Good Friday Holiday

The U.S. stock markets will be closed Friday, April 2nd and our office will be closed as well. Any withdrawals requested from E*Trade Advisor accounts that week will have an extra day delay in processing due to the market holiday. We wish all of you a very blessed Easter weekend!

Tax Filing Deadline Extended to May 15th:

The Internal Revenue Service has extended the tax filing deadline from April 15th to May 15th , 2021 for filing your 2020 income tax return. This gives an extra 30 days this year in order to accommodate all the changes affecting tax filings that were made last year due to the COVID-19 pandemic.

Text Messaging now Available for Communication Mode

We now have a dedicated service for those of you that would prefer to utilize text messaging as a form of communication. If you would like to use texting as a communication option, please either email or call us and we will set up your private text option.

American Rescue Plan signed

The American Rescue Plan (H.R. 1319), one of the largest federal aid packages at a cost of $1.9 trillion, has officially been signed by President Biden last week. This package came in slightly smaller than the $2.3 trillion package signed by former President Trump in 2020. The anticipated $1,400 per individual additional stimulus checks have already started going out to most Americans, however, we’d like to take some time to discuss two aspects of the bill that are less spoken of that we believe will have a major impact on many.

Health Insurance Subsidy Boost

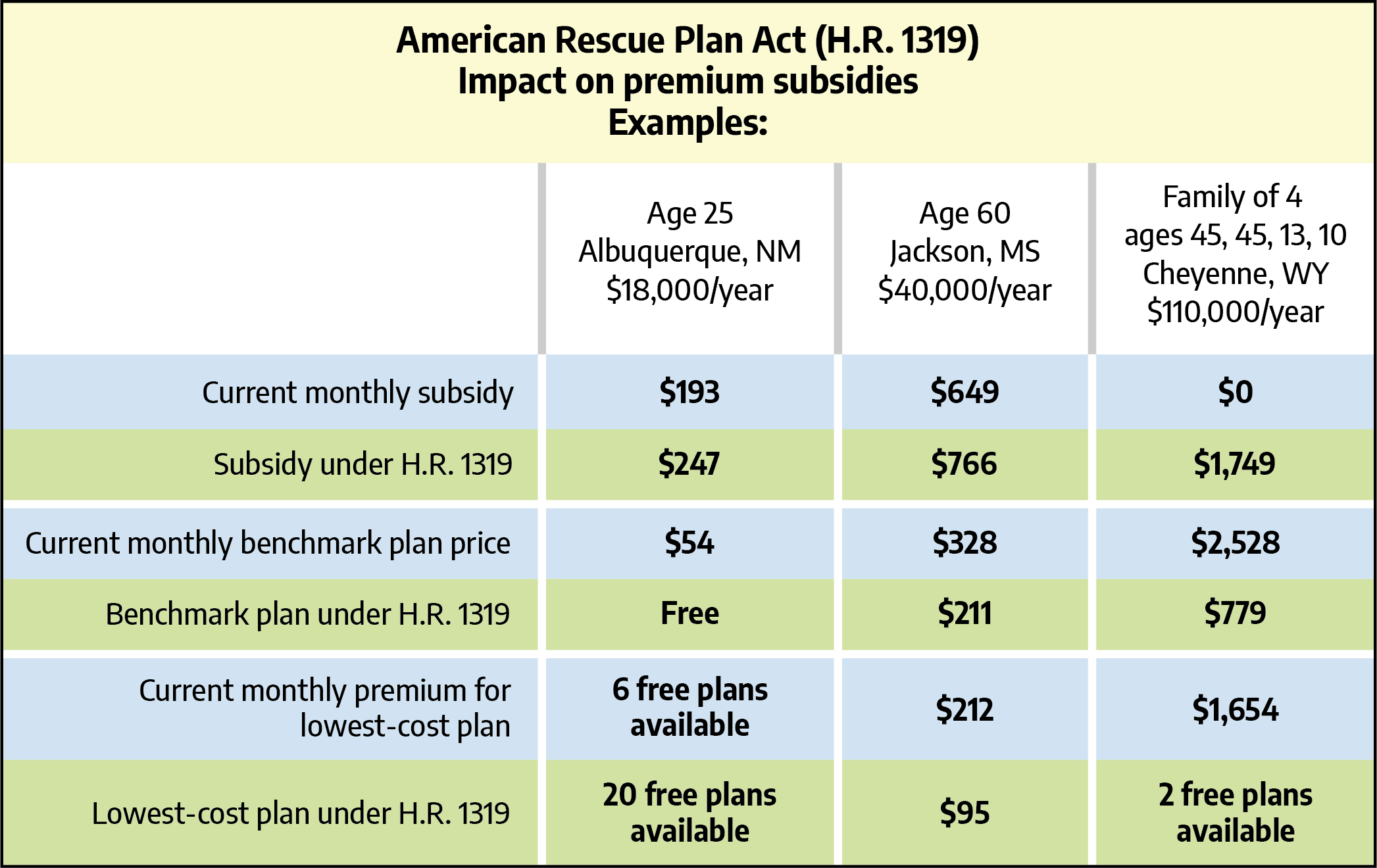

One of the least discussed aspects that has a dramatic impact to those under the age of 65 and paying for their own health insurance is one we’d like to discuss first. Within H.R. 1319, the subsidy for ACA-compliant health care plans has been dramatically escalated for some. Rather than being completely exempted from federal subsidies if income levels were above 400% of the poverty line threshold, now no American in the plan will pay more than 8.5% of their income relative to the benchmark plan. This will give a substantial boost to younger retirees that are not yet eligible for Medicare yet and only have income primarily from investments. The table below tries to illustrate this with varying examples.

From HealthInsurance.org

Specifically for younger retirees, this change should dramatically lower healthcare costs to you before reaching the Medicare age of 65. Essentially, the government will subsidize health insurance premiums above 8.5% of your gross adjusted income. We believe this will push many consumers towards the government health care exchanges and even eventually have a material impact on employer provided health care plans as well in the long run. Currently, 180 million Americans receive health insurance from their employer plans. However, this tweak in the ACA subsidy could benefit both employer and employees by shifting them to their own healthcare plan on the exchange instead of employer sponsored plan and increasing their compensation instead. Depending on the individual state, median household income ranges from $44,000 to over $95,000. Using the top end of $95,000, this new change would cap the family’s cost of health insurance at $675 per month at 8.5% of income. The lower the household income, the greater the individual benefits from being on the exchange rather than insured by their employer.

Child Tax Credit Overhaul

Another aspect of the bill that we see gain less attention but will have a dramatic impact is the one-year adjustment to the child tax credit. Previously, most families earning less than $400,000 per year received $2,000 in tax credits per child. However, this credit could not be fully refunded if no tax was owed. H.R. 1319 removed the non-refund-ability aspect as well as boosted the amount of the credit to at least $3,000. Additionally, the bill will fund the credit in monthly direct installments rather than reconciled in tax fillings. Starting in July, married couples earning less than $150,000 per year will receive at least $250 per child per month. If the child is under six years of age, the couple will receive $300 per month.

This credit will potentially lead to massive stimulus impacts especially for lower income states, such as Oklahoma where the median family income is $68,358 as of 2019. If the family only has one child, it will be nearly a 5% boost income, even greater when factoring taxes as this is a credit and not taxed like ordinary income. In a state such as California, the median family income is $91,377, which will receive the same credit, roughly a 3% boost. Paying this credit in monthly installments will lead to over $20 billion being injected into the banking system every month. We believe this will have varying stimulative effects, but the greatest impact will be lower income states and higher family populated regions.

We believe the change in health care exchange subsidies as well as the child tax credit components of the bill could have the largest economic impact, especially if Congress makes these changes permanent.

Other headline items of the bill include:

- It extends a $300 per week jobless aid supplement and programs making millions more people eligible for unemployment insurance until Sept. 6.

- The plan also makes an individual’s first $10,200 in jobless benefits tax-free.

- The bill sends $1,400 direct payments to most Americans and their dependents.

- It expands the child tax credit for one year, which we discussed above.

- The plan puts about $20 billion into Covid-19 vaccine manufacturing and distribution, along with roughly $50 billion into testing and contact tracing.

- It adds $25 billion in rental and utility assistance and about $10 billion for mortgage aid.

- The plan offers $350 billion in relief to state, local and tribal governments.

- The proposal directs more than $120 billion to K-12 schools.

- It increases the Supplemental Nutrition Assistance Program benefit by 15% through September.

- It offers nearly $30 billion in aid to restaurants.

- The Act clarified forgiven student loans would not be taxed, foreshadowing future legislation.

To try and give some relevance to the size of these packages, in 2019 the US government spent a staggering $4.4 trillion, over $1 trillion more than it brought in in revenues. The first stimulus bill in 2020 was $2.3 trillion, with the current one at $1.9 trillion. Combined, these two packages have essentially been an additional year of spending, with more packages very likely to be coming as well.

Annual Privacy Notice:

The following is our Privacy Policy that we are required to provide to you as our clients annually. If you have any questions, please let us know.

We at F.I.G. Financial Advisory Services, Inc. consider the protection of your sensitive personal information to be an important priority. Our privacy policy and practices are designed to support this objective. We want our customers to understand what information we collect and how we use it.

We collect nonpublic personal information about our clients such as you from the following sources:

- Information we receive from you on applications and other forms and in personal interviews;

- Information about your transactions with us, our affiliates or others which we may obtain in writing, during telephone or Internet transactions or from data gathering software; and

- Responses from your employer benefit plan sponsor, or association regarding any group products we may provide.

We do not disclose any nonpublic personal information about our customers or our former customers to anyone, except as permitted by law or directed by you.

We restrict access to nonpublic personal information about you to those employees, agents, and third parties who need to know that information to provide products, services, or specific transactions to you. We may be required by law or regulation to disclose information to third parties–for example, in response to a subpoena, to prevent fraud, and to comply with rules of, or inquiries from, industry regulators.

We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information. We DO NOT sell lists of our customers nor do we disclose customer information to marketing companies.

Since we work with a variety of third parties in providing financial services and products to our clients, we encourage our clients to review the privacy policy of each third-party firm with which a particular client may do business.

If you have any questions regarding this policy please contact us at 405-844-9826 or visit us online at www.FIGFinancial.com.

We appreciate the privilege to be of service and as always, please don’t hesitate to call or email if you have any questions or if we can be of further service in any way.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc

Looming Risks Overlooked