Street Name and F.I.G. Office Changes Coming November 1st!

We wanted to give all of you advance notice of some changes coming regarding our corporate office. The City of Oklahoma City has voted to change the name of Hertz Quail Springs Parkway to “Bogert Parkway” effective sometime in November. Also, there has been a generous offer to purchase our current building so we will be moving to a new building within the same office park on November 1st. The new building will be larger and give us plenty of room for future expansion. It is located at the entrance of our current office park. Sam designed and developed the new facility, and it will provide us space in which to better serve you. Timing worked well, as we were going to have to change our street address any way, even if we didn’t physically move! Now we will just be moving across the parking lot. The new address will be: 14642 Bogert Parkway once the City’s name change takes effect. Please don’t hesitate call if you have any questions. We are excited to continue to serve you in our new facilities.

Will Proposed Tax Law Changes Increase Your Taxes?

Will you be paying more in taxes next year? Since politicians have taken aim at high earners: Are taxes going to rise for the wealthiest taxpayers? “Will I be ensnared by Congress’ definition of wealthy?” If proposed changes in the tax code that passed a House committee are enacted into law, those that are wealthy, as defined by lawmakers, will likely see their taxes rise.

The major provisions include:

- Raising the top federal tax rate from 37% to 39.6%,

- Levying a 3% surtax on income higher than $5 million for single and joint filers,

- Raising the tax on dividends and the long-term capital gains tax rate for assets held over one year to 25% (up from 20%) for individuals earning more than $400,000 and for couples that earn over $450,000,

- Placing new limits on those who have large retirement account balances, and

These proposals are a long way from becoming law but are winding their way through Congress. The Senate may have its own set of proposals, which would require both legislative bodies to forge a compromise before a tax bill lands on the President’s desk. Moreover, a sharply divided Senate seems likely to pare $3.5 trillion in proposed spending, assuming legislators in the House compromise on new outlays. If new spending is reduced, smaller tax hikes could follow.

Under the current proposal, a couple filing jointly that has over $450,000 of taxable income will see their top rate rise from 35% to 39.6% next year if proposed changes are enacted.

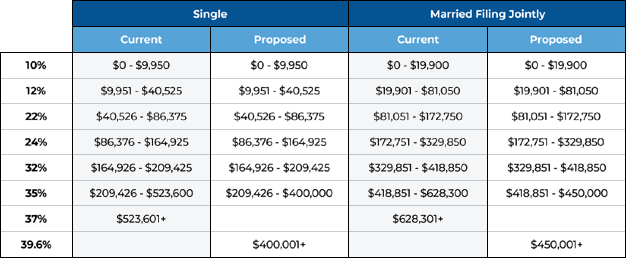

Below is a chart comparing the ordinary income tax rates under current tax law with the proposed legislation based on taxable income:

Source: Kitces.com

A higher rate on dividends and long-term capital gains tax rate is also being considered. As proposed, if a capital gain is realized on or after September 14, 2021, individuals earning more than $400,000 and couples earning over $450,000 will pay a top rate of 25%. The same would hold true with dividends.

With very narrow exceptions, it would be too late to incur a long-term capital gain at 2021’s lower rate.

There will be new Required Minimum Distribution requirements for individuals who have a high income and large retirement accounts, regardless of age. If you exceed $400,000 and $450,000 in income for single and joint filers, respectively, AND retirement accounts total over $10 million, you will be subject to RMDs beginning in 2022. You will also be prohibited from making IRA contributions. However, the restriction on contributions does not apply to employer-sponsored plans such as 401ks, SEP IRAs, or SIMPLE IRAs. If your income is above the $400,000 and $450,000 limits and retirement accounts exceed $20 million (including a Roth IRA), you would be required to distribute funds from your Roth IRA.

Lawmakers in the House have not proposed taxing unrealized capital gains at death, as had initially been proposed by the President. Also, the step-up in basis for inherited assets is NOT changed in the current House proposal. But one proposal being floated is to reduce the estate and gift tax exemption to $5 million. Tax reform in 2017 raised the limit to $11.7 million of individuals and $23.4 million for couples.

Bottom line

These are just a summary of some of the major provisions. They may or may not be enacted into law.

We understand that taxes play a role in overall returns, but so do many variables. Your financial plan should ultimately drive investment decisions, not just tax laws. We can discuss how any of the proposed changes might affect you personally at your 4th quarter review.

Sources and further reading:

[[https://www.wsj.com/articles/capital-gains-and-capital-pains-in-the-house-tax-proposal-11633080602 Capital Gains and Capital Pains in the House Tax Proposal]] [[https://www.wsj.com/articles/democrats-want-to-raise-taxes-heres-your-to-do-list-11631871008 Democrats Want to Raise Taxes. Here’s Your To-Do List]] [[https://www.cnbc.com/2021/09/13/house-democrats-plan-drops-repeal-of-a-tax-provision-for-inheritances.html House Democrats’ Plan Drops Repeal of a Tax Provision for Inheritances]]Debt Ceiling

Last fall, we opined how many seemed to feel the world had never been worse, borrowing a term “presentism” to explain the current environment. Streets were filled with riots, a virus was spreading across the globe, and America believed it had never been so politicized. Since that October 2020 post, the markets have rallied nearly 30%. The discussion quickly turned to everyone expecting a collapse. Now, we have financial headlines pushing fear over things such as the debt ceiling “crisis” as if it was something new. However, this debate occurs quite frequently, but it had not been a topic since emergency limits were suspended then raised to accommodate the massive amount of government spending that was approved for COVID relief. Rather than focusing on the monotony of Congress’ frequent approval, the headlines fill everyone with concern that the government will shut down. Of course, there is no mention that the government has shutdown twenty one times since 1974, although from various reasons.

In most recent history, in late 2018, the government was shut down for a total of thirty-five days, if you recall the fiercely debated border wall funding. This was not due to the debt ceiling, but rather a disagreement on government funding. The US has most recently witnessed a “crisis” from disagreement over the debt ceiling specifically in 2013, 2011 and 1995. In 2017, the debate was resolved before the final hour and never led to a shut down. All of these events though were eventually resolved and none having lasting impact. In 2011, the US’s debt rating was even downgraded for the first time, which many prophesied an impending collapse as the world no longer had a “risk free” rate. The EU and various European nations like Greece were going through substantial debt issues at the time, providing more fuel to the panic. However, with the advantage of hindsight, that moment in 2011 was one of the best buying opportunities for investors.

In relation to the current debate, we find it disheartening that no one even seems to discuss that the US increased the debt ceiling which was bumped up by a monstrous $6.4 trillion on July 31st of this year. And here we are, not even two months later, demanding even more debt or face “financial Armageddon.” Within the last decade, the US has mainly resorted to “suspending” the limit, running up debt, then raising the limit to exceed the previous issuances during suspension. Amazingly, for some reason, the conversation drifts towards eliminating this ceiling as an “unnecessary” burden to continuously suspend or raise it. Rather, why aren’t we focusing on what’s causing limitless debt to be issued? It is possible for the US to endlessly run deficits as long as the market allows, but we do not see any outcome from this behavior other than inflation. For the moment, the debt ceiling has been temporarily resolved to provide for spending into December. At which point, we will most likely see headlines flooded with this same topic once again if nothing is done before that time. So, stay tuned.

Evergrande, Real Estate, and Labor

So, what do we view as a near-term risk if we’re not overly concerned with the debt ceiling debate? Well, another headline you may have previously seen made mention of a Chinese real estate developer called Evergrande. We’re closely watching this situation. While we do not believe it will be catastrophic to the financial markets, it could cause some large ripples. More specifically, it could be the canary to an impending financial crisis in China spurred by home prices falling, which are extremely overheated and have been for some time. In China, real estate makes a substantial amount of market value relative to countries like the US and household debt levels have surged in the last few years. The jump in home prices isn’t unique to China though. Globally, real estate prices have absolutely skyrocketed. While backed by strong fundamentals in many areas, specifically the US, unlike during the financial crisis back in 2008, it is still cause for concern to see prices move so dramatically. Along with those increases, many commodity prices have jumped as well.

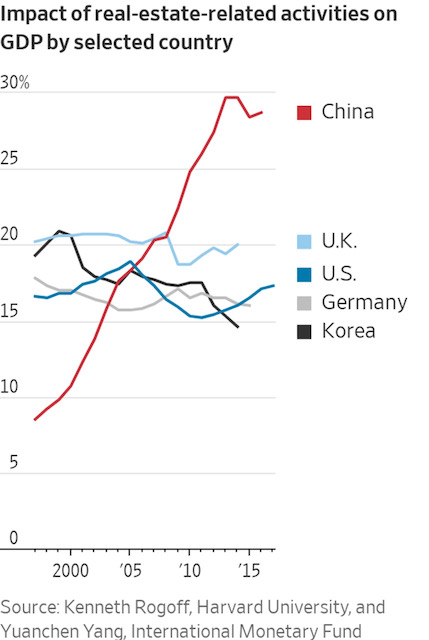

For a company like Evergrande, it could be increasingly difficult to complete construction projects as well as see many projects now be unaffordable, essentially halting its business. The company would most likely restructure its debt, which will also throw cold water on China’s real estate market, which now makes up nearly 30% if its GDP. While the company’s stock has lost over $100 billion already, we see the risk in China’s real estate markets, rather than the company itself, which could dramatically impact the wealth of its citizens. Not to even mention the chaos of purchasers trying to receive any deposit back placed on a currently worthless, incomplete building. This could create a ripple in financial markets, but we currently believe it will be most felt in China and by any great magnitude by other nations. However, we continue to closely observe.

Source: The Wall Street Journal

The one glaring issue we’ve heard from countless sources in nearly every industry is labor shortages. We’ll dedicate an upcoming article to this issue, but a spoiler alert, we believe labor issues could lead to more inflation. For client portfolios, we continue to be focused on how to best protect from inflationary pressures and tend to disagree with the Fed as only being “transitory.” While we could continue to see increased market volatility in the future, we continue to believe investing in value stocks to be one of the best protections for long term wealth, not cryptocurrencies.

We appreciate the privilege to serve each of you and look forward to working together in the years to come. As always, if you have any questions or concerns, or if we can be of further service in any way, please don’t hesitate to call or email.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility