Less than 2 Months Left in 2024!

If you have not yet scheduled your fourth quarter personal review/update meeting, please do so today. This year will be over soon, and now is a great time to discuss any year-end planning issues as well as prepare for the New Year. Call or email us today!

Navigating Uncertainty: Market Strategies for a Volatile Decade

We’ll keep election talk to a minimum, as you’re likely already inundated with political news with less than 24 hours now before the polls open. Every U.S. election is portrayed as pivotal, yet this cycle has felt particularly intense. Since our last update, global events have been anything but quiet. The sitting President announced he won’t run again, shaking the political landscape. The Fed delivered a surprising 50-basis-point rate cut. China rolled out its largest stimulus package since the pandemic, Iran directly bombed Israel, leading to retaliation, and the Southeast U.S. endured a “100-year storm.” Adding to this, the Sahm Rule, a historically accurate recession predictor, triggered an economic warning, while a presidential candidate survived two assassination attempts. The U.S. government also hit a historic milestone, surpassing $1 trillion in interest expenses, now exceeding the Defense budget. No wonder we are all feeling so exhausted!

Reflecting back to the pandemic, we discussed “presentism”—the tendency of each generation to feel like they’re living in the most turbulent times. Yet, with recent events, it’s hard to ignore a heightened sense of global volatility. Many people seem desensitized to the constant flow of headlines, even in the financial markets. For example, few noticed Japan’s recent “Black Monday,” where the Japanese index dropped over 25% in under two weeks. In response, the Bank of Japan swiftly retracted several statements to stabilize the markets, which, for now, seems to have calmed the situation.

Recession Warnings and Market Uncertainty

Over the past eighteen months, beginning with the largest bank collapse since the financial crisis, warnings of an impending recession have persisted—a concern we’ve shared. Throughout this period, economic indicators have swung from positive to negative and back again, embodying true uncertainty and lending some credence to the “soft landing” perspective. However, many warning signs remain. Existing home sales recently hit a 14-year low, while unemployment has risen from its 3.4% low in April 2023 to 4.1%. Most consumer debt delinquencies, except residential mortgages, are climbing or at decade highs. The Conference Board’s Leading Economic Index has also declined since its 2021 peak, diminishing its current reliability.

Stocks, gold, housing, food, insurance costs—you name it, nearly every asset and expense is hovering near all-time highs, making everything feel more expensive. Yet, the Fed recently cut rates by 50 basis points, with markets expecting an additional 25 basis point cut this week at their next meting. Interestingly, oil is one major asset that hasn’t followed this upward trend. Most energy prices, critical to transportation and inflation, remain near lows when adjusted for inflation. This has helped ease economic strain. Looking forward, we expect both inflation and interest rates to trend higher over the next decade, even if U.S. oil production keeps prices in check. This view is increasingly grounded in the U.S. government’s fiscal position.

Fiscal Policy and Rising Interest Rates

Since the 1970s, economists have warned of the U.S. dollar’s potential decline and criticized reckless government spending. Today, however, we may truly be entering a period of rising interest rates, which would limit governments’ reliance on low rates-similar to homeowners repeatedly refinancing. The debt ceiling, originally designed in 1917 to curb U.S. debt growth, was fully suspended during the pandemic, triggering a significant debt surge. Alarmingly, it was suspended again in June 2023 and has remained suspended, resulting in an additional $4.3 trillion in debt. This decision has created lasting risks, as interest expenses have become the government’s largest budget line, averaging a cost on its debt of 3.35%—up from a record low of 1.56% in early 2022. With the 5-year Treasury yield at 4.04%, interest expenses could rise over 20% even if rates remain stable. Against this backdrop, the government’s projected budgets rely on deepening deficits, driving future interest expenses higher, even if rates hold steady.

Possibility of a Lost Decade?

Once the election cycle fades, discussions on U.S. fiscal policy are likely to return, and we continue to hold that this fiscal approach may usher in a period of higher inflation compared to the last two decades. Meanwhile, markets find themselves at an unusual juncture: near-record valuations, high index concentration, and interest rates just beginning to rise from historic lows. It’s difficult to ignore the possibility of entering a “lost decade.” While investments generally trend upward over the long term, shorter periods, including full decades, do not always guarantee positive returns.

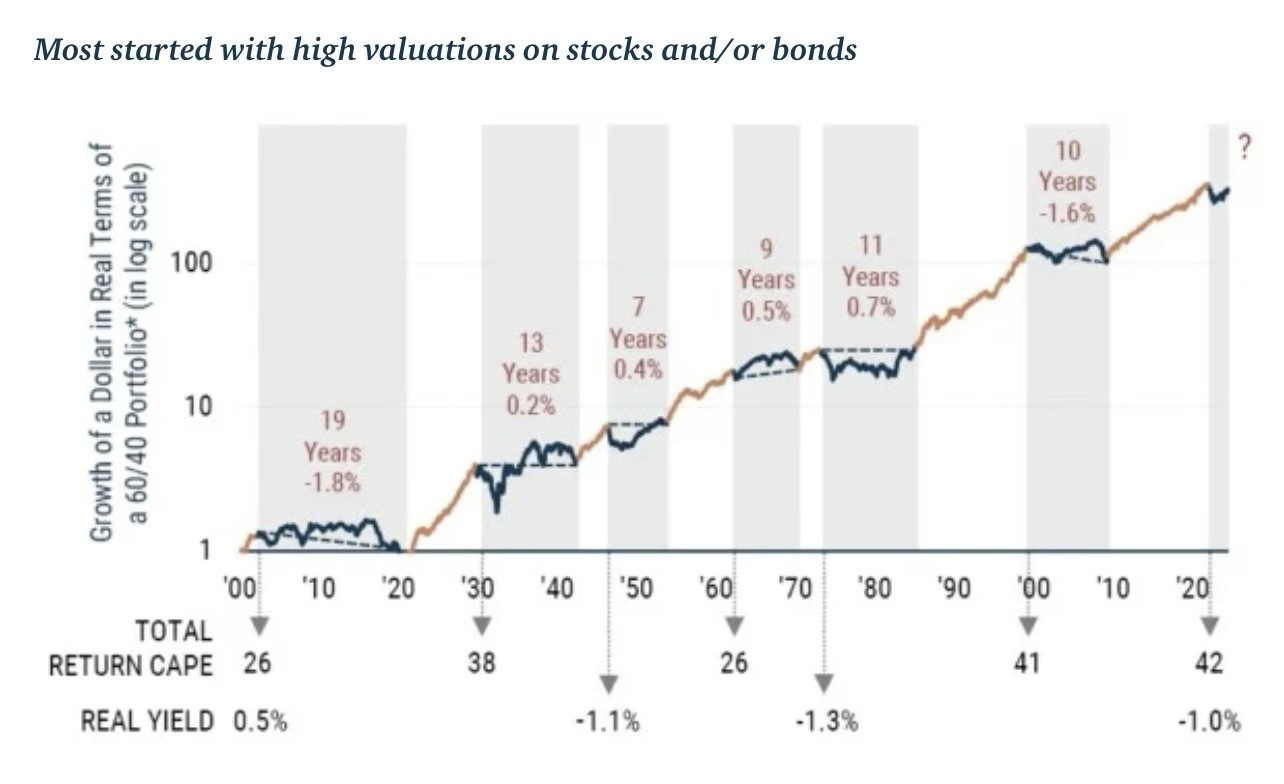

The chart below highlights specific periods for a 60/40 portfolio of equities (60%) and fixed income (40%), with grey areas marking times of stagnation or negative returns. Notably, the recent period from 2008 to 2020 broke from this pattern, spanning 12 years without a “lost decade.” Given historical patterns, we see the markets as primed for a potential reset, as the extraordinary recent run seems unlikely to persist at this pace indefinitely.

Given record valuations and concentrated index holdings, a stagnating period seems reasonable—and it’s not necessarily “bearish” in the negative sense for equities. Valuations can decline either through price drops (bearish) or through earnings growth outpacing stagnant prices, especially with inflation as a factor. Inflation often drives these challenging periods, and if earnings grow while prices hold steady, valuations naturally decrease. Our point is that a “lost decade” doesn’t require a crisis or steep market correction. Instead, we anticipate the next 10–15 years could be challenging for conventional portfolio strategies, which may no longer align with the unique market dynamics ahead.

Given record valuations and concentrated index holdings, a stagnating period seems reasonable—and it’s not necessarily “bearish” in the negative sense for equities. Valuations can decline either through price drops (bearish) or through earnings growth outpacing stagnant prices, especially with inflation as a factor. Inflation often drives these challenging periods, and if earnings grow while prices hold steady, valuations naturally decrease. Our point is that a “lost decade” doesn’t require a crisis or steep market correction. Instead, we anticipate the next 10–15 years could be challenging for conventional portfolio strategies, which may no longer align with the unique market dynamics ahead.

Strategic Positioning for Market Challenges

Greenlight Capital, a respected firm we follow, recently remarked, “we will avoid calling this market a bubble, and simply observe that the dividend yield is low and the P/E ratio is elevated despite corporate earnings being cyclically high, if not top-of-cycle.” In essence, they view the market as richly valued—a perspective we share. However, high valuations alone don’t dictate short-term market direction. As Keynes famously noted, “The market can stay irrational longer than you can stay solvent,” meaning expensive markets can always become even more so.

So, what steps are we taking? We remain optimistic about the future, yet we’re strategically positioning ourselves for a range of possible outcomes. Our portfolios use a long/short strategy as a core equity holding to provide a natural hedge against unexpected events while still allowing for upside. Whether markets continue to climb or hit a rough patch, we believe this approach will perform well relative to alternatives. Additionally, in our “flex” model, we’re focused on areas showing resilience, such as utilities and gold miners, where we’ve held exposure for much of the year. In our “core model,” which centers on fixed-income and commodities, we maintain positions in gold and precious metals and higher-yield bonds like bank loans, convertibles, and emerging market debt. For now, riskier assets remain rewarded, but with credit spreads near all-time lows, we anticipate a potential rotation out of these fixed-income investments in the near future.

We remain committed to protecting client portfolios as best as possible and carefully managing risk based on each clients’ risk tolerance. Regardless of the upcoming election’s outcome, we expect heightened activity but will stay focused on portfolios, not headlines. It appears this election will be very close again and hopefully we will at least know the winner shortly after election day. Regardless of the result, our outlook on the fiscal landscape remains steady, with concerns over a potentially more inflationary environment that could compound over the next decade. We continue to rely on our systems to guide us through these challenges effectively. As always, we will keep you posted.

We appreciate your continued confidence in allowing us to serve you and look forward to many more years to come. Be sure to exercise your right to vote!

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

This update expresses the views of the author(s) as of the date indicated and such views are subject to change without notice. F.I.G. Financial Advisory Services, Inc. (F.I.G.) has no duty or obligation to update the information contained herein. Further, no representation has been made, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This information is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. F.I.G. believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. F.I.G. made attempts to show sources and links to that data, when possible. However, F.I.G. cannot guarantee or be held liable when accessing those links, as it is not the property of or maintained by the author(s). This update, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of F.I.G.

Extreme and Swift Market Movement/Rotation