Third Quarter Coming to a Close:

It’s hard to believe that we are already in the last month of the third quarter and summer is almost officially over! If you have not scheduled a review this for this quarter, it’s a great time to look at planning towards year-end and update your overall long-term plan. Contact us today to schedule your personal review if you have not yet done so since the first half of this year. We can set-up an in-person or online review to fit your schedule. Call or email us today!

Client Events:

As most of you know, we have hosted an annual client event each year for over 30 years. Many of you have inquired regarding an event for this year. After our 35th year anniversary celebration with Bob Stoops as our guest speaker last year, the large turnout, and all the positive comments, we have decided to hold our large future events less often but try to provide a comparable and exceptional experience like last year for you at each event. We are starting to plan our next event and at this time anticipate hosting a large and special event for you in the Spring of 2021 and then again to celebrate our 40th year anniversary in the fall of 2023. We plan to alternate between the Spring and Fall so more of you can attend approximately every 2+ years. We hope this will better serve all of you in the future and provide you with a unique experience at each event. If you have any questions, comments, suggestions for venues, speakers, or entertainment, please let us know. These events are designed for you, our clients.

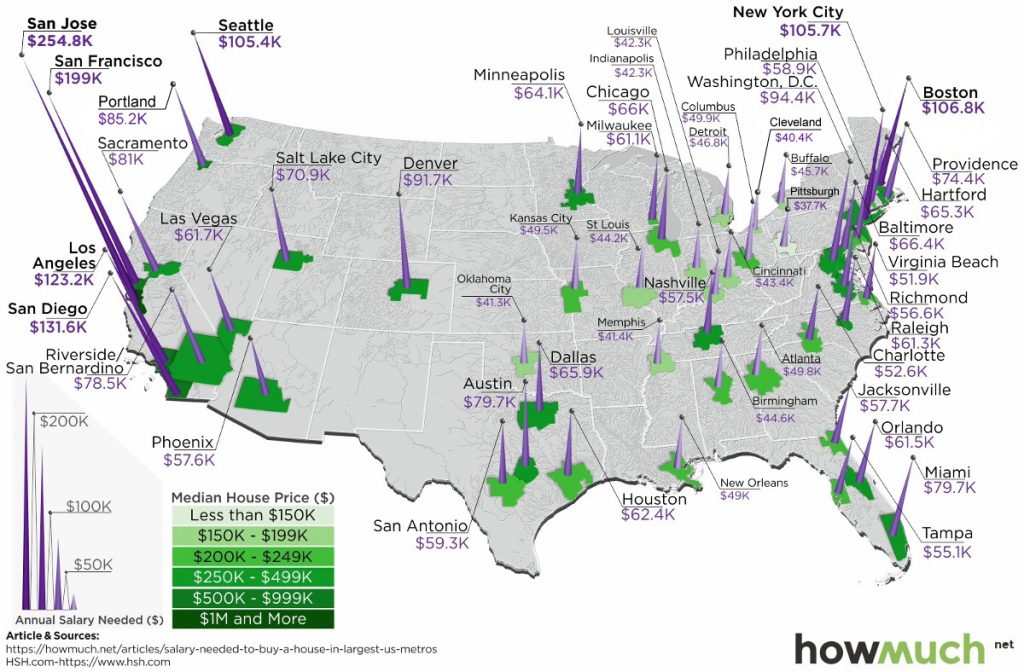

What Income Does It Take to Purchase an Average Home Today?

The following map shows the annual household salary needed to purchase a home at the median price for various parts of the Country:

Interest Rates:

Interest rates continued to fall lower over the past month, and the U.S. yield curve remains “inverted” as we have discussed in previous updates. The 30-year U.S. Treasury Bond yield reached an all-time low by the end of August, with the yield dropping to 1.96%. The 10-Year U.S. Treasury yield at the end of last month was approximately 1.5%. (MarketWatch) When interest rates fall, the price of bonds rise. Mortgage rates fell as well, with the national average for a 30-year fixed mortgage is 3.69%, while the 15-year fixed rate is 3.05%. (Bankrate.com). Now might be a good time to review your current mortgage rate and see if refinancing makes sense for you. Call us if we can help.

Portfolios:

We have remained cautious in our investment allocations across all risk levels, and it has paid-off during market declines overall. We see enough warning signs to stay with a more cautious approach as we move forward. Recession fears have surfaced over the past few months and the protectionist theme regarding trade has accelerated. We don’t expect a recession in the near-term, but there are enough reasons at this point to remain more conservative than normal in our investment strategies at this time. Our bond/fixed income positions, which are over-weighted in all risk levels, have benefitted from falling interest rates, and our lower than normal allocation to stocks/equities have helped to reduce the relative volatility of portfolios for all our risk categories as well. We will continue to monitor and keep you posted.

We hope you all had a wonderful and restful Labor Day weekend and were able to spend some extra time with family and friends. We appreciate the privilege to be of service and look forward to working with all of you in the years to come. As always, if you have any questions, or we can be of further service in any way, please don’t hesitate to call or email.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

It is important that you do not use this to request or authorize the purchase or sale of any security or commodity, or to request any other transactions. Any such request, orders or instructions will not be accepted and will not be processed. All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment advice. Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities and commodities mentioned in this report may not be suitable for everyone. U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Past performance is not a guarantee of future performance. Different investments involve different degrees of risk, and there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is referenced will be profitable or be suitable for your portfolio. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Before making any investments or making any type of investment decision, please consult with your financial advisor and determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how it may impact your financial goals. All opinions are subject to change without notice in response to changing market and/or economic conditions. 1 The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results. 3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

Uncertainty and Volatility