Within the last few weeks, the market experienced some extreme volatility. Most of the indices fell 5%, while some sectors like semiconductors fell by 12% or more. With a substantial amount of earnings coming this week and next, volatility will most likely continue. Precious metals, interest rates, and other sectors as also seeing some large swings, as the market begins to interpret recent inflation data. Many of the market-heavy weights are beginning to get the wind sucked from sails. Tesla’s stock is now down 65% from its 2021 high. NVIDIA has seen a 20% pullback and has yet to determine whether it’s only a blip or the beginning of a further decline. Even Apple has been impacted, seeing its stock fall over 15% in the last few months.

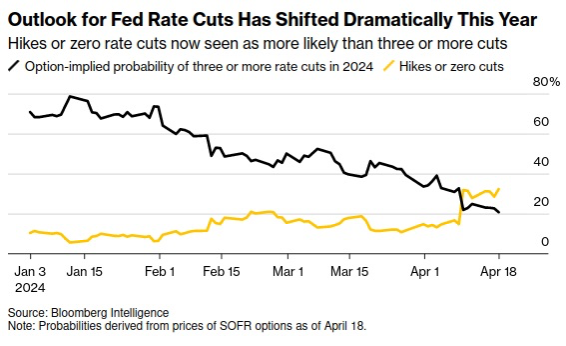

So, what’s going on? Well, looking back to last year, the markets had assumed that the Fed would already be cutting rates by now. However, this has been increasingly less the case as more data has come in. Inflation seems to remain elevated above the Feds liking, which has increased market uncertainty. We have continued to be about the possibility of a continued rising interest rate environment, which is now playing out in front of us so far this year. The Fed is finding it much more difficult to tame inflation and even has some expecting no rate cuts this year and even the potential for rate hikes instead. Much of this expectation came from hot inflationary data in April, as can be seen in the chart below.

It has dramatically impacted commodities; however, it is mixed across the board. For example, lumber prices dropped over 15% since this news, while copper and gold have seen double-digit rises. Long-term interest rates have started to rise again since the first of this year. An ETF that tracks long-term treasuries is also experiencing a double-digit decline so far this year.

This is a market environment that is expressing confusion with mixed signals from recent economic data. The market clearly has no idea whether rates will rise or fall in 2024. We do continue to be concerned with the prospect for higher rates. Volatility as measured by the VIX, has jumped 50% this year; however, it is still within reasonable bounds in a historical context. But, add all this uncertainty along with what is poised to be one of the most interesting elections in recent history coming up this year. It will be important to see what plans come from the current fiscal issues faced by the US. It is unprecedented to witness such excess spending with no recession. Typically, the government will aid the FED through stimulus. That’s already currently been occurring along with higher-than-desired inflation and a robust job market and economy. The question becomes, what happens if this changes? It is a concern that can’t be ignored, especially with the backdrop of interest rates that now appear to be on the rise.

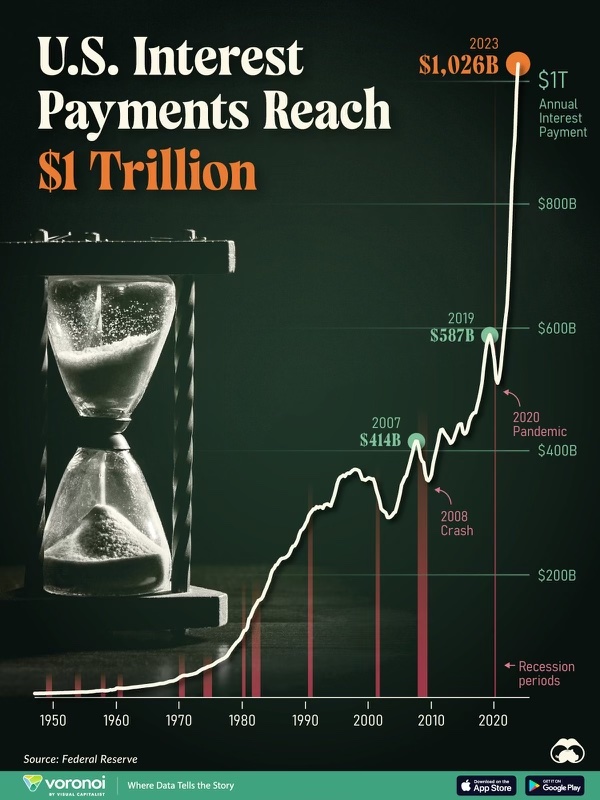

You’ve probably seen the government’s interest only rate payment charts, but the US has witnessed annual interest expenses that now surpass $1 Trillion per year. In response, the government has also transitioned to utilizing short term debt aggressively in what would seem to be an effort to take advantage of the possibility of lower rates in the future.

But what if lower rates don’t come like so many keep assuming and what if we are back in an overall rising interest rate cycle? That seems to be what the market is trying to grapple with right now. The pandemic stimulus spending also kept many businesses alive that would have most likely closed their doors, which are now beginning to pop up. At the consumer level, we’ve seen excess savings depleted and now a move higher in credit card loan delinquencies. For example, Discover Financial, the sixth largest credit card issuer, saw net charge-offs surge to 5.7%, off a low of 1.5% just less than two years ago.

These types of charge-offs have not been seen since the financial crisis back in 2008. More troubling, interest costs have now eroded a larger part of the consumers’ income unlike ever before. These are not rosy developments coupled with many other concerns that we’ve discussed in the past such as the commercial real estate markets. And, we say this to show markets are increasingly difficult to understand at the present time. While these problems exist, it’s also on the backdrop of some companies being flush with more cash than ever before. So, we do not necessarily believe in a “doomsday” outcome, but other concerns come to mind if the scenario of higher interest rates persists. Charles Schwab, a massive bank and broker, saw another deposit decline in the first quarter of this year. The stock has remained resilient, while the company has been able to raise capital to plug the hole between its book value and losses. But, the gap remains, and it is at-risk of economic uncertainties that could be around the corner.

We’ve continued monitoring our allocations, which have begun tilting heavier towards commodities, at least in our core holdings. Our flex modeling still favors equities and with a small amount of commodity related exposure as well. This is due to the dramatic underperformance of fixed-income and bond-related investments that is continuing to persist, which could eventually lead to more market turmoil. We’re constantly reviewing our portfolios and strive to continue serving all of you well in such an uncertain market environment. We will keep you posted.

As always, please don’t hesitate to call or email if you have any questions or we can be of further service at any time. We are looking forward to serving you in the years to come.

God Bless,

Your TEAM at F.I.G. Financial Advisory Services, Inc.

This update expresses the views of the author(s) as of the date indicated and such views are subject to change without notice. F.I.G. Financial Advisory Services, Inc. (F.I.G.) has no duty or obligation to update the information contained herein. Further, no representation has been made, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This information is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. F.I.G. believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. F.I.G. made attempts to show sources and links to that data, when possible. However, F.I.G. cannot guarantee or be held liable when accessing those links, as it is not the property of or maintained by the author(s). This update, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of F.I.G.

Uncertainty and Volatility