Update on Rick’s Health

As many of you already know, I have had lower back issues now for about 10 years. In the past, steroidal back injections worked on managing the pain and allowed me to avoid surgery. It appears I have now come to the point where the back injections are no longer effective, and the pain has been constant for over a month. I have consulted with one of the best back surgeons in Oklahoma, and my lower back issues have now come to the point where it appears surgery will be necessary to give me some relief and correct the problem. Currently, I am scheduled for back surgery on May 16th. So-for the next two months-I will be limited as to time in the office. I plan to be in the office at least two days per week and if the pain subsides any, I hope to eventually be in the office three days per week and will be working remotely the rest of the time.

They have said recovery time after the surgery is at least 6 weeks, and total recovery around 6 months to a year. I hope to be back and better than normal as soon as possible after surgery-hopefully within the 6–8-week time frame. Chris and Sam will be in the office as usual and are more than capable of keeping things running smoothly and providing the service you’ve become accustomed to receive. We will keep you updated.

Rick

A Historic Bank Failure

At the end of 2022, we wrote about how equities and bonds mirrored some economic concerns. It’s more comforting to see both markets draw the same conclusion. The headlines also said recession, which brought little concern as this is what the markets expected. In that article, we said, “Because of these expectations, the risk lies in not seeing a recession next year, which would raise concerns about a longer period of interest rate hikes.” And here we are. The job markets are nearly as tight as ever, consumer faced inflation remains elevated, specifically for goods like food and housing. From everything the Fed has implied, they have no choice but to continue hiking. They’ve been fixated on an arbitrary 2% inflation target as well as the “imbalance” in the labor market, as we’ve repeatedly spoken about before. This is beginning to cause stress in some financial systems as rates surged from 0 to 4.5% in just months.

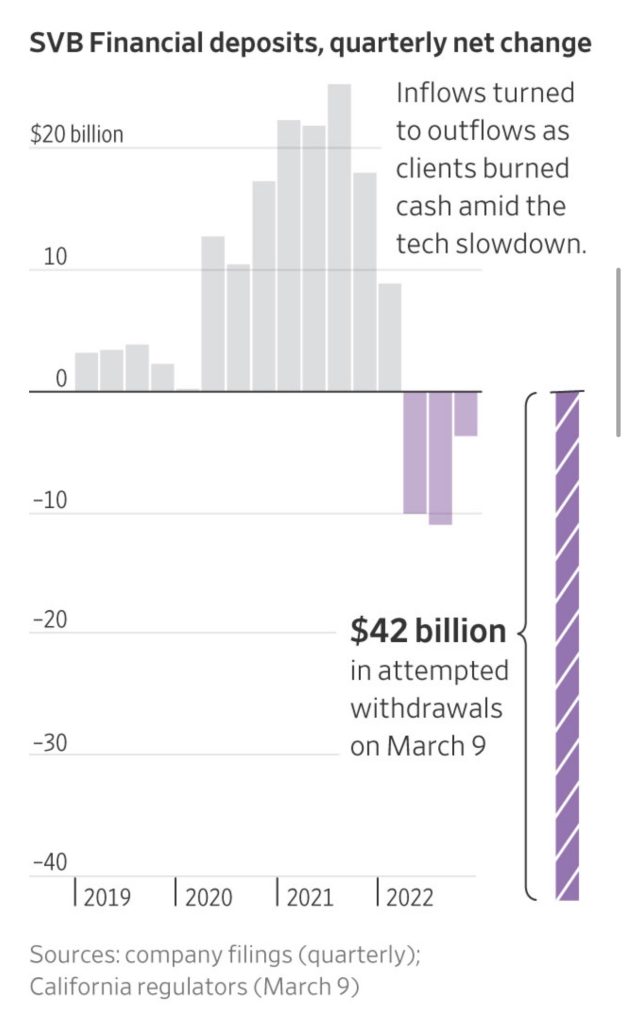

Last Friday, Silicon Valley Bank (SVB) was taken under the receivership of the FDIC. It is the first FDIC-insured bank to fail this year and will join the list of one of the largest bank failures in history. It was a bank that had historically focused on Venture Capital (VC)-related and start-up companies as clients. Funding for these kinds of businesses has hit a hiccup and slowed in funding after the surplus seen in 2021 dried up, which, coupled with the surge in interest rates that caused a large drop in their security holdings, left a disconnect between funds continuing to come in versus go out. When times are good in the start-up space, more companies will open an account with huge deposits from freshly raised VC funds. However, when these inflows slow, it could lead to large net withdrawals, jeopardizing the bank’s liquidity. Many clients and VC-funds realized this and began pulling deposits, which exacerbated the issue and caused the bank to fail. It is very similar to a bank run.

SOURCE: Wall Street Journal

The day before failing, SVB was valued at over $6 billion with $200 billion in assets. We do not doubt that many depositors will receive their full deposit amounts. The FDIC already announced all insured deposits will be paid. However, it could take time. Some companies are already decrying the inability to make payroll due to frozen funds. It will be a headache for many. But, the funds should be recovered. The main concern becomes whether this will have an impact on other banks that may have been working with SVB. This is typically referred to as contagion. Additionally, some may see it as the “canary in the coal mine,” as many other banks may face similar issues.

Outside of the startup space, we would have higher concerns for commercial real estate, primarily the once revered “premium” real estate in major US cities, such as San Francisco and New York. In the fourth quarter of last year, occupancy rates were under 45% in San Francisco. Many of these assets were lent to at overly favorable terms, with expectations that it was a for sure bet and nothing could ever go wrong. Now, with many either leaving the city, utilizing remote work, or cutting back on office space, these assets are severely underwater. Not only that, but interest rates have also now skyrocketed making the buildings even larger losers, which may lead to bankruptcy for some. Many banks own these loans and will face severe headwinds. It is a situation eerily similar to what was seen in the late 70s with the same problem of erratic interest rates.

We do not relay this opinion to cause panic. We think it’s vital for clients to know we’re aware and actively trying to navigate the current environment to protect portfolios from these risks. To alleviate these concerns, we have reduced most exposure to commercial real estate-focused companies except for a few holdings for our REIT investment models. Additionally, we have limited banking exposure and hold an inverse financial sector ETF for many clients, which should profit if the financial sector declines. Over the recent months, we have also shifted the bulk of our bond holdings to government-related securities as well as lengthened duration. We believe these kinds of bonds should perform well if markets begin to see more stress.

This could be a very short-lived situation, or we could see it spreading to other institutions. No one knows the future and we will attempt to maneuver through the current environment as best possible and take advantage of any opportunities that might occur.

And ironically, all of this is said against the backdrop that the American economy remains strong, forcing the Fed to save face and keep hiking rates. We believe that the Fed will ultimately start buying assets again, just like during the pandemic and financial crisis. However, they may hold rates steady while doing this. It would allow them to appear that they didn’t overdo it while helping bring liquidity to some of the assets banks are trying to offload to meet depositor redemptions. If more liquidity crunches occur as they did with SVB, we believe the Fed will start doing this sooner than later. We will keep you posted.

We appreciate the privilege to be of service and if you have ANY questions, concerns, or if we can be of further service in any way, please let us know. Also, the first quarter of 2023 is quickly coming to a close and if you have not yet scheduled your personal review this year, call or email us now to reserve your time.

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility