Christmas and Holiday Schedule:

We want to take this opportunity to wish all of you a very blessed Christmas and safe and Happy New Year from our family to yours. As we prepare to close out this year and move into 2022, we wanted to let you know the financial markets schedule for the upcoming holidays, as well as our office schedule. This year the US financial markets will be closed on Friday, December 24th in observance of Christmas. Since New Year’s Day falls on a weekend this year, the New York Stock Exchange will not be closed for the New Year Holiday. Our offices will be closed Thursday, December 23rd and Friday, December 24th for Christmas. We will also close early Thursday, December 30th at 3:00pm and be closed all day Friday, December 31st for the New Year Holiday. As always, we will have access to all email and phones during the Holiday’s should you need anything while our office is closed.

As has been our tradition over the past several years, we will once again be donating $1,000 to the Angel Tree Program on behalf of all our clients. Angel Tree provides Christmas presents to thousands of children that have a mom or dad in prison.

America, Richer Than Ever

With labor shortages currently seen as one of the largest issues facing businesses, we wanted to explore what we see as both the transitory issues as well as the potential secular catalysts that could be leading to much of the stress in the labor markets that may not subside soon. Particularly, it seems as though workers have been vanishing while customer bases continue growing. While the headlines remain focused on many of the negatives, we see quite a positive long-term story when looking into the data. Times are good in America and have only continued getting better over the decades. Yet, there seems to be a consistent focus on America’s demise.

Secular Trends

The Education Elevation

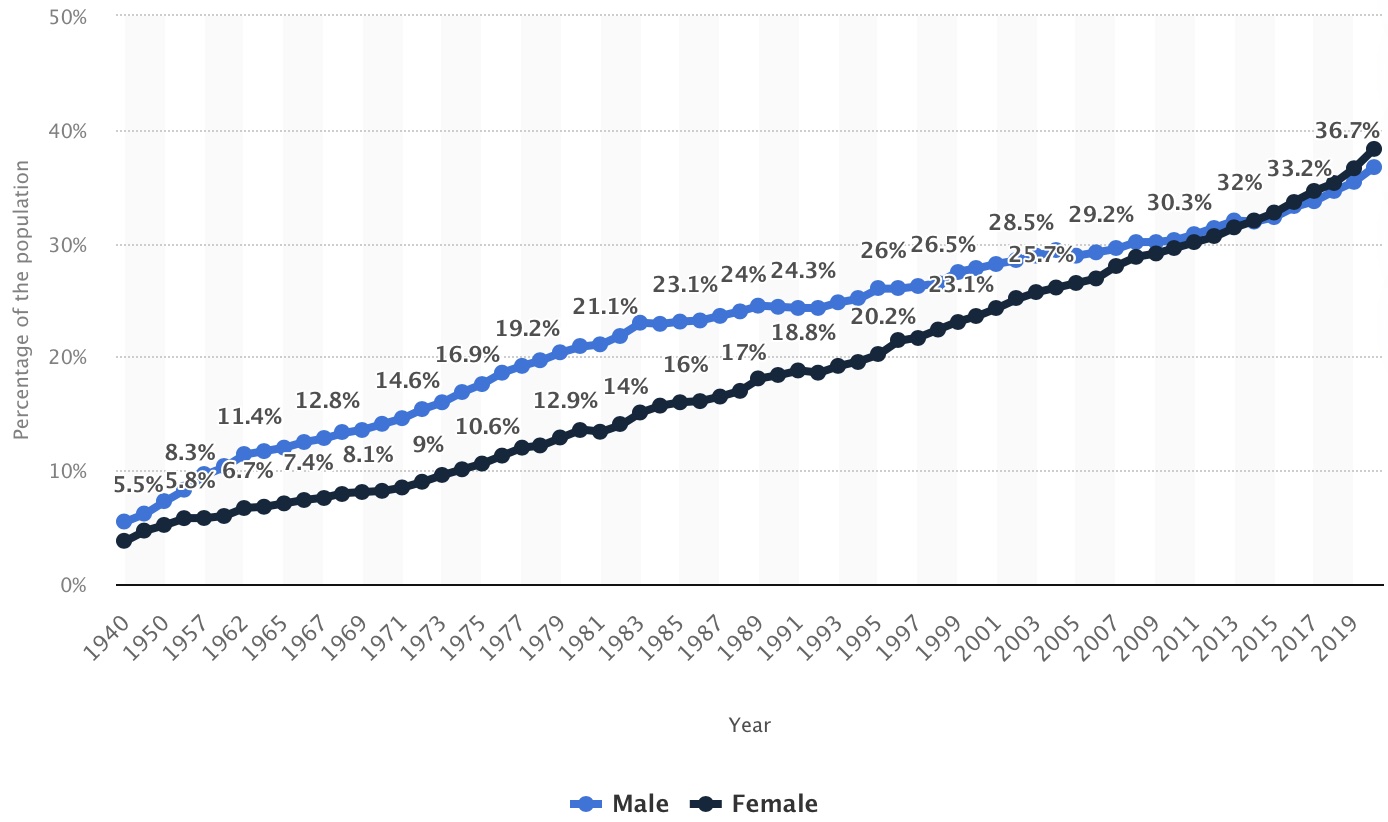

One aspect that correlates quite high with lower unemployment and higher incomes is education levels. Specifically, individuals that are college educated tend to see much lower unemployment and higher incomes than others. This group has dramatically increased over the decades, even as the cost of higher education has risen substantially. In 1970, only 14% of males and 8% of females had completed four years of college. Contrast that today where 36.7% of males and an astounding 38.3% of females have met this same metric. We know from job data, college educated individuals are much less likely to work in manufacturing or service-oriented jobs, which seem to also be having the greatest difficultly filling positions. It’s long been prophesied manual labor jobs won’t exist long-term and would be entirely automated away. While automation has indeed increased exponentially over even just the last decade, the economy still has an appetite for workers it struggles to satisfy. This is not just since the pandemic. For example, truck drivers have been in short supply since 2011. Technology is continuing to help productivity, workers are continuing to get more educated, and yet more workers continue to be in demand.

Source: Statista

Source: Statista

Much of this is has also been while America, and the developed world as well, has been getting richer as a whole. Looking at the US specifically, one in three American households file incomes over $100,000. Looking back in recent history, in 1970 only one in ten American households achieved this status and that is after factoring inflation. Not to mention, there are also twice as many households now when compared to then. Instead of seeing how rich America has become, doomsayers point only at inequality showing that the divergence of ultra-wealthy that have substantially more wealth than “most” rather than looking at how much more wealth “most” have now relative to any point in history. So, if there has been a death to the middle class, it has most likely been due to them joining the upper class. And we’re supposed to be pessimistic about this?

In the short-term during the pandemic, the government has also been shoving money into accounts of nearly 90% of Americans in the form of stimulus payments and childcare credits, causing a dramatic bump to the financial position of many, at least in dollar terms. We believe this action has contributed some in pushing inflation to its highest reading in over thirty years. But when we look at the bigger picture, America continues to become increasingly wealthy overall, which has only been exacerbated by this short-term stimulus. And current supply chains are not struggling to fill “normal” demand, but rather trying to fill a surge to all-time highs with America importing more goods than ever before

It does make filling jobs more difficult for some businesses, even those such as successful restaurants. If you listen to a restaurant owner, they may make mention of this struggle to find workers. However, what you may also hear that seems to be left out of perspective is on the demand side. Restaurants seem to have substantially more individuals coming to sit at their tables but fewer to help them serve these tables. This in turn leads them to invest in better processes to help those employees better fill this demand. Excluding the short-term spike in 2020, the US has fewer unemployed individuals than there are job openings since 2017, which has led to an extremely tight labor market. The previous low prior to the financial crisis was 1.6 unemployed workers per job opening in 2006.

Business owners are investing in technology to improve capacity, not necessarily to replace workers. The supply of workers seems to continue shrinking relative to the customer bases that seem to be expanding. This can be seen in many industries such as manufacturing, construction, leisure, food, and service-oriented industries just to name a few. With such a tight labor force, it can be assumed wages will have to eventually be pushed higher for well qualified employees as demand for them remains high, lending to future inflation as well. And as these businesses continue investing in technology, productivity and efficiencies should continue to see gains. That’s not even factoring the explosion of efficiencies we’ll most likely see in the next decade from AI (artificial intelligence) alone, but we can save that discussion for another day.

Demographics

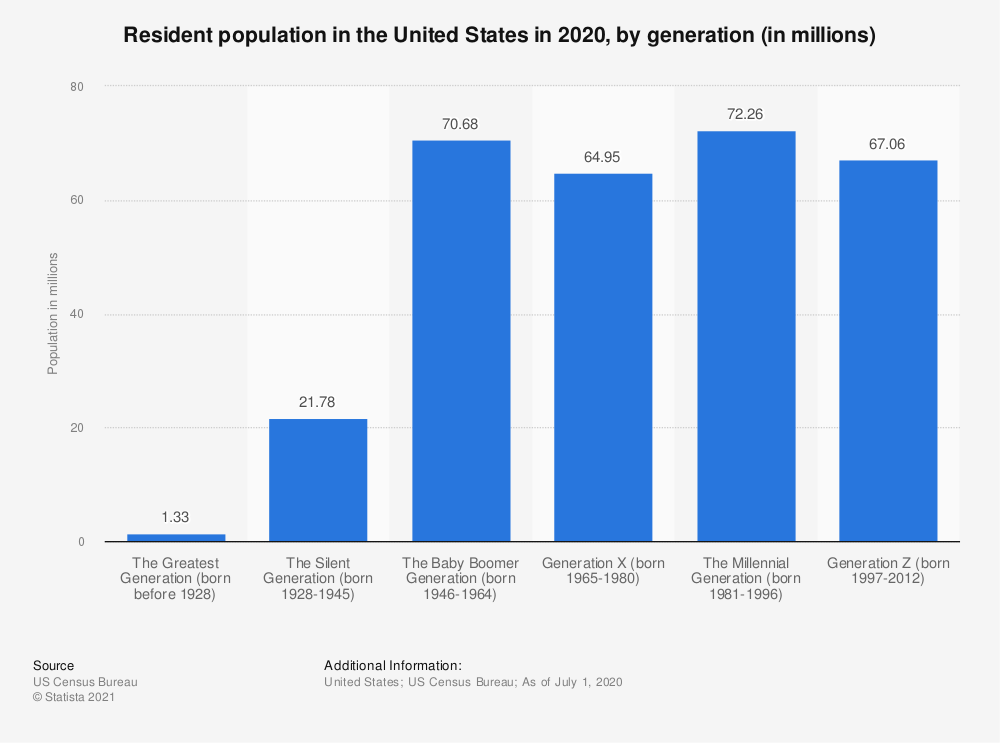

Population composition plays a large role in much of this theme. Many of our retired clients fit into the “Baby Boomer” generation, which currently make up the second largest demographic cohort in America. And what’s the first largest cohort? Their children, the “Millennial” generation (or Generation Y). On average, this younger cohort is between the age of 25 and 40. The largest population by age in this group is currently 30 years old. From income data concerning peak earnings, we know one’s 30s are typically some of the stronger income growth years, especially for college educated individuals, which is over 40% of the Millennial generation. For example, those in legal occupations aged 30 see, on average, twice the pay than at age 22. As this generation continues to age and gain in earnings power, it can be an easy conclusion that this age group will be at least a contributor to higher demand in some industries, especially those favored by the Millennial generation. Industries with high demand by both Baby Boomers and Millennials should see a compounding of the need for more supply. Think of the healthcare industry, which will see expanding demand as America ages. On the labor supply side specifically, the Baby Boomers continue to leave the workforce as they retire. In 2020, more than 8,700 baby boomers on average retired every single day!

Also relative to an aging population, transfer of wealth from older generations to their heirs or charities, is also a large factor in diversifying the number of hands in control of a significant amount of wealth that could lead to further spending and increased demand over time. It’s estimated there could be $68 Trillion worth of wealth transfer over the next two and a half decades, three times larger than the annual US GDP.

Near-term Trends

Energy Markets

One of the most relatable jumps in inflation has been in energy prices. Energy markets continue surging as demand remains high and supply is struggling to catch up. China, Japan, India, and the US have begun releasing oil reserves in attempt to alleviate the supply constraint. The US is releasing roughly 5% of its total reserve. This can be viewed only as a short-term solution. It would be assumed that American producers would eventually step in, but it could be detrimental if OPEC eventually floods the market again to cripple domestic producers. Natural gas prices continue to be the greatest concern and an area we continue to watch. Specifically, prices abroad are at some of the highest levels ever see. If a drastically cold winter hits again, it will be a massive unknown on how utility operators are able to navigate the market and provide for their customers. To help give perspective, below is a chart of the price of natural gas in the EU for the last decade. In America, prices are elevated but not at unnatural levels on a historical basis, unlike in Europe.

Source: TradingEconomics.com

We wouldn’t believe this to be a long-term concern or catastrophic to equity markets but instead a very acute short-term issue that will cause chaos for those effected. Imagine the power issues seen by Texas last year occurring in most parts of America and Europe as well as Asia. While it would be assumed widespread negative temperatures wouldn’t be seen again, it would still cause societal issues in colder developed areas if many are unable to heat their homes and natural gas dependent utilities unable to provide power. If prices escalate higher and utilities are forced to purchase at such escalated prices, it will undoubtedly lead to higher future utility bills as costs are passed on. It could also be extremely difficult for many of the utility companies to be able to purchase at these elevated prices. While that is a shorter-term trend, we do believe energy costs could rise over the long term as regulations seem to be continuing to escalate on energy industries, not just domestically but also globally.

The Ever-Mutating Virus

As is common with most viruses, they mutate. We believe COVID will continue to do the same. We believe the advent of the mRNA vaccines will help alleviate any long-term risks, however it is becoming much more arguable that COVID will be with us for some time if not perpetually. Countries such as Germany that contained the virus so well in the beginning of the pandemic seem to be struggling more now with this recent surge. It could be plausible it is from the lack of community spread building immunity, but we will let the professionals grapple over this. As for investment portfolios, there could be impacts related to the virus, but we believe them to be short-term. The risk seems to be from the actions of the government now and not relative to the virus itself. Governments started halting travel and implementing restrictions for a variant that has been described by scientists whom experienced cases as “extremely mild.” Yesterday, it was the delta variant. Today, it’s omicron, which has now been confirmed in the US. We’re sure to see more strains tomorrow, which seem to be getting more mild rather than more aggressive.

Pessimism Still Sells

As of this year, F.I.G. was established for over 38 years ago, nearly four decades. Through that time, it has consistently benefited one to maintain an optimistic view. But for some reason, the pessimists’ messages reign supreme time and time again. Markets are near all-time highs and somehow this gets spun as a negative and a reason for some not to invest, yet new highs are nothing new in history. Real estate, typically the highest percentage of net worth held by Americans, gained in value more than any time before, backed by strong fundamentals. This benefited the 65% of Americans who own homes, and yet alarms sounded that times are too good to be true.

We undoubtedly believe markets are volatile and see gains and losses from year-to-year. However, we continue to see a strong economy being treated as weak. When the omicron strain was announced, markets saw their “largest” drop in 2021 of only -2.27%, and immediately pundits said the Fed needs to delay hiking interest rates. They make these comments not from any change in the economy, but simply the markets barely declining for one single day. How spoiled and dependent on the Fed have we become? The Fed continues easing and has only discussed tapering its asset purchases.

We hope this year end letter leaves our clients with a view of optimism for the future as everyone else continues to only focus on the negatives. We take each of these pessimistic points into account, monitoring them constantly, but continue to walk away encouraged for the years ahead of us. There are many reasons for us all to be optimistic for the years to come.

May you and yours have a blessed Christmas Season and a very happy and safe New Year! We are looking forward to working together with you in the years to come and assist all of you in achieving your long-term financial goals!

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

This update expresses the views of the author(s) as of the date indicated and such views are subject to change without notice. F.I.G. Financial Advisory Services, Inc. (F.I.G.) has no duty or obligation to update the information contained herein. Further, no representation has been made, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This information is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. F.I.G. believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. F.I.G. has made an attempt to show sources and links to that data, when possible. However, F.I.G. cannot guarantee or be held liable when accessing those links, as it is not property of or maintained by the author(s). This update, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of F.I.G.

Uncertainty and Volatility