2021 Tax Reporting

By now you all should have received your 2021 tax information in the mail for both taxable and retirement accounts. This year is slightly different than past years due to the acquisition of E*Trade Advisor Services by AXOS Advisor Services as of August, 2021, so you could have two sets of reporting documents from each entity if you owned your accounts for the full calendar year.

REMEMBER: To make all this simpler for you, we can send the information directly to your tax preparer along with the “CSV” (Excel) file that can be downloaded into most tax preparation software. We will set up a secure link for your tax preparer to access which should save you time and money. Simply email Chris at chrisjurrens@figfinancial.com with your tax preparer’s current email address and a request to do so and he will get this done for you.

Also, if you happen to be doing your own taxes on either TurboTax or H&R Block software, your tax information can be downloaded as well. If you have any questions or need further assistance, please call or email Chris.

Is the next world war unfolding?

In March 2020, we witnessed some of the cheapest valuations for equities/stocks in decades. The valuations were not unjustified, as there was a possibility of total financial collapse due to governments around the globe mandating business closures. Because of this, the markets were in a complete panic. In less than one month, the volatility index surged to levels not seen since the financial crisis. The government reacted swiftly with unprecedented measures. We did not believe in the dystopian messages that we were in the midst of the next great recession that media reports were proclaiming. Some of the most irrational valuations were witnessed during that period except in robust businesses, primarily in the technology space. Back in August of 2020, we wrote about the unprecedented high valuations of that sector, which began taking a huge turn lower throughout 2021 as markets recalibrated and accelerated at the beginning of this year. We didn’t believe the sky-high values were originally wrong; however, the markets were pricing in the next decade of returns, leaving investors with a horrific risk/reward balance.

If you reflect on the “dot-com” bubble of 2000, except for some businesses, the market was technically correct. The internet did change the world, and some of those businesses went on to be the largest behemoths the world ever saw. It just priced that assumption in at that point in time, which marked a fruitful selling opportunity. Once the bubble burst, it became one of the greatest buying opportunities after the Nasdaq index had fallen nearly 80% over two years. Today, many technology stocks have fallen this much or more since their highs.

With the context of the current technology stocks declines, we are now seeing equity markets fall seemingly from the international political climate. Russia has invaded Ukraine, which could ultimately lead to World War III in a worst-case scenario. Many fear impending cyberattacks on the US. At best, the heat of the event fizzles if Ukraine falls, and Russia remains sanctioned. In any event, from most extreme to least, we are concerned for the energy markets, which were already an issue as we expressed in December as gas prices and utility rates in Europe were skyrocketing. Escalated by this exogenous event, we see energy prices remaining high and potentially moving higher for the foreseeable future. It could lead to higher prices elsewhere, placing financial stress on consumers in all directions as higher transportation costs could hit nearly every aspect of life. Inflation had been a previous concern of ours, and now it seems even more likely to be persistent. President Biden announced a commitment to release more oil reserves if necessary, but this action has already been taken by many countries with prices still elevated.

While many may quickly conclude, “buy energy companies.” We are looking at the longer term. We favor alternative energy companies more than before and technology-focused businesses after valuations have fallen. Initially, fossil fuel and commodity-based companies may benefit from higher prices. However, it only makes the alternatives even more viable in the long run. And at last check, the sun’s and wind’s energy’s price will remain constant at a whopping price of free. Client portfolios already own companies like NextEra Energy Partners, which holds various alternative energy sources like solar and wind farms. These businesses will have a continued competitive advantage by not paying higher fuel costs to run their plants. We also like technology-based companies that will not see as significant cost increases and potentially experience even greater demand for their products as others turn to them to help lower their expenses. The pandemic brought forward inevitable technology adoption several years and this adoption will only continue.

We see an opportunity to add investments for clients in companies like Zoom, a business once valued at $180 billion during the fall of 2020, now trading near a $39 billion valuation barely a year later. The market got overzealous, but the pendulum has now swung back so far in the opposite direction that it trades at an attractive valuation for clients to hold long-term. If the stock continues to fall further, we will increase our overall allocation to it. Companies with valuable networks, like Upwork (UPWK) or Meta (FB), are compelling as their networks create a clear competitive advantage for the business. Not until the recent tech decline have these become attractive from an investment standpoint. UPWK is down 60% from its highs, and FB is down nearly 50%. We now hold both of these companies’ stock in various client portfolios. We even hope to allocate to stocks like Spotify (SPOT), a streaming service, and Sonos (SONO), a premium speaker brand, which both have seen their values plummet. We do also favor Real Estate Investment Trusts (REITs) in this environment. REITs hold a variety of assets, including real estate. If costs remain high and potentially move higher, all the assets they own should generally increase in value.

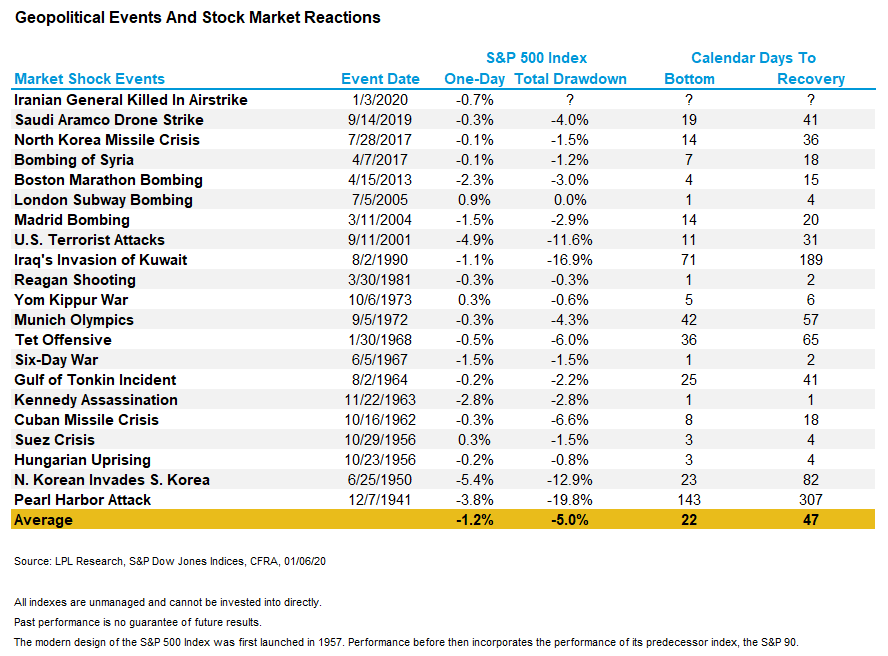

The following chart illustrates previous geopolitical events in history and how the US markets (as measured by the Standard & Poor’s 500 stock index) initially reacted and the number of days to both reach a bottom and recovery days to recoup the loss:

World War III is the worst-case scenario for the near future. While it is a possible outcome, especially if China decided to invade Taiwan amid the chaos, it isn’t a reason for us not to invest. It could cause increased volatility and concerns, but as we discussed some time ago, stocks had a positive return from the beginning of WWII until its end. How many customers will cancel their Spotify accounts due to war? Or will others quit using Zoom? We see it as unlikely. It would indeed be a wild ride in between, and it is one we hope we will not have to experience. We are aware, however, it is one we might have to, and we will continue to be diligent in safeguarding clients’ long-term financial well-being. And as outlined during the pandemic, we will personally be taking the ride with you, as our 401k accounts are fully invested in our risk models. As further events unfold, we’ll stay in communication with you and provide timely updates. In all reality, we face unknown geopolitical events every day and can’t predict when and if they will occur.

We appreciate the privilege to serve each of you and look forward to working together in the years to come. As always, please don’t hesitate to email or call at any time if you have any questions or concerns, or if we can be of further service in any way.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility