, on the other hand, that would typically hold around 60% stock exposure will now hold less than 45%. We are underweight equities for all risk levels and intend to hold this stance for the foreseeable future. The banking sector is seeing stress as mentioned above, and we also see the potential for additional stress in commercial real estate assets, which will be yet another headwind for banks holding loans on these assets. We prefer to take a position of preservation in these moments and look for better opportunities that should lie ahead. We hope to wake up in twelve months with no more concerns and be able to begin overweighting stocks again. But, at this point, we see the current issues as a continued trend that should exist for several months and even potentially well into 2024. If true, it would not be surprising to see the Fed begin dropping rates. They’ve already begun a short-term “QE” by lending to banks at par value of their securities.

When we wrote about Credit Suisse’s issues last October, opportunities were abundant, and the markets were priced for concerns, which was comforting. We were happy to remain invested. Since then, markets, especially in the tech sector, roared back higher into February. Home builder stocks have nearly doubled since then, along with the vast majority of construction-related stocks. The market paints a different picture than only six months ago and is now a rosy one. Prior to the collapse of Silicon Valley Bank, we were still not overly concerned about valuations and continued to agree with that picture. However, due to recent developments this opinion has materially changed, and we feel it is important to be transparent and let clients know we have made a major shift in our portfolios’ stances. We are now focusing on preservation and intend to for some time. Governments keep intervening, trying to put out fires by throwing money around. Before taking any elevated risk, we’ll wait to ensure there isn’t a larger fire ahead at the horizon. We would prefer to err on the conservative side in light of recent developments. We will keep you posted of any changes/developments as they may occur.

As always, please don’t hesitate to call or email at any time if we can be of further service or you have any questions. We appreciate the privilege to be of service now and in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc

This update expresses the views of the author(s) as of the date indicated and such views are subject to change without notice. F.I.G. Financial Advisory Services, Inc. (F.I.G.) has no duty or obligation to update the information contained herein. Further, no representation has been made, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This information is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. F.I.G. believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. F.I.G. made attempts to show sources and links to that data, when possible. However, F.I.G. cannot guarantee or be held liable when accessing those links, as it is not the property of or maintained by the author(s). This update, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of F.I.G.

Uncertainty and Volatility