We just wanted to provide you with a brief update today regarding our office procedures moving forward given the fluid and ever-changing environment regarding the COVID-19 outbreak. Like many, we have been closely monitoring the ever-evolving situation and we wanted to let all of you know what we will be doing to respond over the next few weeks.

We will be:

- Actively monitoring the situation on a daily basis and assessing any risks to us and our clients.

- We will disinfect our common areas utilized by guests after each visit. We are not in a high traffic public access building.

- Will be prepared to actively implement any changes to our day-to-day business operations recommended by appropriate and reliable sources including the Centers for Disease Control and Oklahoma Department of Health

- Monitoring ourselves in assuring proper health procedures including but not limited to regular hand washing and staying at home if any of us exhibit symptoms of any kind.

- We have a contingency plan in place if we ever need to work remotely for any type of emergency of disaster.

We would encourage you to take advantage of our Go-To-Meeting online option for reviews during this time. We can go over the same information and data as we do in our face-to-face meetings, and this will allow for your personal review in the safety of your own home or office. All you need for the online meeting is either a computer, smart phone, or tablet. We can schedule these for you at your convenience.

We will continue to monitor this situation on a daily basis and will be in our office as usual to serve you at this time. We just wanted to update you as we want to help reduce the spread of this virus while still serving you as we always have.

Again, we are not medical professionals or experts, but we still believe there is no reason to panic and for the most part, the current reaction to this virus seems to be extreme. Today, the Federal Reserve announced an interest rate cut to -0- percent for Fed Funds Rate and will purchase at least $700 billion of asset purchases. This is the most extreme move by the FED since the 2008 financial crisis. This decision was made after a special meeting by the FED today prior to its scheduled meeting this coming week.

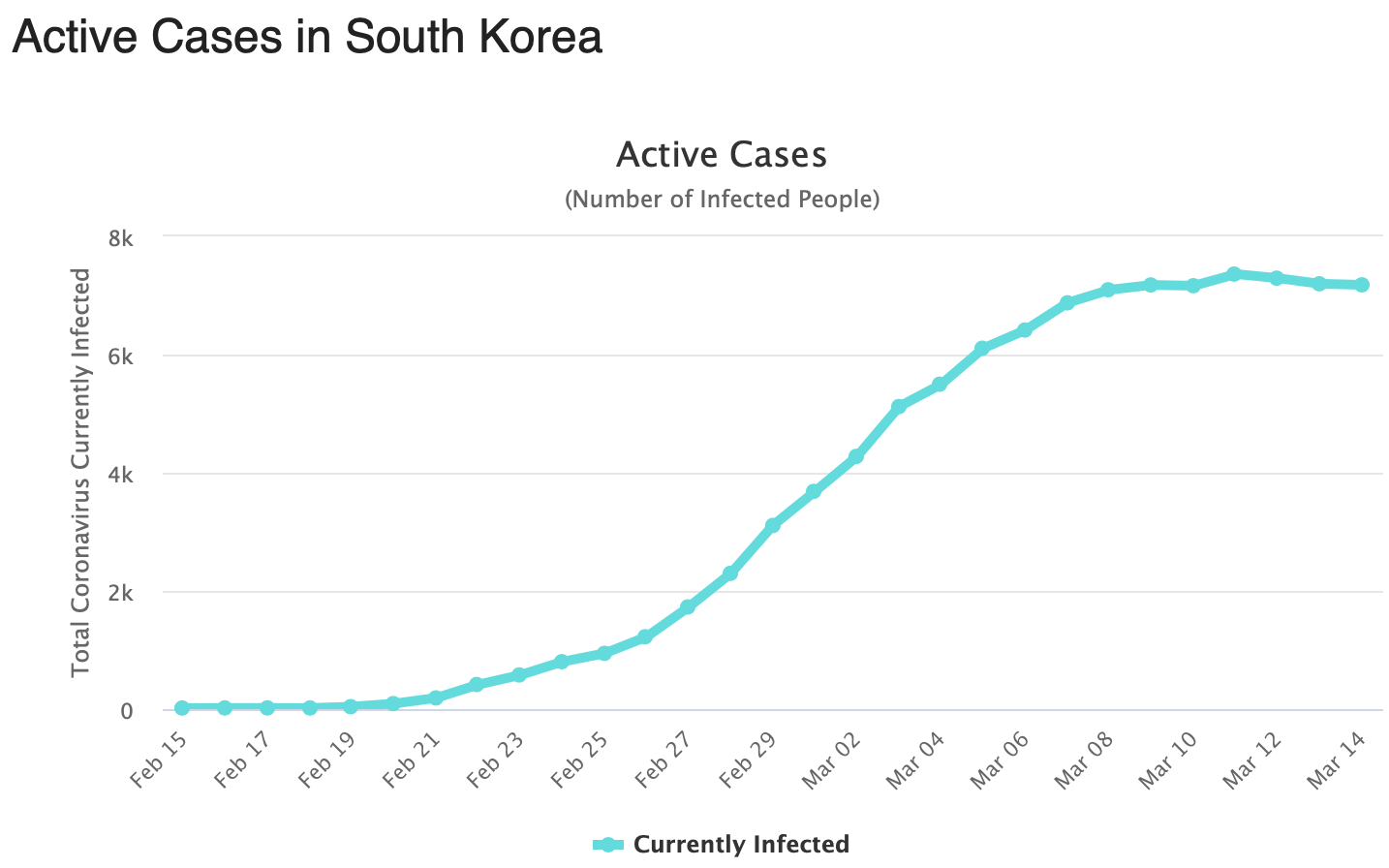

We have actively been following the results experienced in South Korea since this outbreak, and wanted to give you the following information as we think a similar result could occur in the U.S. South Korea first saw the COVID-19 outbreak roughly twenty-two days before the US did. If the US follows a similar trajectory timeline, daily active cases should be in decline by the end of the month if not before. China followed almost an identical timeline to South Korea as well. The outbreak seems to be hitting different countries at varying times. South Korea was one of the first countries to be impacted by the outbreak after China as well as conducted a high quantity of tests. It makes the country a great case study for the scope of the virus. South Korea is at roughly 160 cases per million population. If the U.S. sees the same outbreak, it should report roughly 53,000 cases over the next few weeks. The U.S. cases will most likely surge over the next two weeks, possibly causing even more panic due to more completed tests. Headlines will continue to cover the outbreak, cases will continue to increase, but we are expecting calmer heads to prevail once active case stabilize in April.

The chart below shows the daily reported cases in South Korea by each date. As you can see, the country’s cases seemed to peak sometime in the first week of March, and daily cases have been in decline since. Total active cases have remained stable since the second week of March. We would expect to see active cases beginning to fall by month end. The U.S. on the other hand is just in the beginning phase of cases surging. The U.S.’s current timeline would be roughly at February 22nd based on the experience in Korea when looking at the charts below. Assuming a similar timeline is seen as observed in China and South Korea, the US would witness stable active cases by the end of April.

SOURCE: WorldOMeters.info

We would expect to continue to see volatility in the financial markets moving forward until the current fear and panic subside, which could be April/May, but in the meantime, we still feel the opportunity to find “bargain” stocks in this environment is at levels we haven’t seen in over 10 years.

We are here to serve you and as always, we appreciate the privilege to be of service and are here to answer any questions or concerns you might have at any time. This too shall pass.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

Uncertainty and Volatility