A Review of Your Investment Risk and Financial Plan

After the strong recovery of the investment markets over the past 12 months, now is a great time to schedule your overall review. It is a good time to evaluate your personal risk tolerance and overall financial plan. Call us today to schedule your personal review time. We can set up your meeting in-person or online, whichever you prefer. Call or email now!

A Look Back

This time last year, the World Health Organization recently had declared that the spread of Covid-19 constituted a (https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19—11-march-2020) worldwide pandemic. Stringent measures in the U.S. were being taken to slow the spread of Covid and “flatten the curve.” The lockdowns and shelter-in-place orders dealt a body blow to U.S. economic activity.

Investors, who attempted to price in economic activity over the next six to nine months had no prior experience to compare an economic shutdown and eventual reopening of the economy. It was like driving through a dark and foggy night with no headlights to guide our path. Consequently, investor reaction was swift, and the first bear market since 2009 descended upon investors. Volatility was intense. In just one day, the Dow Jones Industrial Average lost nearly 3,000 points, or 12.9% (March 16, 2020 St. Louis Federal Reserve DJIA data). That one day accounted for over 25% of the Dow’s nearly 11,000-point peak-to-trough loss.

The major market indexes bottomed on March 23 (St. Louis Federal Reserve). We were fortunate enough to actually add stocks to our client portfolios based on risk that specific day. The bear market lasted barely over a month, if we use the broader-based S&P 500 Index as our yardstick. It was a swift decline, but it was the (https://www.reuters.com/article/us-usa-stocks-s-p500-bear-graphic/say-goodbye-to-the-shortest-bear-market-in-sp-500-history-idUSKCN25E2R9) shortest bear market we’ve ever experienced. The ensuing rally off that low has been nearly unprecedented.

Treasury bond yields have jumped as the government has embarked on an expensive $1.9 trillion stimulus package and talk of new spending from Washington is gaining momentum. Further, bullish enthusiasm can sometimes spark unwanted speculation. Might the economy overheat and spark an unwanted rise in inflation? Might rising bond yields temper investor sentiment? Up until now, investors have focused on the rollout of the vaccines, reopening of the economy, and stimulus that has added record amounts of liquidity to the financial system.

Housing Boom 2.0

The recent market movements have been in response to what we see as a culmination of multiple forces convening all at one point. Since it seems to be one of the most relatable area to many clients, we thought it may be helpful to look at the real estate markets in particular, which are seeing quite a boom at present. While it may seem like it’s only happening locally, the entire nation is seeing a massive jump in real estate prices which hasn’t occurred in such coordination since the financial crisis. However, the nation is in a much different state today than during that time. Lending standards are extremely scrupulous now, unlike then, when nearly anyone was capable of getting a mortgage. Interest rates are dramatically lower now and the consumer is substantially healthier. Saving balances have shot up during the pandemic, not from just the overwhelming amount of stimulus being doled out but also a temporary halt in discretionary spending from the shutdown of businesses. The consumer stopped eating out, stopped traveling and was unable to spend much on entertainment. This has led to a dramatic boost in financial positions for many Americans. Even for those unemployed at modest to lower incomes, they have found themselves in better a position than before due to the massive bump in unemployment benefits.

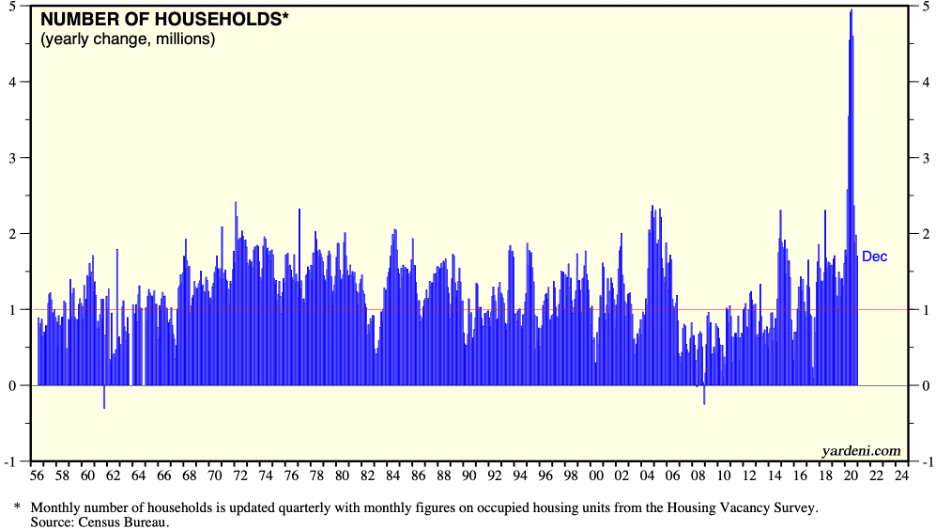

Looking at other factors besides the impact of the pandemic, something much greater was occurring in the background related to demographics. Remember the “boom” driven by the baby boomers? Well, those boomers had children that are sparking another ripple in the economy now. Looking at the data, this shift seemed to really start taking off in 2018, when household formations began accelerating into 2020. Formation of households saw a jump to nearly 5 million more than the year prior, one of the largest jumps on record. Much of this swing may be credited to millennials now moving out and claiming independence. Households with only one or two people have been gaining share. It could be assumed this will eventually decline as these household potentially get married and even have children.

This shift in demographic changes could be contributing much of the housing boom being witnessed nationally. It is undoubtedly being aided by the influx of stimulus money; however, we believe much more to be at play being this shift was appearing to start well before 2020. Unlike in 2008, housing inventories are now near some of their lowest levels on record. According to the National Association of Realtors, existing homes available for sale (home inventory) was roughly one million homes, compared to over four million at the peak of the previous housing bubble. Realtor.com has released a great video summarizing many of these optimistic economic numbers in a video available on YouTube.

New construction does not appear overheated either in terms of abnormal amounts of permits, which could be assumed to start escalating in order to try and meet the severe influx of demand that is outpacing supplies and justifying builders to build more. According to S&P CoreLogic, national home prices saw a fifteen year high in price change at an average of 11.2%. The average US home price is now well north of $300,000, marking the highest price on record when adjusting for inflation. Throw a pandemic and unprecedented government intervention on top of these forces, we witnessed supply chains grind to a halt expecting a collapse in demand, which has led to further supply pressures and an even greater escalation in prices. This is something we previously spoken about in past updates The pandemic also pulled forward much demand in home renovations and durable goods orders such as appliances as many consumers found themselves at home with funds to spend. Most economic related commodities also continue making new highs, such as lumber and copper.

We see no comparison to this housing boom relative to what contributed to the financial crisis. The only similarity in our opinion is that housing prices are rising at an alarming rate. We believe the consumer is in an extremely strong financial position and is continuing to be aided by central banks continuing to ease. Market volatility has also plummeted, which we would not be surprised to see eventually pick up at some point. Market pullbacks are normal and do not hold any weight in our analysis. Instead, we look to the underlying forces, which we believe to be positive to economic health. In the event of any material equity market pullback, we would look to escalate our aggressive positioning into long-term equity holdings. There could undoubtedly be some speed bumps ahead, but the government has indicated money will continue to be showered on the economy. In our opinion, this will be to the benefit of assets and investments priced in this money, as the cash (dollar) itself continues to lose value. And as with any boom, it will eventually slow down, but we do not see this happening in the next twelve months. We will continue to diligently watch when we see this pendulum potentially turning. In the meantime, we have begun positioning portfolios to benefit from continued increase in prices as well as the eventual rate hike to follow by the Fed at some point in the future. In our opinion, this will mark the beginning of the potential slow down. While the story in the media primarily remains dire, we do not find this in any current data. Additionally, a large theme for us and the portfolios we manage is the future demand for utility energy which will likely continue to increase over time and we have added investments for clients to potentially benefit from this as well.

As always, if you have any question, or we can be of further service at any time, please don’t hesitate to call. We appreciate the privilege of serving you and look forward to working together in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc

Uncertainty and Volatility