Reminder: The US Financial Markets Will Be Closed Wednesday, June 19th:

All US financial markets will be closed this Wednesday, June 19th in observance of the Federal Holiday, Juneteenth. Our office will close as well and be back open Thursday, June 20th as usual. Also, any distribution requests from AXOS Advisor Services will be delayed one extra day due to the holiday this week.

Economic/Market Update-Outlook:

- Regional bank struggles have crept into the headlines again with rising credit card delinquencies and higher interest rates, while larger banks capitalize on opportunities from smaller bank failures.

- Recent government data shows unemployment may be on the rise with inflation still elevated.

- Commercial real estate woes intensify, with increasing vacancies and over-leveraged funds facing soaring debt costs, and more appropriate asset valuations are beginning to settle in, unsettling investors.

- The US fiscal situation worsens with interest payments on debt surpassing defense spending amid persistent inflation and elevated interest rates that could continue for the decade ahead.

- Market concentration in AI-driven giants like Apple, Microsoft, and Nvidia highlights a shift in dynamics. It reduces the impact of Federal Reserve actions on the broader market and potentially allows the markets to sail higher.

Regional Bank Struggles

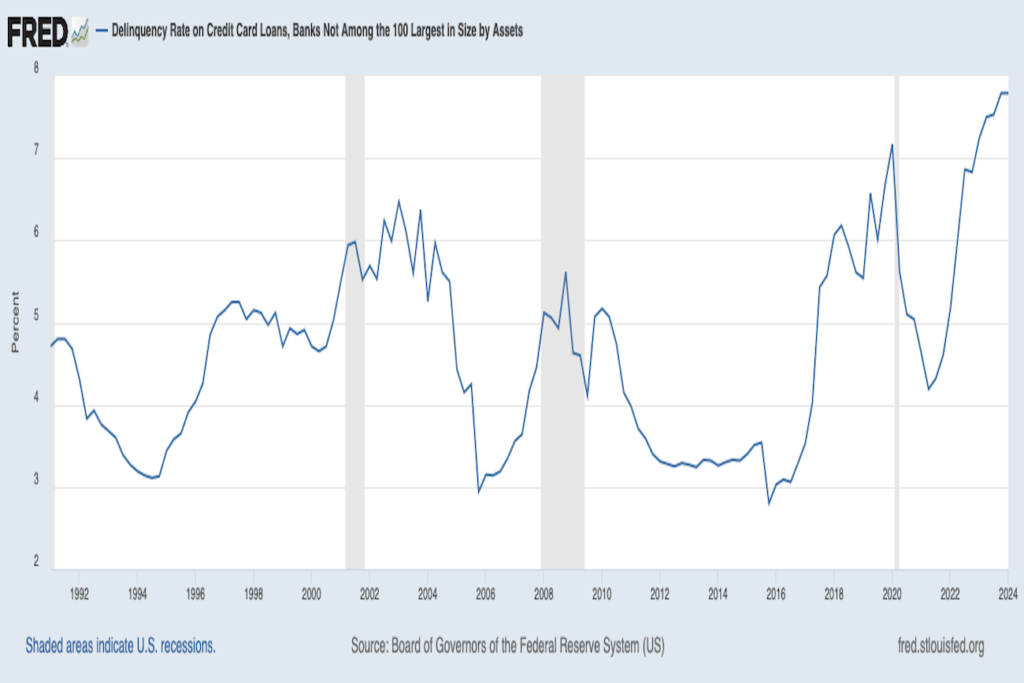

Regional bank concerns have begun popping up again. While we’ve never seen these as dire, they are concerning in certain regional pockets of concentration. These concerns are alleviated primarily because some banks, especially larger ones, can benefit from them. For example, J.P. Morgan was nearly handed First Republic’s $250 billion asset management arm for free, substantially boosting their business—First Republic shareholders were the losers. But smaller banks seem to be holding their breath, still hoping for lower rates. Credit card delinquencies for small banks have jumped to new highs, even higher than during the financial crisis. See chart below:

But this is not true for big banks, in fact quite the opposite. Most major banks continue to grow in strength, although a few have glaring holes from unrealized losses in their bond portfolios. These fears are most likely unfounded, as the Fed has previously opened an emergency facility to help firms cover the gap. These unrealized losses will eventually dissolve. However, it could take a decade to do so. The Fed has been willing to lend the future value today, eliminating most insolvencies for major banks. If these losses caused systemic issues again, the Fed would most likely open the facility as before.

Commercial Real Estate Still Faltering

Real estate continues to be a concern. PIMCO recently echoed these concerns, specifically in what they see the commercial real estate crisis escalating. In private funds, most have halted or dramatically reduced distributions for quite some time now. However, some have not valued their assets, which will eventually have to occur as time passes, making investors aware as to the size of losses. Commercial real estate vacancies continue to climb, and we don’t see how that will improve anytime soon, especially as AI develops and allows for lower employee counts. We sit in the camp that thinks we likely will see elevated interest rates and inflation for quite some time moving forward. This doesn’t mean rates will move straight up, but we believe the longer-term trend spanning a decade or longer will be higher. If this is true, it could change the makeup of portfolio allocations that could produce overall positive returns moving forward. Each week that passes, more debt must be refinanced. Losses, for some, are becoming real. Over-levered funds that over-promised returns are now starting to be revealed with soaring debt costs. One entity sharing the burden of higher rates is the US government.

Fiscal Recklessness

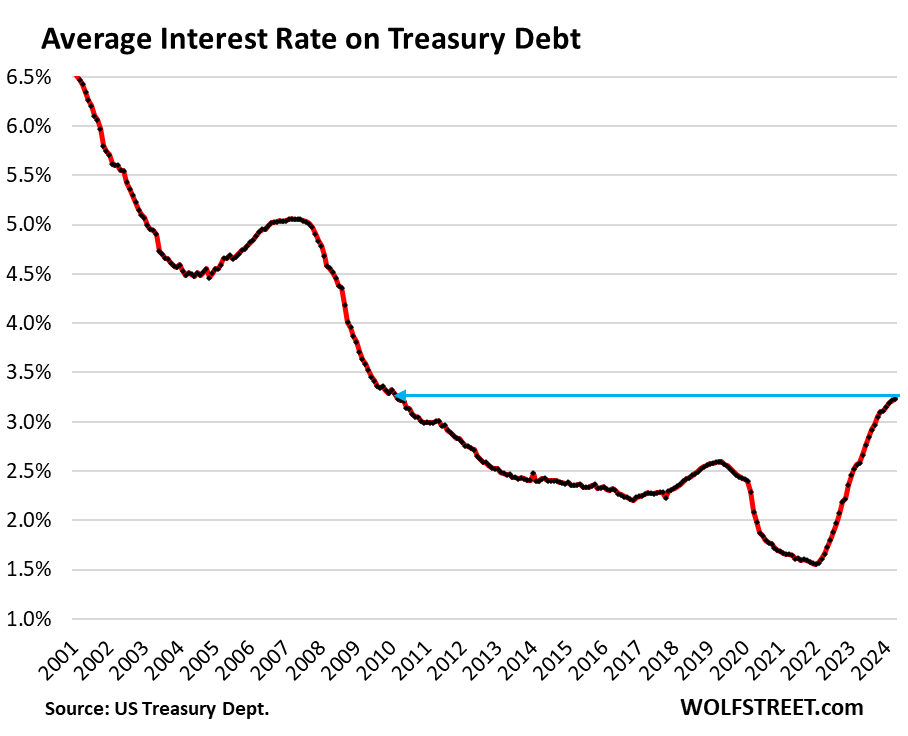

The US fiscal situation has become quite alarming, not in a doomsday or “end of the dollar” sense. However, it just heightens our “higher for longer” interest rate thesis and proves to be an incredibly difficult investment environment for what was once previously viewed as a safe asset: US government bonds. The US now spends more on interest than it does on defense spending. This will only escalate with higher interest rates. Currently, the interest rate for US debt stands at only 3.25%, which will likely continue to rise as over $9 trillion, over 25% of outstanding debt, needs to be refinanced in the next twelve months.

If lower rates do not come in the next year or two, the US will find itself in a difficult hole, issuing more debt with most of the deficit going solely to pay interest. You can begin to imagine the endless spiral that could unfold. The US isn’t alone, as countries like Italy, Spain, and France have seen their spreads dramatically widen, which could evolve into something similar to what was seen in late 2011 as an EU debt crisis unfolded. The crisis was handled with even more debt back then, which panned out due to rates eventually falling lower. Will they be so lucky this time? Not surprisingly, we see this as doubtful.

If lower rates do not come in the next year or two, the US will find itself in a difficult hole, issuing more debt with most of the deficit going solely to pay interest. You can begin to imagine the endless spiral that could unfold. The US isn’t alone, as countries like Italy, Spain, and France have seen their spreads dramatically widen, which could evolve into something similar to what was seen in late 2011 as an EU debt crisis unfolded. The crisis was handled with even more debt back then, which panned out due to rates eventually falling lower. Will they be so lucky this time? Not surprisingly, we see this as doubtful.

It has led us to believe that the markets are entering a new era, which we’ve discussed before. We have compared it more closely with the 1950s through the early 1980s, when the markets saw a relentless rise in interest rates. The markets continue to be in a state of an identity crisis, potentially waking up to the idea that the rate environment of the last few decades no longer applies. Each newsprint that could dictate future actions of the Fed is causing volatile ripples throughout stocks, interest rates, currencies, and commodity prices. The ECB cut rates for the first time since 2019, right after the Bank of Canada had also cut. These actions caused ripples in the currency markets, as the US currently has no justification for cutting, with the Fed president even arguing for a hike. The dollar has strengthened against these currencies, helping the US’s fiscal issues be masked more than usual for now, but if global rates in general rise, it will become increasingly difficult. Ignored by most, Chinese bonds are nearing historic lows, whereas most other countries see rates well above their pandemic lows.

An Era of the Past

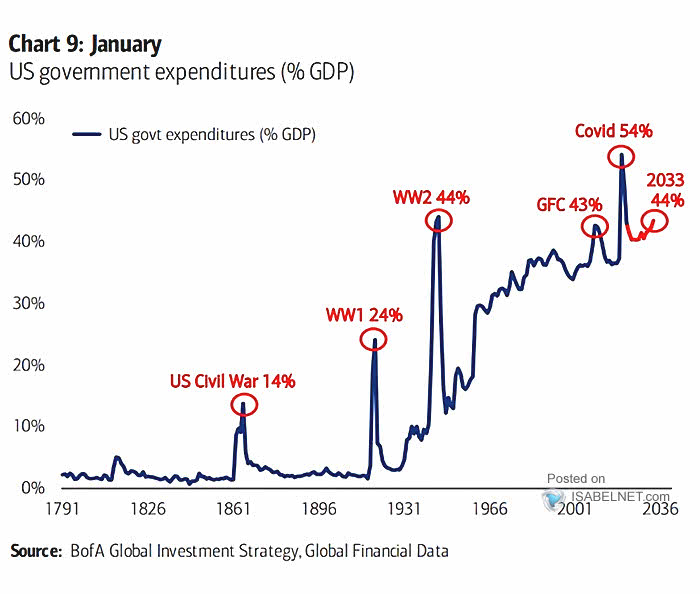

During the 1950s through 1970s, the Fed behaved quite sporadically, unlike the smooth actions of the last few decades. But one major event blamed for the rate environment was World War II. The world was emerging from the destruction that had occurred and focused on rebuilding. Most governments spent in excess to finance the war, with many practicing fiscal restraint thereafter. We see dramatic similarities between the amount of war spending that occurred and the pandemic spending over the past few years. The only difference is most governments now continue spending into excess, spoiled by declining rates of the past and ignoring the concerns that rates may rise in the future. European countries didn’t wake up from their first debt crisis that occurred just a decade ago, and most sovereign nations have continued spending at unprecedented rates.

Coming out of the excessive spending caused by WWII, the US saw government spending relative to GDP fall from a high in 1945 of 45% to nearly 18% by 1948. That period saw a “bottom” in interest rates in 1945. Interest rates would rise and not peak for almost four decades. In contrast with the pandemic, America spent 47% of GDP in 2020. Since then, spending has stabilized around 35%, which is where it has normalized for the last decade. The point is that the government has been lulled to spend continuously, and now, it finds itself with increasingly more expensive and almost permanent debt loads. As more US debt matures, new issuances are being made at higher rates, thereby continuing to increase this cost with no change in current interest rates. Economic growth saved the economy for much of the post-war era, and the US also kept debt levels stable for nearly 30 years with little net debt issuances during that period, as well as running surpluses for several of those years. So, unlike today, the US did not continue to dig an endless debt hole but was eventually granted the luxury of declining rates and inflation. While history does not exactly repeat, we still look to this era of the past for the most clues of what could lie ahead for markets.

AI – The Market Savior?

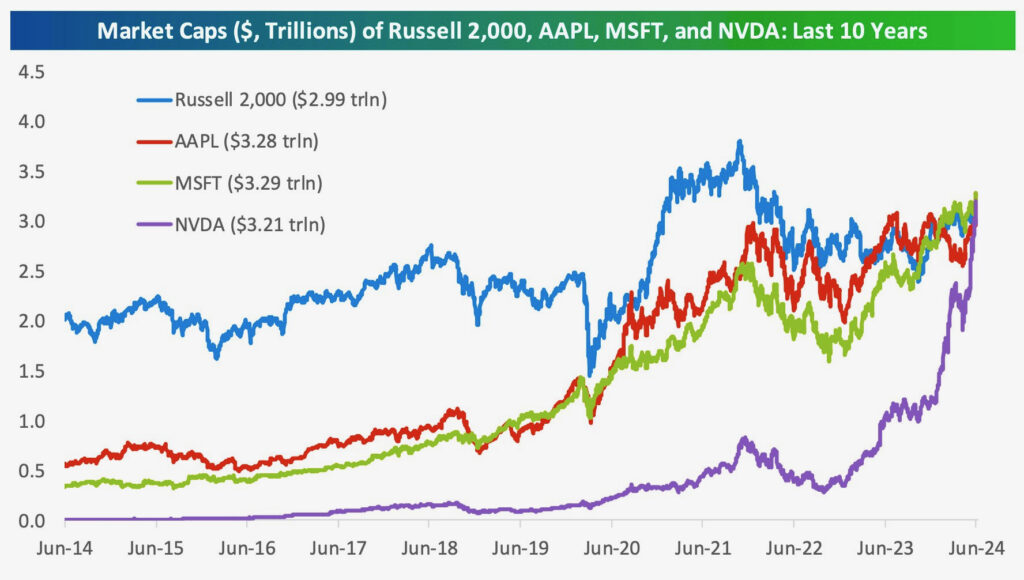

Ironically, as gloomy as this sounds, we believe two factors could negate much of these concerns. The first is that higher interest rates benefit quite a few businesses. The other, an event that we’ve discussed in the past, is well underway: an AI-related bubble. Both of these factors primarily continue benefitting the largest companies in the world. The chart below shows the immense size of three companies evolving over the last decade: Apple, Microsoft, and Nvidia. All three are now individually larger than the Russell 2000 index, comprised of 2000 public companies. Nvidia is the most remarkable as to how fast the value was created. We see AI potentially accelerating these themes, as margins can expand quite dramatically in the future for those businesses able to utilize its powers.

From: Bespoke Investments

From: Bespoke Investments

So, what is the significance of this? It highlights that Russell 2000 still gained 50% in value. However, the other three companies dramatically dwarfed this gain, creating nearly six times the value over the same period, only ten years. It’s a dramatic shift in the markets, also leading to extreme concentration in indices like the S&P 500, which we’ve highlighted in the past. But this concentration has only gotten more extreme since then. We also believe this leads to the Fed’s decisions having much less impact on the markets. We believe Fed actions will only have to get larger to make an impact, creating even more volatility. During the financial crisis in 2008/2009, fiscal and monetary actions were almost unprecedented. That is, until the pandemic occurred, we watched both the Federal Reserve and government respond in a way that dwarfed the financial crisis’s actions roughly four to one. So, when the next recession or crisis comes, we see the trend continuing and the Fed struggling to have any meaningful impact on the markets, as these businesses are typically flush with cash. The Fed ultimately targets banks and businesses that rely on leverage or debt with their policy, hoping to cause a chain reaction in the economy. From this, we believe a continued divergence between businesses adversely impacted by inflation or higher rates and those not.

While every business, and investor for that matter, will deal with the impacts of interest rate volatility, our point is to bring awareness of what we see ahead. We believe inflation will be persistent for most. Accelerating the issue is that we have little to no optimism that government budgets will be cut dramatically soon. According to the Congressional Budget Office, the federal budget deficit was $1.2T in the first eight months of fiscal year 2024, with outlays up 8%, $332 billion more than during the same period last year. This is from post-pandemic levels without the country experiencing a recession. Everything that bailed the US out of the post-war fiscal mess seems stacked against the country today. These views have spurred us to continuously improve our investment process for what we believe could pose a difficult investment environment ahead, especially for those relying primarily on data from the last forty years. We see a volatile decade marred by elevated interest rates and inflation. We also believe the market is in the midst of realizing this as the more likely scenario, contributing to some of the recent volatility.

We have made some major adjustments to client portfolio allocations starting back in November of last year. The daily volatility has increased somewhat, but overall, we feel the net benefit to clients will be positive moving forward. Obviously, we cannot guarantee future results, but we are much more comfortable looking ahead at this time with the changes we have made as we attempt to meet the challenges that may lie before us. So, are we in a current situation similar to 1999-2000 when the “.com” bubble was created, or are we headed to more of a 1950’s-early 1980’s cycle? Time will tell and we will keep you posted.

We appreciate the privilege to be of service and look forward to working with you all in the years to come. Don’t hesitate to call or email if you have any questions or we can be of further service in any way.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

This update expresses the views of the author(s) as of the date indicated and such views are subject to change without notice. F.I.G. Financial Advisory Services, Inc. (F.I.G.) has no duty or obligation to update the information contained herein. Further, no representation has been made, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This information is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. F.I.G. believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. F.I.G. made attempts to show sources and links to that data, when possible. However, F.I.G. cannot guarantee or be held liable when accessing those links, as it is not the property of or maintained by the author(s). This update, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of F.I.G.

Uncertainty and Volatility