Mid-Year Review

Be sure to contact us today if you have not already done so to schedule your personal 2020 “Half-Time” review. We can schedule a time that is convenient for you either in-person or online, whichever you prefer. A review of your overall investment risk profile, portfolio performance summary, and personal financial plan is crucial to your long-term financial success and peace of mind. Call or email us today!

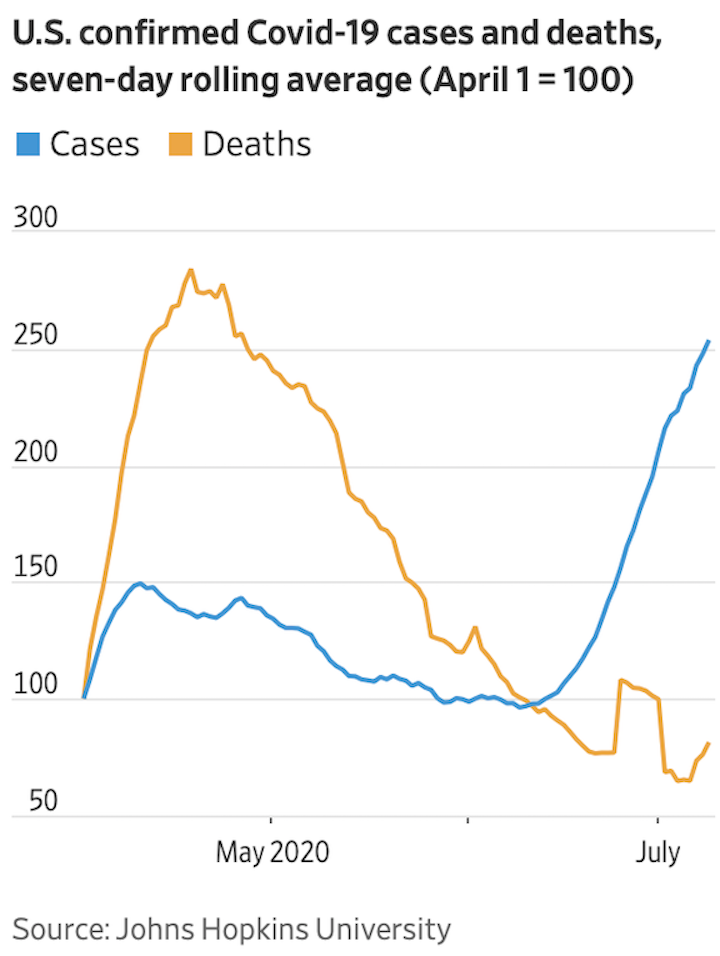

Virus Cases Continue Rising

Currently, the US has a seven day average of 743 daily deaths, which is down over 70% from the 2,749 daily mortality peak in April. This is also during a time that positive daily case counts have doubled from the peak of 32,500 daily new cases in April to now over 65,000 daily new cases today. Additionally, this daily count has been continuing to increase, without much follow through on the fatality side-at least not as of yet. In the previous surge of cases in April, fatalities trailed the peak of daily cases by roughly one week. Currently, case counts have been dramatically increasing for the last month. Daily fatalities have slightly risen off the low, however it is nowhere near the chaos that was seen in April. Of course, one death due to any cause is unfortunate, however, we believe these numbers show the current situation is not spiraling out of control like it did in New York, New Jersey, Massachusetts and Connecticut earlier this year. The disproportionately affected population remains the elderly. For example, in Texas, those over the age of 80 make up roughly 4% of positive cases, yet 40% of deaths. We do remain highly concerned with future consequences of actions being made by governments, in particular now the hot button issue of school closures. With large flu outbreaks, schools nationwide do shut down for a few days at a time to avoid local flu outbreaks. This may be justified, since the flu is much more dangerous for youth relative to this coronavirus. However, closures have not been done for an entire school year in major areas, and it will be a concerning experiment particularly stress on lower income families and disadvantaged youth expected to self-learn online.

Graph: Wall Street Journal

Amazing Companies Seeing Excessive Valuations

Within the last month, we have witnessed extreme divergences in valuations particularly in tech-related businesses. Specifically, we’ve seen valuations of companies like Netflix, Apple, Amazon, Facebook, Google, Tesla and Microsoft soar to unprecedented levels. These giants have also skewed returns in the major stock indices relative to the broader market. We personally find these to be remarkable businesses; most of which we even personally use on a daily basis. Some of you may have wondered why we do not currently have any of these companies within our portfolios. We would urge you to not look at how amazing these companies are, but rather, what are you paying for the business? In most cases, investors owning these companies at these price levels will need to see these businesses remain not only dominant but also in a high growth mode for the decade ahead. Both outcomes could be highly likely, however, investors are paying valuations today that already assume this will occur. Even if we had perfectly timed purchasing these stocks before the massive run up they have experienced recently, we do not see how we could justify continuing to hold these positions at these valuations for our clients. As value investors, we must be able to believe that investors are being appropriately compensated for risks.

We absolutely agree these are incredible businesses and deserve premium valuations, however we also believe there are more attractive opportunities today for our clients in terms of justifiable returns and appropriate risks. We have been actively finding stocks trading at depressed multiples that we believe should bode better for portfolios relative to those stocks that are priced for perfection. To help illustrate this point, let’s discuss a stay-at-home favorite, Netflix. Netflix has the advantage of being the first company that popularized digital streaming content in-home. It now predominantly focuses on in-house content licensed or created by Netflix only. The company now boasts over $20 billion in annual revenues and just over $2 billion in net income for shareholders. Netflix still burns through quite a bit of cash, so it chooses to predominantly issue debt to finance its monstrous media spend to create more content. Including all its currently outstanding debt, investors have to pay roughly $260 billion for this business.

Let’s contrast Netflix to another media company, Discovery Inc. Discovery owns networks such as HGTV, Food Network, TLC, Cooking Channel, Magnolia, Animal Planet and many more domestic and international brands. We understand it isn’t a perfectly comparable company, however Discovery has stated a separate service for them priced at $5 per month would be hugely profitable. If they pursue this path, it would be extremely comparable in terms of business model. Regardless, the way it is today, the business does roughly $11 billion in revenues and just over $2 billion in net income. To own this business, investors pay less than $30 billion, including all of Discovery’s outstanding debt. So, for roughly the same amount of net income, investors pay one tenth the price to own Discovery, Inc. relative to Netflix. However, “growth” is hailed as the reason why this premium exists, which we can agree with. As value investors, it may be surprising to hear we do not shy away from growth. However, it needs to be at a justifiable price.

Given past trends, it could be reasonable to assume Netflix might grow revenues 25% per year over the next five years. If this came true, Netflix would post roughly $60 Billion in revenues for 2025 and beyond. If we assume the same margins, Netflix may book about $6 billion in net income. So, if we now run a similar analysis as before, with $60 billion in future sales assumed and $6 billion in net income at year five, investors would then “only” pay 43 times earnings for Netflix, and again only if these assumptions are achieved. An important caveat though, Netflix would most likely be issuing further debt to continue its media spend, which would make it more expensive than this example. But let us digress. We are simply trying to put the premiums paid for these growth companies in perspective without over complicating the comparison. So, we look at Netflix’s 43 times multiple if it successfully compounds growth and compares it to roughly 15 times for Discovery, today. Let’s take it one step further and assume Netflix achieves 25% growth for the next decade, year after year. If that becomes true, investors are then paying roughly the same multiple for Discovery, Inc. However, this assumes Netflix achieves $180 billion in revenues, which is in line with AT&T’s total current revenue. Possible? Maybe. But that’s what you’re paying for today by owning Netflix stock. The only way this becomes justified and a potential investment for us, is if in ten years, Netflix is still capable of compounding growth. We do not believe anyone can accurately predict or speculate that far into the future.

So, when we look at two businesses like this, we prefer paying a 15 multiple on a profitable business that has lower near-term growth (Discovery) instead of placing hopes on a business that would be trading at a similar multiple only if it achieves these high growth rates consistently over the next decade (Netflix). Said another way, investors are already paying for Netflix to achieve these goals, ten years before even doing so. Netflix needs to exceed these growth rates in order to be justifiable, which we believe would be difficult to project, especially in the media business.

We’ve repeatedly heard individuals say that “fundamentals no longer matter.” It seems some investors have thrown their hands up and said, “You have to just buy these stocks because they keep going up.” We are value investors. We love growth, but we must be able to justify it and believe clients are being appropriately compensated. We agree these technology stocks are amazing companies. However, amazing companies do not always translate to great investments. These businesses deserve premiums and most of them have extreme moats built around them. However, at these price levels, we do not believe investors are being well compensated for risks that exist. We strongly believe current valuations for our client portfolios undoubtedly matter. If you have a fifty-year timeline, these may become interesting. However, it seems the risks today in these tech heavy weight stocks are much too great, especially relative to other stocks we continue to be in favor of buying today.

Stocks are simply ownership in a specific business, and we believe investors must always ask: “What is the price being paid?”, rather than buying amazing businesses at any price. We ask for your patience during this period of valuation divergences that are capable of sustaining for long periods of time. However, we believe these valuations are too great of a risk for our portfolios. And to reiterate, we are continuing to find other attractive stocks. We have now become increasingly concerned about the major tech heavy weight valuations, which have typically traded at premiums in the past. However, concerns arose as these premiums escalated in the last month to levels that seem incredibly hard to justify. As a historical example, the last time Amazon traded at this valuation based on trailing revenues was in 2003. From its peak in 2003 to its bottom in 2006, the stock fell nearly 55%. If you remember, other stocks performed quite well during that period. We are not predicting any kind of collapse in these stocks as that is anyone’s guess as to price movements. However, we believe other investments remain significantly more attractive. Could these “expensive” stocks get even more expensive? Of course. We just have more conviction in investments that can be justified based on current valuations for our clients.

We hope you and your family have remained safe and healthy during these trying times and we are here to serve you in any way we can. Please don’t hesitate to call or email if we can ever be of further service in any way or if you have any additional questions or concerns.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Looming Risks Overlooked